Transitioning the ownership of a business brings uncertainty, complexity, and additional oversight to business owners—especially if they’re not ready to sell.

A successful transition needs to be managed efficiently while meeting personal goals and business goals.

- Personal. Determine timing, opportunities, risks, and the amount you need to earn from the business’ ownership transition to continue living your desired lifestyle and leave behind a legacy.

- Business. Determine the market-based value of your business, and the market value drivers; the growth strategy, identified opportunities, and associated pro forma adjusted financial model; management team depth, quality, and resources needed; the ability to be prepared for due diligence; and the business’ transition alternatives.

A transaction preparedness evaluation can help business owners achieve these goals. To prepare for an evaluation, there are a series of questions business owners can ask that look at both personal and business circumstances. The answers can help owners better manage company resources, improve the likelihood of a successful ownership transition, and prepare for the next phase of life.

Key Considerations

Do you have a personal financial plan in place, and does it align with your goals for your business?

Starting your transition process with a sound financial plan could greatly contribute to the transition’s success—helping you evaluate opportunities as they present themselves, assess your risk profile, and evaluate the plan itself.

A personal financial plan models your personal balance sheet, considers your business goals, and calculates how your personal wealth allocation may change over time. This process can be as important as the end product because it allows business owners to identify their goals and create a timeline for achieving them.

Additionally, an estate plan that’s put in place in alignment with your personal financial plan and business plan can help resolve unique family issues, fairness, equality considerations, life-time cash flow needs, and enhancement of after-tax wealth transfer and asset protection.

These combined components can help you understand the net amount you need to receive from selling your business to achieve your desired future lifestyle, as well as put numbers to your estate plan and business value.

What’s your timing?

Though this step is often overlooked, knowing your timing is vital to successfully transitioning your business. To determine this timeline, business owners can ask themselves the following questions:

- Does transitioning align with your current personal and professional goals?

- Does your team currently have the capacity to manage the business and a transition at the same time?

- Is your business performing to a level that will attract sufficient buyers of your organization?

- Is there currently a demand for your organization from buyers?

- Have you completed the necessary preparatory steps for a business sale?

Working through these questions could help you determine the appropriate time to transition the business given your and your business’ resources and needs.

Have you generated a personal wealth allocation plan and evaluated risks?

Generating a wealth allocation plan and evaluating risk can help you understand how assets flow through your business. It can also help you determine how to manage your investment strategy for the next decade.

As a business owner, understanding your personal balance sheet can help you stay on top of your allocation plan. Within a personal balance sheet, each asset class has its own unique risk characteristics. There are a few topics business owners can consider:

- Assets such as business ownership, real estate holdings, and liquid capital shouldn’t be measured independently because the value of each asset class will change over time and in relation to each other.

- It’s important to factor in the risks associated with each asset class. Wealth may be created through concentration, such as ownership in a business, but it’s maintained through diversification.

- Asset classes and investment structures may have different tax profiles. Diversifying your wealth can help you adjust to future changes in tax law.

Consult a professional to create a snapshot of your wealth allocation, discuss the risks, and determine an approach for managing how your assets could evolve over time.

Do you know the key metrics driving the value of your business and the market-based valuation of your business?

In a competitive market, understanding the market value of your business can help you objectively evaluate your transition options. A market-based valuation of your business may also allow you to identify and address the key issues or risk areas of your business and help you protect its value.

Have you identified opportunities for your business, developed a growth strategy, and documented this strategy with a pro forma adjusted financial model?

Your business plan should align with both personal and professional business goals. To meet these goals, consider identifying the following:

- Strategic business decisions. Determine the decisions you can make today to enable you to meet your business’ growth objectives in the future.

- Future opportunities for growth. Most buyers will want to know about the opportunities you see and how you and your management team plan to pursue these opportunities.

- Your growth strategy. Being able to articulate your strategy and have a well-prepared pro forma adjusted financial model will help get buyers excited about partnering with, or acquiring, your organization.

Have you identified a strong successor and built your management team bench?

The quality of your management team determines much of your company’s strength—and therefore much of your company’s value. Before purchasing your business, a buyer will need to know your company will run smoothly once you’ve transitioned out of ownership.

Business owners can begin transferring key relationships years before selling. You can begin this process by assessing your management team, reallocating vital responsibilities, and removing yourself from the business’ daily proceedings.

Are you prepared for due diligence?

Pre-transaction due diligence prepares your company for the transaction process and improves the conditions of a sale. Answering the following questions before you go to market can provide you with confidence in your position and help you avoid surprises during the transaction process:

- Have you set up a virtual data room that’s organized to address key buyer due diligence issues?

- Have you prepared a quality of earnings report, review, or audit?

- Have you identified pro forma adjustments to your financial statements for nonrecurring items?

- Are internal financial statements up-to-date?

- Have you identified non-GAAP accounting policies?

- Do you know key risk areas present within your company?

- Does your company have significant, uncertain tax positions that a buyer may identify?

Pre-transaction due diligence performed by a professional can help manage your internal resources and identify potential gaps.

Have you evaluated transition options?

