Governmental Accounting Standards Board (GASB) Statement No. 72, Fair Value Measurement and Application, provides guidance for determining and applying fair value measurements for financial reporting for governments. It’s effective for years beginning after June 15, 2015.

Governmental Accounting Standards Board (GASB) Statement No. 72, Fair Value Measurement and Application, provides guidance for determining and applying fair value measurements for financial reporting for governments. It’s effective for years beginning after June 15, 2015.

GASB No. 72 requires you to plan ahead and use your investment advisors, fund managers, and internal policies to analyze how your investments and other applicable assets and liabilities are valued and to report the valuation inputs in more detail. This article takes you through a simple approach to implementing GASB No. 72 and provides guidance on how to draft the required disclosures.

What Is Fair Value?

GASB No. 72 describes fair value as an exit price. Fair value is the price you would receive upon selling an asset (or transferring a liability) in an orderly transaction between market participants at the measurement date. The fair value shouldn’t be adjusted for transaction costs.

GASB No. 72 Implementation Steps

Step 1: Create a List of Assets and Liabilities You'll be Required to Report at Fair Value

Investments are the most common assets reported at fair value. GASB No. 72 also requires fair value disclosures for derivative instruments, such as interest rate swaps and foreign currency exchange contracts, even if they have a liability balance at year-end.

Certain investments aren’t measured at fair value and are excluded from the GASB No. 72 requirements. These investments include:

- Money market investments

- Investments in life insurance contracts

- Common stock investments that meet the criteria for applying the equity method

- Unallocated insurance contracts

- Synthetic guaranteed investment contracts

- 2a-7-like external investment pools

GASB No. 79, Certain External Investment Pools and Pool Participants, was issued in December 2015. It established criteria for an external investment pool to measure all of its investments at amortized cost for financial reporting purposes.

GASB No. 72 doesn’t require other assets and liabilities to be reported at fair value unless already required by another GASB statement. Capital assets, for example, aren’t subject to the fair value measurement and reporting requirements of GASB No. 72.

For assets that have characteristics of both capital assets and investments—for example, a building that provides administrative office space and generates lease revenue—you must determine the asset’s best and highest use. For assets with multiple uses, consider the asset’s primary purpose and whether a mixed-use allocation is necessary.

Consider sharing this list of assets and liabilities subject to GASB No. 72 with your auditors or consultants at an early stage of your analysis. This gives you an outside perspective on whether all applicable items are included in your analysis.

Step 2: Determine the Fair Value Source for Each Item

Determine the source of the fair value information for each item on your listing. Begin by determining the unit of value for the item: Is the item valued at a unit value, at a share value, or as a percentage of ownership? Then determine if the item is valued using observable inputs (such as quoted prices in active markets) or unobservable inputs (such as management assumptions or proprietary information).

Apply one or more of the following valuation techniques, depending on which is appropriate under the circumstances and best represents fair value:

- Market approach uses prices and other relevant data from market transactions for identical or similar assets or liabilities.

- Cost approach represents the amount that would be required to replace the present service capacity of an asset.

- Income approach converts future amounts or current market expectations for future amounts to a single discounted value.

For investments with quoted prices, the fair value source could be a pricing service or broker that reports information from a validated pricing source. For debt securities, quoted market prices may be reported for the government or markets where similar assets have been traded. Alternative investment funds often require audited financial statements or statements received from fund managers to help a government determine the fair value of its investment. Other hard-to-value investments may require appraisals.

Certain investments that don’t have readily determinative fair values (those that aren’t quoted on active markets) are valued using net asset value (NAV) as a practical expedient.

Don’t rely solely on the so-called fair value reported on monthly brokerage statements. As we’ll cover in Step 3, contact the financial institutions that issue these statements to understand how they determine fair value, and evaluate whether it’s done in accordance with GASB No. 72. There’s often a timing difference on the valuation of alternative investments, and some may even be reported at historical or adjusted cost.

Donated Assets

GASB No. 72 states that donated assets are now reported at acquisition value: the appraised or measured value at the time of donation (an entry price). The most common examples are donated infrastructure, art, and historical treasures.

For items with quoted values, contact the broker or pricing service to understand how it determines the quoted price. Brokers and custodians will usually provide this information upon request.

To prepare for the level classifications you’ll need in Step 4, ask whether:

- Assets are valued using actual quoted market prices (level 1).

