This article was updated July 1, 2020.

Assembly Bill 85 (AB 85), which intends to close a gap in the budget created by the COVID-19 pandemic, was signed into law by Governor Gavin Newsom on June 29, 2020. It was passed by both houses of the California state legislature on June 15, 2020.

The most significant provisions of the bill are:

- The suspension of taxpayers’ ability to deduct net operating losses (NOLs) during tax years 2020, 2021, and 2022

- The limitation on the amount of tax that can be offset by business credits to $5 million for tax years 2020, 2021, and 2022

The limitations on NOLs and business credits are discussed in more detail below, as well as highlights of other provisions in AB 85 that focus on specific industries or taxpayers.

Strategic tax-planning can help taxpayers reduce tax exposure during the years in which NOLs and credits are limited by the legislation. Some of these opportunities, however, require tax treatments that must be made on a timely-filed 2019 tax returns. As the 2019 filing deadline is fast approaching, any interested taxpayers will need to act quickly.

Net Operating Loss Limitation

The legislation, which applies to individuals, flow-through entities, and C corporations, disallows the use of California NOL deductions if the following conditions apply:

- The taxpayer recognizes business income

- The taxpayer has a federal adjusted gross income—or, for corporations, income subject to tax—that’s greater than $1 million

Modifications for the latter could apply for registered domestic partners computing income as spouses.

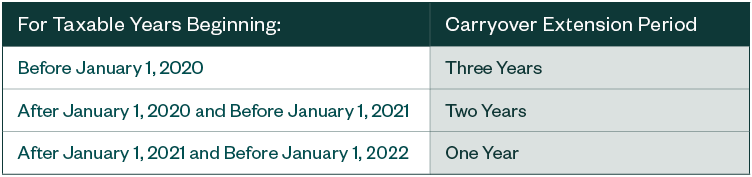

The carryover periods for NOL deductions disallowed by this provision will be extended as follows.

Business Tax Credit Limitation

Any business credit will only offset a maximum of $5 million of California tax. California defines the term business credit as including the California Research Credit and the California Competes Tax Credit, among other business credits.

The carryover periods, if applicable, are extended by the number of years that a credit is disallowed by reason of this limitation.

Additional Items

The legislation also includes the following notable provisions.

Limited Partnership Certificates

An exemption from the $800 minimum tax is allowed for the first year that a limited partnership or limited liability company files a certificate of limited partnership, or registers with the secretary of state, during tax years beginning on or after January 1, 2021 and before January 1, 2024.

Film Production

Provisions related to an existing taxpayer election to convert income tax credits for film production to sales tax credits cap the annual sales tax benefit at $5 million for tax years 2020-2022, without impacting the $5 million credit cap applicable for income tax purposes.

The carryover period for these credits is also extended by five years for taxpayers impacted by the limit.

Automobile Dealers

Provisions requiring reporting and remittance of sales tax collected by automobile dealers directly to the Department of Motor Vehicles, within 30 days of retail sale, replace the existing requirement that dealers remit taxes to the California Department of Tax and Fee Administration on a quarterly basis.

Hygiene and Other Products

Additional provisions exempt sales of certain women’s hygiene products and infant, toddler, and child diaper products from sales taxes.

We’re Here to Help

To learn more about how your business could be impacted by AB85 or to identify tax-planning opportunities, contact your Moss Adams professional.