As banks continue to pursue acquisitions as part of their growth strategy in a rising interest rate environment, core deposits are receiving increasing buyer scrutiny during the due diligence process.

As banks continue to pursue acquisitions as part of their growth strategy in a rising interest rate environment, core deposits are receiving increasing buyer scrutiny during the due diligence process.

It’s important to anticipate that the fair value accounting conventions required to translate a transaction to a bank’s financial statements can affect post-acquisition earnings. This is because the intangible asset associated with the core deposits needs to be recognized after a transaction, and a bank’s auditors will certainly dissect the measurement of that intangible asset.

Measuring Core Deposits

A bank’s deposit base provides value as a source of funds that’s typically less expensive than alternative funding sources. The benefit of this cost savings is represented by the core deposit intangible (CDI). The highest value deposits will be those from long-term depositors at modest interest rates. Certificates of deposits generally don’t add value to the CDI.

Checking, savings, and money market deposit accounts generally have characteristics that make them core deposits because the interest carried on these deposits is less sensitive to changes in market rates than other bank products. This rate inelasticity is usually due to a customer’s desire for convenience, safety, or accessibility to funds. Certificates of deposit (CDs) are generally considered noncore because near or above market rates are paid and are viewed as being less relationship driven.

Valuation Trends

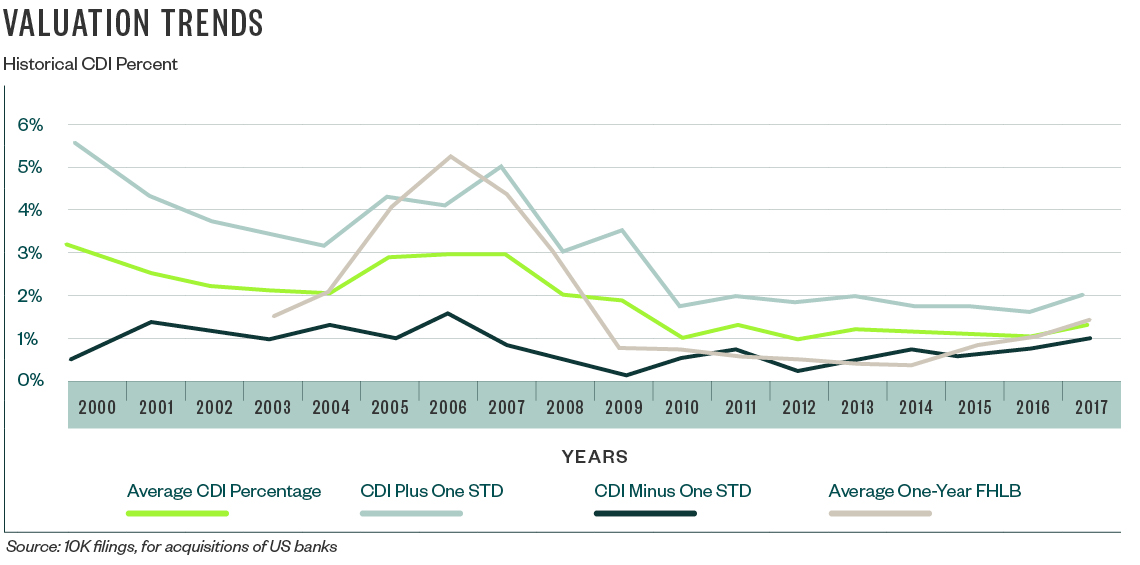

Changes in the value of CDIs over time are largely driven by changes interest rates. In particular, the market levels of alternative funds such as Federal Home Loan Bank (FHLB) advances, brokered CDs, and retail CDs influence CDI values.

As a percent of total deposits, CDIs have been low since 2010. From 2000 to 2010, average core deposit intangibles declined 2.1%, down to 1% from 3.1%. The range of CDI as a percent of core deposits has also tightened since 2009. However, CDI values are expected to rise as the Federal Reserve continues to implement rate increases.