- Pricing models or matrices are used to value the item based on purchases and sales of similar items (generally level 2).

Most debt securities are priced using models and matrices and tend to be level 2. The exception is some US Treasuries, which are traded on active markets and qualify as level 1. (For more detail, see GASB No. 72, Appendix C.)

For investments valued using NAV as a practical expedient, contact the fund manager or reference the investment agreement for answers to the following questions:

- Are there unfunded commitments at year-end?

- What is the fund’s strategy, and how is fair value determined?

- Are there restrictions on redemption? What is the redemption frequency?

- Does the fund have audited financial statements that support the quoted NAV?

You might also need to make adjustments to the information provided by the fund manager, such as in the following cases:

- The investment’s NAV may be reported at a measurement date that differs from your reporting date. Obtain transaction history or similar purchases and sales information to roll the fair value measurement forward or back to your reporting date.

- There may be a lag of one to six months between a fund manager’s reporting of an investment’s NAV and the actual fair value measurement date. (For example, March 31 values are presented on an investment statement dated June 30.) Make sure to obtain the current NAV from the fund manager.

Step 4: Classify Fair Value Inputs by Level

Inputs to the valuation techniques used to measure fair value are prioritized into the following levels:

- Level 1: quoted (unadjusted) prices in active markets for identical assets or liabilities (most reliable)

- Level 2: quoted prices for similar assets or liabilities, quoted prices for identical items that aren’t actively traded, or other available observable inputs (reliable)

- Level 3: unobservable inputs (least reliable)

Investments valued using NAV as a practical expedient are excluded from the classification of fair value inputs, but you’ll need to consider whether the reported NAV is appropriate. You’ll be required to gather and report additional information for footnote disclosures related to NAV as a practical expedient, including:

- The balance of any unfunded commitments at year-end

- Descriptions of how the investment’s fair value is determined

- Disclosures of any restrictions on redemption of the investment

Classify fair value measurements for applicable assets and liabilities by input level (level 1, 2, or 3). Remember that investments reported using the NAV practical expedient aren’t classified in the fair value hierarchy.

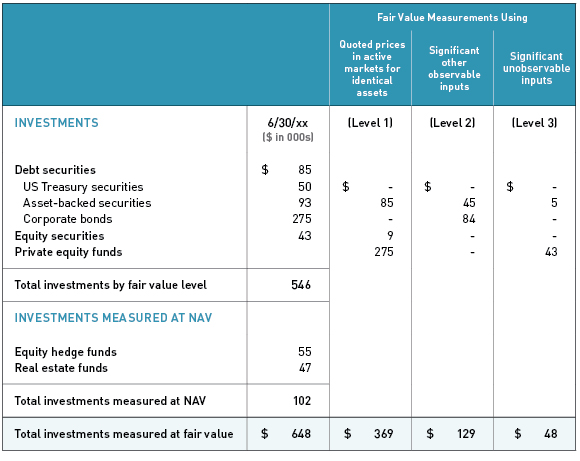

The following chart is a simplified example based on the GASB No. 72 illustrations that shows the presentation for the fair value hierarchy levels.

Step 5: Accumulate Disclosure Information and Prepare Your Fair Value Disclosures

Determine the appropriate level of aggregation of assets and liabilities for footnote disclosure purposes, and gather the necessary information to draft the accompanying footnotes. Required footnote disclosures include:

- Descriptions of valuation techniques and any changes in valuation techniques

- Nonrecurring fair value measurements (for example, impairments)

- Required disclosures for investments measured using NAV as a practical expedient, including the fund’s strategy, method of valuation, restrictions on redemption, liquidity issues, and unfunded capital commitments, if any

You’re now ready to prepare a draft of the new fair value disclosures. Consider sharing this draft with your investment consultants and auditors prior to the start of your audit.

Best Practice

The valuation methodology, classification of fair value inputs, and other aspects of applying GASB No. 72 are determinations of management, but your auditors may challenge your methodology, input level classifications, units of account, and the completeness (and clarity) of your footnote disclosures.

As a best practice, share the draft of your footnote disclosures—as well as your other evaluations and conclusions—with your auditors well in advance. In fact, it’s best to do so throughout the financial reporting process to allow sufficient time to make corrections as needed.

We're Here to Help

For more information on GASB No. 72 and how it might affect your organization, contact Kory Hoggan at (505) 878-7214 or kory.hoggan@mossadams.com.