Additional reporting may be on the horizon for disregarded entities (DRE) in the United States that are wholly owned by a foreign person if proposed regulations are enacted.

Additional reporting may be on the horizon for disregarded entities (DRE) in the United States that are wholly owned by a foreign person if proposed regulations are enacted.

The regulations would require that a US DRE—such as a single-member limited liability company (LLC)—be treated as a domestic corporation separate from its foreign owner for purposes of reporting, record maintenance, and other compliance requirements. This is the same standard that currently applies to domestic corporations that are at least 25 percent owned by foreign shareholders.

Proposed regulations issued by the Treasury Department and the IRS on May 11, 2016, would require DREs to disclose:

- Sole owner’s identity. DREs will be required to obtain a taxpayer identification number (TIN) to identify this information.

- “Reportable transactions.” These include sales, assignments, leases, licenses, loans, advances, contributions, and performance of services with its parent or other foreign related parties.

The regulations would also require DREs to maintain records “sufficient to establish the accuracy of the information return and the correct US tax treatment of such transactions.” This may cause a significant hurdle for reporting purposes as the DRE will be required to determine any direct or indirect 25 percent owner.

Failure to properly file a Form 5472 may result in a $10,000 penalty. Currently, there aren’t exceptions for de minimis transactions or small companies.

Who’s Affected

Below are a couple of examples when potential taxpayers may be subject to the proposed reporting requirements.

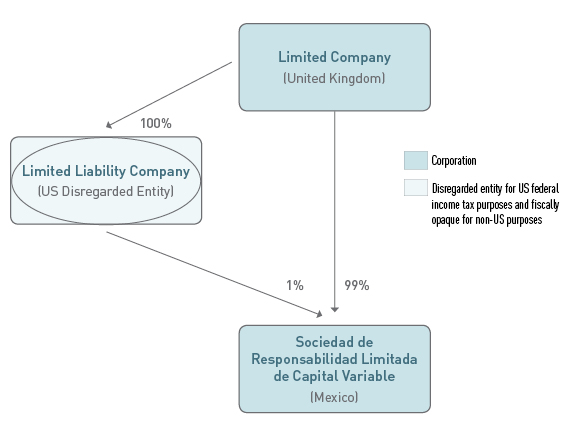

Example 1

There are numerous foreign jurisdictions with entities that behave similarly to US LLCs in that they are:

- Relatively easy and cheap to establish

- Provide the members a lot of freedom in their administration

- Have less cumbersome compliance requirements

- Provide liability protection for its members

However, unlike the United States, some foreign jurisdictions require multiple members for incorporation of these entities—India, Chile, and Mexico, for example. A US DRE is often included as one of those members because, like in the foreign jurisdiction, DREs are cheap and easy to establish while still maintaining liability protection for its shareholders. This first example demonstrates a structure that will be impacted by the proposed regulations if or when they’re enacted.

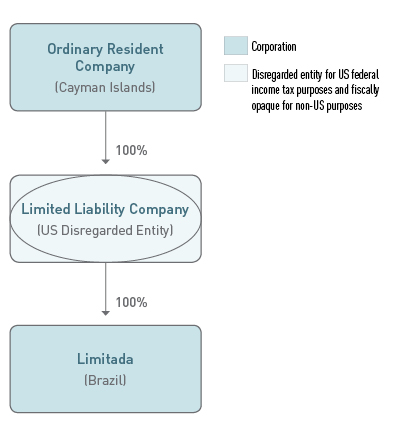

Example 2:

Many private equity and venture capital investment entities are incorporated in the Cayman Islands. At the same time, other jurisdictions have blacklisted Cayman Islands entities as tax havens. US DREs are often used as a means of protecting the investment from anti-tax haven legislation.

Should You Prepare?

The regulations support the measures that the United States has already undertaken to increase financial transparency and combat tax evasion. In recent years, the United States enacted the Foreign Account Tax Compliance Act, known as FATCA, and has pressured foreign jurisdictions to share information regarding US taxpayers.

However, international critics have accused the United States of applying a double standard regarding the disclosure of information within their borders. In the preamble to the regulations, the IRS concedes the difficulty of fulfilling its numerous information-sharing obligations.

There are potential hurdles when it comes to complying with the proposed regulations before they’re finalized. Foreign-owned, single-member LLCs should begin preparing now for the new reporting requirements because there will be heavy penalties for failing to file Form 5472.

Next Steps

Following are some of the requirements that must be met in order to file Form 5472.

The DRE will be required to have an employer identification number (EIN) which will, under the current instructions, require a responsible party to have a Social Security number (SSN), an international taxpayer identification number (ITIN), or an EIN.

If the responsible party doesn’t have any of these items, then the application process for an ITIN can be an incredibly time-consuming and burdensome process. Presumably the DRE will have to file a tax return as well because the IRS can’t process Form 5472 unless it’s attached to an income tax return.

We're Here to Help

For more information about how this might impact your business, contact your Moss Adams professional or email internationaltax@mossadams.com.