The Multistate Tax Commission (MTC) is partnering with participating states to offer a limited-time voluntary disclosure initiative for certain online marketplace sellers, including, but not limited to, those that established nexus through the presence of inventory at a warehouse or through activities performed on behalf of the seller by an online marketplace.

These sellers—including those using marketplace facilitators, such as Fulfillment by Amazon—can apply anonymously and choose the specific states and taxes for which they seek voluntary disclosure.

Key Components

The initiative allows taxpayers to voluntarily disclose unpaid sales and use tax and franchise and income tax liabilities. Some states are also offering waivers for lookback periods, which means they won’t impose payment of back tax liabilities, penalties, and interest.

Application Period

Applications will be accepted from August 17, 2017, through October 17, 2017.

Eligibility Requirements

Taxpayers with any amount of tax liability can apply for this initiative. Additional eligibility requirements include the following:

- Can’t be registered, have filed tax returns with the state taxing authority, made payment of tax, or had contact with the state taxing authority

- Must be an online marketplace seller using a marketplace facilitator to facilitate sales subject to sales tax in the state

- Can’t have any nexus-creating activities apart from making sales subject to sales tax through a marketplace facilitator

- Must apply electronically in a timely fashion through the MTC voluntary disclosure initiative

All applicants must also provide a good-faith estimate of back-tax liability for the prior four years of activity and agree to register with the state to do the following:

- Begin to collect, report, and remit sales and use tax no later than December 1, 2017

- Agree to file and pay franchise and income tax no later than December 1, 2017, including taxes due for the tax year commencing with the effective date

Participating States

The following states are participating in the MTC voluntary disclosure initiative:

- Alabama

- Arkansas

- Colorado (with exceptions)

- Connecticut

- District of Columbia (with exceptions)

- Florida

- Idaho

- Iowa

- Kansas

- Kentucky

- Louisiana

- Massachusetts (with exceptions)

- Minnesota (with exceptions)

- Missouri

- Nebraska (with exceptions)

- New Jersey

- North Carolina (with exceptions)

- Oklahoma

- South Dakota (with exceptions)

- Tennessee

- Texas

- Utah

- Vermont

- Wisconsin (with exceptions)

Exceptions

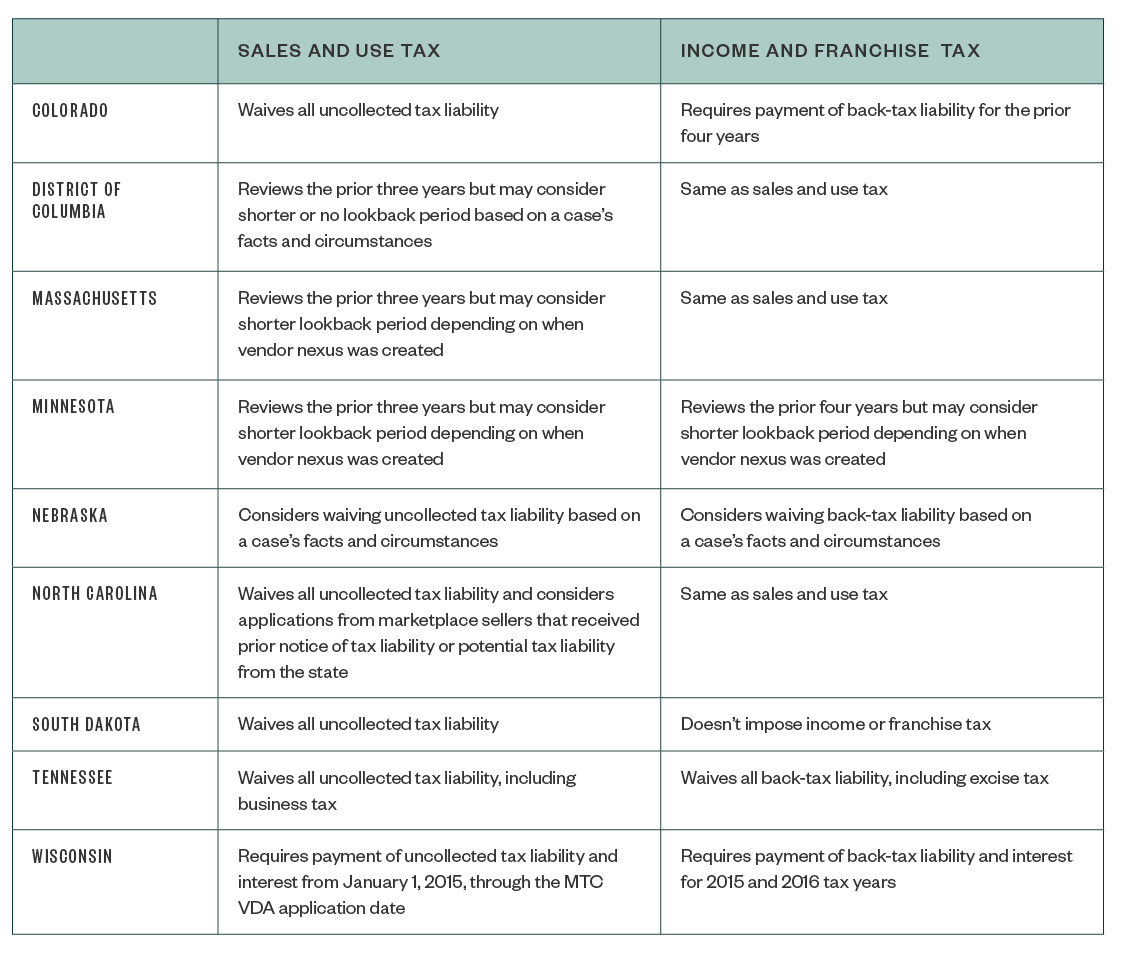

Generally, participating states waive sales and use tax and income and franchise tax liabilities—including penalties and interest—for all prior tax periods without regard to any lookback period. However, certain states take exception to this guideline.

The table below shows which states have specific rules regarding lookback periods, filing requirements, and program benefits.

Next Step

Taxpayers considering whether to participate in this program can benefit from comparing the value of this initiative with the advantages of separately complying with state and local tax liabilities through participation in state-sponsored voluntary disclosure programs.

We’re Here to Help

For more information about next steps or how this may affect your business, contact your Moss Adams professional or email statetax@mossadams.com.