As real estate investment trusts (REITs) proliferate in both public and private real estate sectors, there’s a growing list of benefits they can provide when compared to partnerships.

REIT Tax Overview

REITs, as corporations for income tax purposes, must own predominantly rental real estate assets or debt secured by real estate that’s held for enjoyment of income and long-term appreciation.

Dividends are tax deductible. At least 90% of net ordinary taxable income must be distributed and 100% is required to avoid REIT-level tax.

REITs can’t be closely held, as defined, and must have at least 100 shareholders. A vast and nuanced array of organizational, operational, asset, and income tests must be met.

Shareholder impact is generally straightforward. A dividend, documented on a 1099 and consisting of ordinary income and sales gains, represents their proportional share of the REIT operation for the year.

Despite the rule set complexities, REITs can be highly efficient and useful vehicles for real estate assets and debt. Note that in a fund setting, captive REITs with the common stock owned by a fund above it plus 100 direct preferred shareholders, are common structures.

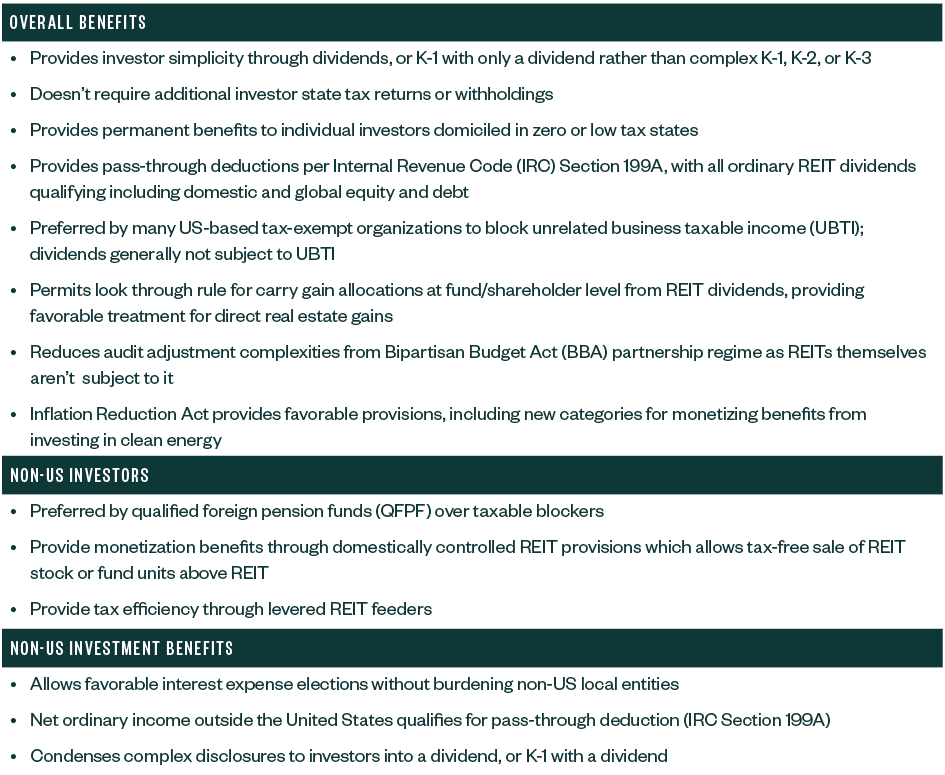

REIT Benefits

REITs require high levels of administration and technical precision. Though potential downsides exist compared to partnerships, the benefits they provide can be significant, for US and non-US investors alike.

Overview of REIT Benefits

A more in-depth look into REIT benefits follows.

State Tax Blocker

The REIT may have properties located in several states. It may have tax returns filed in each state, but an individual or trust shareholder would receive the dividends that are generally only taxable in the shareholder’s state of domicile with no added investor state filings or liabilities.

When a fund-owned REIT operates properties, the fund receives the dividend. The outcome for its partners is the same as described above, except that the investor gets a K-1 reporting dividend income.

There’s also no state withholding tax on REIT dividends and none for a fund owning the REIT, which reduces administrative upkeep while improving cash flow.

For shareholders or partners domiciled in zero- or low-income tax states, REIT benefits compared to partnerships can be substantial, as they avoid income taxes in other, higher tax rate, states—all or part of which would be a permanent cost.

Tax-Exempt Investor Tax Blocker

Leveraged rental real estate can produce UBTI for tax-exempt partners of a partnership operator. Real estate debt funds needing leverage in financing their loans could also produce UBTI.

REITs, assuming they’re not closely held by pensions, can solve this issue, as the dividend from a REIT isn’t taxable to tax-exempt owners. This can be a particular benefit for individual retirement accounts), foundations, and certain other tax-exempt investors in leveraged real estate funds.

Pass-Through Tax Deduction (IRC Section 199A)

Rental real estate and certain debt funds may produce qualified business income for their partners, which would produce a 20% partner-level deduction for individual investors. This provision is scheduled to sunset after 2025 unless extended by congress.

Limitations depend on sufficient partnership allocations of wages and the unadjusted basis immediately after acquisition (UBIA) as it relates to tangible property. Many debt funds have no wages or tangible property, and instead pay a fee to a sponsor or manager.

Rental real estate funds may also have no wages, and the tangible property, if highly appreciated and of older vintage, may not produce sufficient UBIA metrics.

REITs, with wage and UBIA limits inapplicable, produce ordinary dividends which categorically qualify for the 20% deduction—subject to further shareholder or partner level limitations. Locating real estate rental and debt assets into or beneath a REIT, even if below a fund, can produce simplification and tax benefits for investors. See below for additional benefits for non-US operations.

Qualified Foreign Pension Funds (QFPFs) Achieve Tax-Free Appreciation

The complex Foreign Investment in Real Property Tax Act (FIRPTA) regime generally taxes non-US investors on indirect US real estate gains. In addition, all non-US taxpayers are taxable on US business income or gains directly beneath a partnership interest.

A QFPF can use a REIT to enjoy tax-free real estate appreciation and gain on exit.

For a QFPF the following are untaxed, including where REIT shares are held indirectly through a fund:

- REIT dividends consisting of gain on a real estate asset sale

- Sale of REIT shares generating a gain

- Sale or redemption of fund units where the fund owns only REIT shares

The special rules applying to QFPFs are intended to increase capital flows into the United States and REITs are the key to a successful structure. It should be noted that ordinary REIT dividends paid to QFPFs are subject to US-source withholding, net of treaty benefits.

Domestically Controlled REITs in Funds

REITs may facilitate tax-efficient monetization for non-US investors other than QFPFs.

In a fund setting, a domestically controlled REIT is more than 50% owned by US persons. It falls outside of the FIRPTA regime, allowing non-US owners to sell REIT shares, or potentially partnership units holding REIT shares free of US tax.

This scenario can provide an efficient path for investor monetization if they can either sell REIT shares, sell partnership units above such REIT, or, in certain cases, be redeemed of either prior to a gain on sale dividend, which would attract FIRPTA withholding.

By contrast, there’s no comparable exception for interests in partnerships owning real estate directly.