Valuation

Because no market exists for CDIs, a pricing model needs to be applied in order to value them. The discounted cash flow (DCF) method is typically used to value CDIs. Using this method, the CDI represents the present value of costs savings, which is the difference between the cost of deposits and the cost of an equal amount of funds from an alternative source. The discount rate used is the expected cost of equity for a market participant—typically, developed base on a capital asset pricing model (CAPM).

Because of distinctive characteristics of deposit types such as non-interest bearing, interest bearing, savings, and money market, each deposit type should be separated and valued independently.

Value Drivers

Knowing what will drive value changes in the CDI will help determine what assumptions about the features of the deposits being acquired matter the most. The main features of deposits that can be modeled in a DCF and affect the ultimate value include the following:

- Interest paid

- Overhead costs

- Service fees

- Cost of alternative funds

- Deposit runoff

Interest currently paid on deposits and how the costs of these deposits will change need to be considered.

Next Steps

If a bank and its competitors are aggressively pursuing deposits, it may need to consider a higher deposit beta. This is the degree to which interest paid on deposits changes with market interest rate indices, such as the Federal Funds Rate. Deposit betas have risen with the Federal Reserve’s tightening monetary cycle.

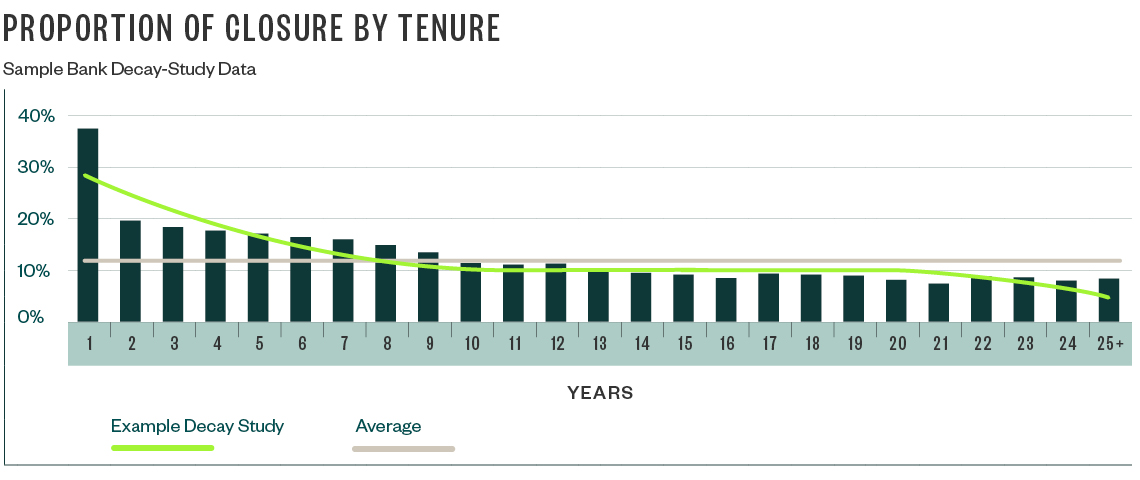

The most significant assumptions for this analysis typically surround the deposit runoff—or attrition—chosen. Deposit accounts will be closed out over time for a number of reasons, including mortality, migration, and changes in competitive services. Since the number of individual accounts on the transaction date erodes over time, the deposits are considered a decaying asset with a finite useful life.

When performing a CDI valuation, it’s important to consider attrition from initial deposit loss once the deal closes due to:

- Depositors not wanting to stay with the acquirer

- Attrition due to possible changes in interest rates paid and other policy changes

- Ongoing attrition

Since future attrition can have a large impact on the value of deposits acquired, it’s useful to have a decay study performed on the deposit base being acquired. These studies can reveal attributes of the deposit base such as deposit behavior by tenure and type. For example, there may be a disproportionately high rate of account closures for short term deposit tenures. This type of study provides strong support for important future attrition assumptions.

We’re Here to Help

Bank acquisitions can pose unique challenges and regulatory risks. For more information about value drivers, the impact of post-acquisition earnings, and merger and acquisition accounting conventions, contact your Moss Adams professional or visit our Financial Services Consulting page.