This article was updated March 17, 2023.

New or small businesses—including those with no gross receipts—may be eligible to apply for the R&D tax credit against their payroll tax.

How to Reduce Your Payroll Tax

You can potentially offset up to $250,000 annually until December 31, 2022. After that the Inflation Reduction Act increased the election to $500,000 in R&D credits to use against your payroll tax each year, for up to five years.

The additional $250,000 would be used to offset the employer paid Medicare payroll tax of 1.45% each calendar quarter. The R&D payroll tax credit attributable to the employer paid Medicare tax must not exceed the tax imposed. Any unused R&D credits will be carried forward and applied to a succeeding calendar quarter as a credit.

Are You Eligible?

Consider the following to help you determine if you’re eligible to apply the credit against your payroll tax.

Are You Eligible to Claim the R&D Credit?

- Your activities MUST meet the tax definition of R&D

- Eligible expenses incurred by those activities can include wages, supplies, contract research, and computer leasing.

Are You Eligible to Apply the R&D Tax Credit Against Your Payroll Tax?

- You’ve generated gross receipts for five years or less.

- Your gross receipts are less than $5 million current year

Applying the Credit

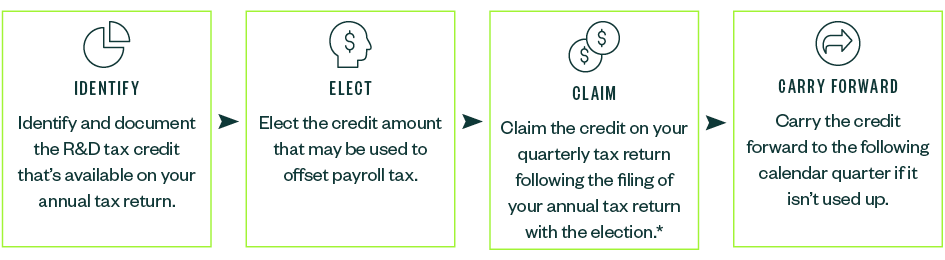

If you answered yes to the questions above, here’s the process to apply the R&D tax credit against your payroll tax:

Once the credit is applied to your payroll tax, it can only be applied to future payroll tax and not to your income tax.

We’re Here to Help

For guidance on how to offset your payroll tax with R&D tax credits, contact your Moss Adams professional.

You can also submit a R&D tax credit benefits estimate request form, or visit our R&D Tax Credit Services for additional resources.