Agribusiness

Grow Toward a Prosperous Future

To remain competitive in the complex agribusiness marketplace, your company should look to improve efficiencies, reduce waste, and control your tax exposure. Our professionals share your entrepreneurial ethos and want to support your business’ growth.

Instead of merely identifying problems, we help companies strategically plan for the future. Unbound from big-firm conventions, we deliver forward-thinking solutions that empower your business to seize emerging opportunity.

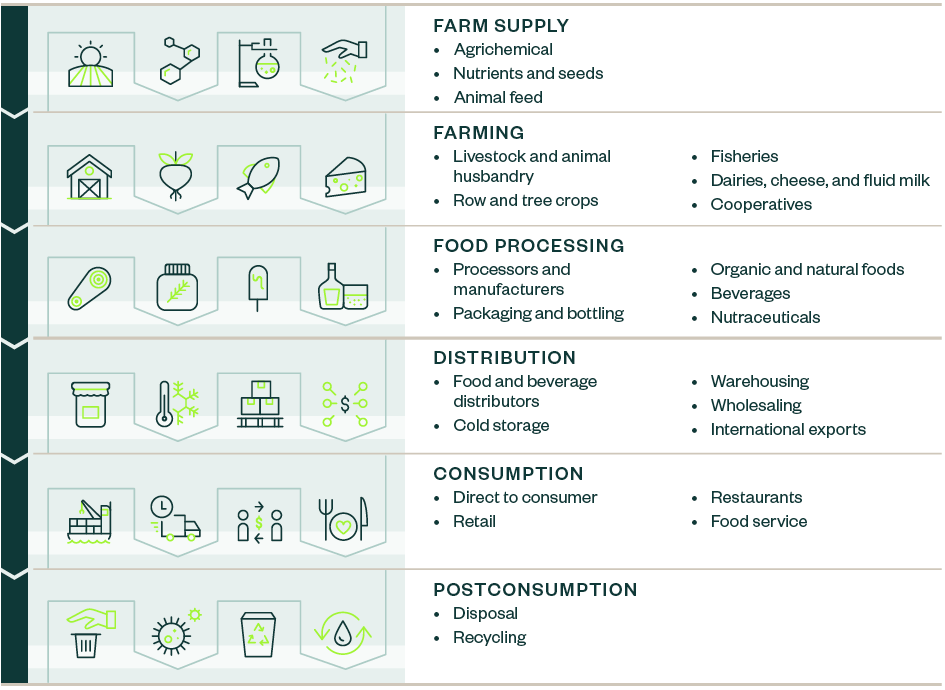

Our industry-smart insight into the entire supply chain—from grower to consumer and all points between—provides fresh perspectives designed to help your business thrive.

Conquer Industry Challenges

Confront ever-changing legislation, environmental and safety concerns, and international issues, and other obstacles with our guidance.

We're All In

Our collaborative approach takes the time to understand your unique business needs and contextualize how they may be impacted by the industry as a whole.

We advise companies in all areas of agribusiness including:

- Cold storage warehouses

- Egg and dairy farmers

- Farm equipment, feed, and fertilizer retailers

- Fruit and berry growers

- Grain, hay, hemp, and hops farmers

- Nurseries

- Row crops

- Tree fruit, nuts, and citrus

Wherever your business operates in the supply chain cycle, our professionals can help determine what steps are right for you.

Valued Industry Perspectives

With more than 25 locations in the West and nationwide, our professionals support the country’s top agribusinesses including 46% of apple-growers nationwide and 75% of Washington state’s.

Our clients aren’t the only industry leaders who look to us for guidance. We frequently collaborate with influential industry organizations such as the California League of Food Processors, Food Northwest, Hop Growers of America, National Council of Farmer Cooperatives, National Society for Accountants for Cooperatives, Produce Marketing Association, US Apple, and United Fresh.

Watch Webcasts Related to Agribusiness

Dive deeper into industry hot topics to help your business stay ahead of change and plan for what’s next with our complimentary webcasts, available to view on demand. Explore upcoming events and watch the latest series.

Insights

National Practice Leader