Whether you’re transitioning to family, selling 100% of your business, or forming an employee stock ownership plan (ESOP), there are many ways to transition your business. It’s critical that your chosen transition plan aligns with your overall estate objectives, your personal objectives, the business financial plans, and your after-tax cash flow and liquidity needs.

Does your entity structure need to be evaluated and modified to allow for greater flexibility and to create future value?

Assessing your business’ structure can help you identify possible modifications to increase its future value. These changes could include the following:

- Introducing alterations in management

- Improving processes through new technology

- Enhancing your current entity structure

These changes can help initiate a tax-efficient sale or transition of the business, with a specific focus on the tax changes introduced through tax reform.

To learn more about how these tax law changes may affect you or your business, contact your Moss Adams professional.

Do you understand the mechanics of how the transaction will happen from a personal and business planning perspective?

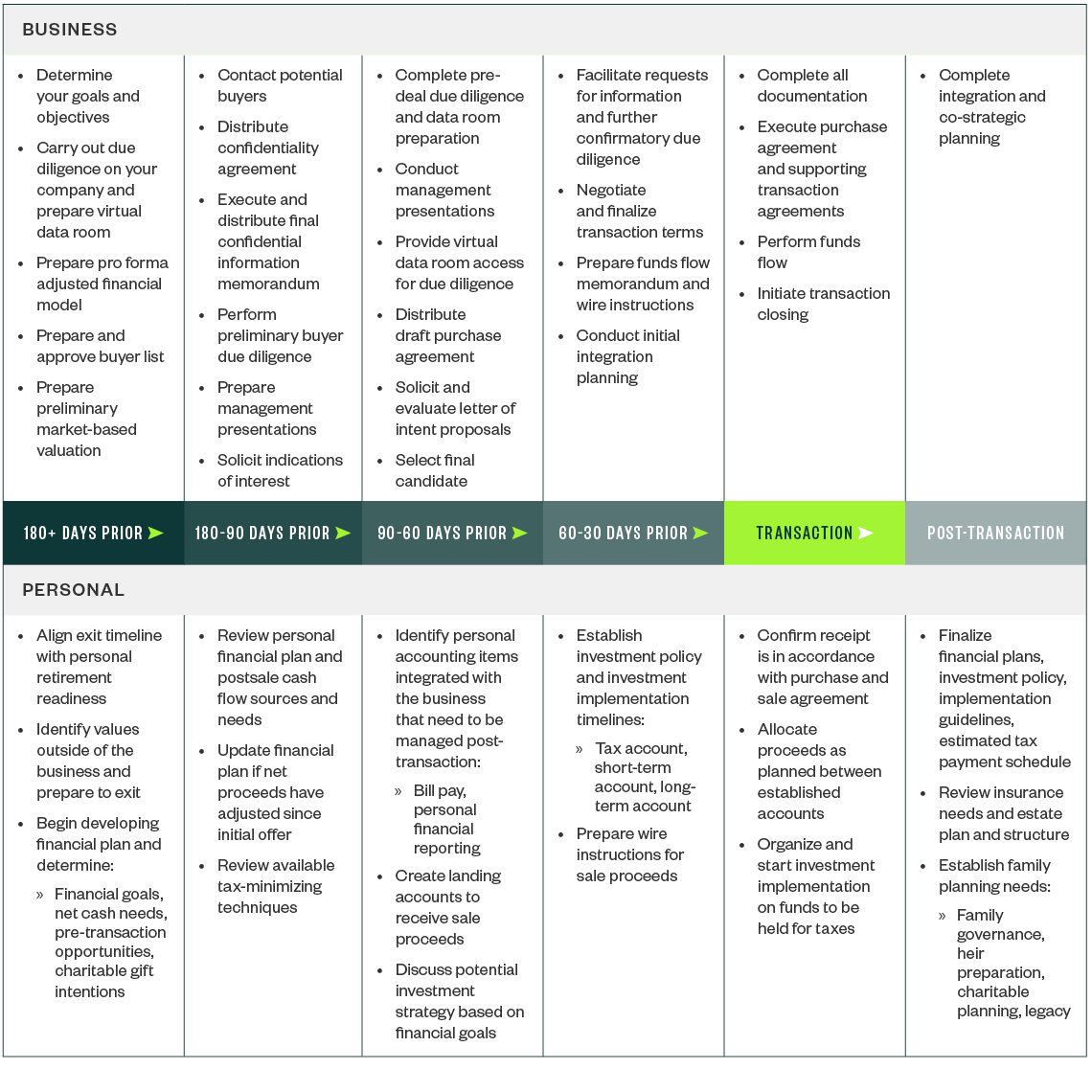

Building a personal and business planning timeline before you’re ready to sell will help you get the most out of your transition. The following example may help you approach your sale proactively.

Transition Checklist

To help determine and apply these steps, an advisor can review your current structure, considering your personal and professional objectives, and make recommendations.

We’re Here to Help

For more information on how transaction preparedness could benefit you and your business, contact your Moss Adams professional or visit our Transaction Consulting Page.