During the campaign, President-elect Donald Trump proposed changes to the tax law that would have a significant impact on both individual and business taxpayers, including changes to tax rates, deductions, and repeals of existing tax law.

Many of the changes he proposed during the campaign are similar to those presented in “A Better Way: Our Vision for a Confident America,” which was released by House Republicans in June 2016 and is known as the Blueprint. This alignment will potentially make enacting such changes more likely with Congressional control resting with the Republican Party.

Here are some of the most significant changes affecting individuals and businesses.

Individuals

Tax Rates

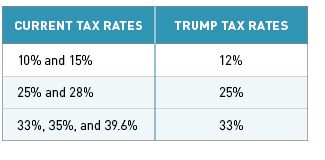

President-elect Trump has proposed to condense the current seven tax brackets into three, which is the same as the Blueprint. Under these plans, the income tax brackets would change as follows:

Deductions

The standard deduction for single individuals would increase to $15,000 and to $30,000 for married couples filing jointly. The 2017 standard deduction under current laws is $6,350 and $12,700, respectively. Similarly, the Blueprint proposes to increase the standard deduction, though at slightly lower amounts than those proposed by Trump. Trump’s proposal would also place a cap on the amount of itemized deductions an individual filer can take—$100,000 for single filers and $200,000 for married filing joint filers.

Capital Gains and Dividends

Under Trump’s proposal, the current rates for long-term capital gains and qualified dividends would remain unchanged; however, the 20 percent rate would kick in at a lower threshold. However, Trump has proposed to repeal the 3.8 percent net investment income tax. The Blueprint proposes to reduce taxes on investment income in general.

Alternative Minimum Tax

Trump’s proposal and the Blueprint both eliminate the individual alternative minimum tax (AMT).

Childcare

Trump proposes to create a deduction for child and dependent care expenses for taxpayers with income up to certain thresholds. In addition, he proposes to increase the earned income tax credit allowing more taxpayers to qualify.

Carried Interest

Carried interest is a share of profit in an investment fund paid to the investment manager in excess of the manager’s contribution. Carried interest is currently taxed at capital gains rates; however, Trump has proposed to tax carried interest at ordinary income rates. The Blueprint doesn’t detail any provisions related to carried interests.

Estate and Gift Tax

Trump has proposed to eliminate the estate and gift tax. The Blueprint similarly repeals the estate and generation-skipping transfer taxes. Under current law, the estate and gift tax for 2017 starts at $5.490 million for single individuals and $10.980 million for married individuals.

Businesses

Tax Rates

Trump has proposed to lower the corporate income tax rate to 15 percent and eliminate corporate AMT. The Blueprint proposal would reduce the corporate tax rate to 20 percent and would repeal the corporate AMT. The top corporate income tax rate is currently 35 percent.

Small Businesses (LLCs, S Corporations, and Sole Proprietorships)

Trump proposes a plan for pass-through entities to choose whether they want to be taxed at the corporate rate, which would be 15 percent, rather than their individual rate, as is the current tax law. However, taxing at the corporate rate may create a second layer of taxation on distributions. The Blueprint would limit the tax rate for income earned by such entities to 25 percent.

Cost Recovery for Property Investments

Under Trump’s proposal, the annual Section 179 expensing cap would increase from $500,000 to $1 million. In addition, Trump has proposed that manufacturing companies could immediately deduct all new investments in the business. In contrast, the Blueprint would essentially permit an immediate expensing for all investments in tangible and intangible property, regardless of industry or amount.

Childcare

The annual cap for the business tax credit for on-site childcare would increase from $150,000 to $500,000 per year. In addition, businesses that pay a portion of an employee’s childcare expenses can exclude those contributions from income. The Blueprint doesn’t outline any changes related to this issue.

Repatriation of Overseas Profit

Trump’s proposals would permit a one-time repatriation of corporate profit held offshore at a tax rate of 10 percent. The Blueprint would allow profit to be repatriated at even lower rates.

What Does this Mean for You?

Any potential tax reform will likely have a significant impact on you or your business. As proposed tax changes become clearer, we’re here to help you evaluate your specific circumstances. For more information, please contact your Moss Adams tax professional.