Recipients of the Provider Relief Fund (PRF) and other funding from the Department of Health and Human Services (HHS) that meet certain requirements are subject to audit.

As deadlines approach to meet audit requirements, review key considerations below.

Is Your Organization Subject to an Audit?

Organizations that expend a total of $750,000 or more in federal funds during a fiscal year are subject to audit requirements.

For HHS funding, these requirements are defined in the Code of Federal Regulations Title 45 Section 75.501. This requirement includes organizations subject to the Single Audit Act as well as commercial organizations.

Common Programs Subject to Audits and Requirements

Common HHS programs that may be subject to audit are:

- Assistance Listing Number 93.498 Provider Relief Fund and American Rescue Plan (ARP) Rural Distribution

- Assistance Listing Number 93.461 COVID-19 Claims Reimbursement for the Uninsured Program and the COVID-19 Coverage Assistance Funds

- Assistance Listing Number 93.697 COVID-19 Testing and Mitigation for Rural Health Clinics

- National Institute of Health Research and Development or other HHS grants

For the above programs, other than PRF, the audit requirement is triggered when an organization expends a total of $750,000 or more of federal funds in a fiscal year.

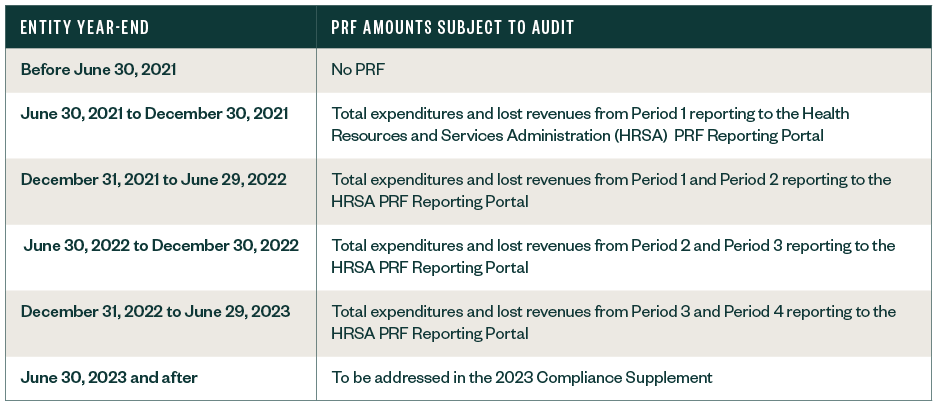

The audit requirement for PRF is tied to the periods of availability that end within an organization’s fiscal year.

Audit Deadlines and Extensions

Any nonfederal entity or commercial organization subject to audit requirements must submit the audit report by a due date determined by the entity’s fiscal year-end. The report is due 30 calendar days after receiving the audit report or 9 months after the fiscal year, whichever is earlier.

Organizations that haven’t submitted audit reports as of March 19, 2021, and have fiscal years ending through June 30, 2021, have a six-month extension. For example, the extended due date for a June 30, 2021, year end entity is September 30, 2022.

All other entities must submit an audit report no later than nine months following their fiscal year-end. Calendar year end organizations must complete and submit the audit by no later than September 30, 2022.

Submission Requirements

Nonfederal entities with HHS funding must have a Single Audit conducted in accordance with 45 CFR Section 75.514 or a program-specific audit conducted in accordance with 45 CFR Section 75.507. They must submit reports electronically to the Federal Audit Clearinghouse.

Commercial organizations have two options under 45 CFR Section 75.216(d) and Section 75.501(i):

- Financial related audit of the award in accordance with Government Auditing Standards

- An audit that meets the requirements of 45 CFR Section 75.501—a Single Audit or a program-specific audit

For commercial organizations, reports must be submitted via email to HRSA’s Division of Financial Integrity.

We’re Here to Help

If this audit requirement is new to your organization, now is the time to ensure you have a plan. For questions to complete your audit and file in a timely manner, please contact your Moss Adams professional.

You can also find additional resources at our Health Care Practice.