On July 13, 2018, the IRS issued Notice 2018-61, which could provide significant tax savings for nongrantor trusts and estates.

The notice represents the IRS’s intent to issue future regulations on guidance provided therein—giving nongrantor trusts, estates, and individuals who are beneficiaries of nongrantor trusts or estates access to deductions that were previously uncertain, providing tax relief, and potentially impacting estate planning strategies.

Background

Because tax reform, referred to as the Tax Cuts and Jobs Act of 2017 (TCJA), was passed in a rush before Congress adjourned for the year, some of the act’s provisions are ambiguous.

One of the changes in question is the repeal of miscellaneous deductions. For individual taxpayers, that change is clear: Deductions subject to the 2% floor limitation on Schedule A won’t be deductible until 2026. However, the wording of the repeal isn’t as clear for trusts, forcing trusts to piggybacked off the same code section as individuals.

Changes for Trusts and Estates

Notice 2018-61 implies that the US Treasury intends to issue regulations permitting nongrantor trusts and estates to deduct costs that are no longer deductible for individual taxpayers. It also provides a unique planning opportunity for nongrantor trusts, estates, and individuals who are beneficiaries of nongrantor trusts and who wish to deduct frequent trust expenses.

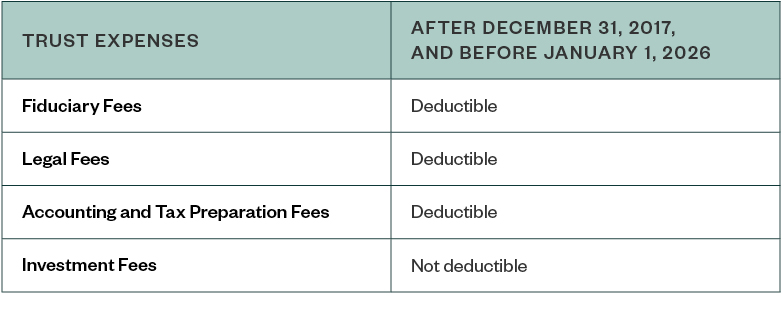

The below table shows the deductibility of the most frequent trust expenses:

We’re Here to Help

If you’d like to learn more about how these and other tax law changes made by the TCJA may impact your estate planning strategies, contact your Moss Adams professional or visit our dedicated tax reform web page.