On January 26, 2017, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) 2017-04, which simplifies the test for goodwill impairment and amends US generally accepted accounting principles (GAAP) ASC Topic 350, Intangibles—Goodwill and Other.

The main objective of this update is to simplify the current requirements for testing goodwill for impairment by eliminating step two from the goodwill impairment test. Effective dates, which we list below, vary according to business entity type, and early adoption is permitted for all entities.

The amendments are expected to reduce the complexity and costs associated with performing the goodwill impairment test. The changes may also result in entities recording impairment charges sooner than under the current guidance. This is due to the fact that currently an entity could fail step one of the goodwill impairment test, but end up not recording a goodwill impairment charge because of how impairment is calculated under step two.

Background

Under the FASB’s current guidance, the quantitative test for goodwill impairment is a two-step process. Step one requires that an entity first determine whether the fair value of a reporting unit exceeds its carrying value. If the answer to step one is yes, there is no impairment.

However, if the answer to step one is no, the entity must proceed to step two and determine whether the carrying amount of the reporting unit’s goodwill exceeds its implied fair value. The implied fair value is calculated by assigning the fair value of the reporting unit to all of its assets and liabilities (including unrecognized intangible assets) as if it had been acquired in a business combination. The step-two test can be extremely complex and costly.

Entities that have reporting units with either a zero or negative carrying amount currently must perform a qualitative assessment. If it fails the qualitative assessment, the step-two test described above must be performed.

Key Provisions

Following are the key provisions of the amendments.

Elimination of Step Two from the Goodwill Impairment Test

Under the revised guidance, an entity will perform its quantitative goodwill impairment test by comparing the fair value of the reporting unit to its carrying amount (referred to as step one under the current guidance). If the fair value of the reporting unit is less than its carrying amount, an impairment charge is required to be recognized for the difference—but it can’t exceed the total amount of goodwill allocated to the reporting unit.

In measuring the amount of a reporting unit’s goodwill impairment, an entity should consider the tax effect of any tax deductible goodwill, if applicable. The revised guidance didn’t change an entity’s ability—or the option—to first perform a qualitative assessment prior to performing the quantitative test.

Reporting Units with Either Zero or Negative Carrying Amounts

The amendments eliminate the current requirement for entities that have reporting units with either zero or negative carrying amounts to perform a qualitative assessment to determine whether the step-two test must be performed. All reporting units are now subject to the same quantitative goodwill impairment test.

The revised guidance requires disclosure of the following for each reporting unit with either a zero or negative carrying amount:

- The amount of goodwill allocated to each reporting unit

- Which reportable segment the reporting unit is included in (if the entity reports segment information in accordance with ASC 280, Segment Reporting)

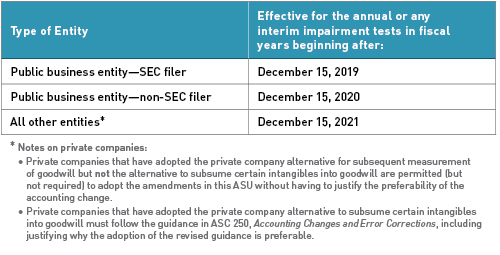

Effective Dates and Transition

Early adoption is permitted for interim or annual goodwill impairment tests performed on testing dates after January 1, 2017. Otherwise, entities should apply the amendments prospectively, as follows:

We're Here to Help

For any questions or to better understand how this new standard may affect your business, contact your Moss Adams professional.