Oil prices increased as expected in 2017; however, unexpectedly, energy stock prices didn’t follow suit.

Oil prices increased as expected in 2017; however, unexpectedly, energy stock prices didn’t follow suit.

Alongside reduced production and growing demand, we expect oil prices will likely continue to trend upward throughout 2018. As these higher oil prices become more trusted in the market, energy and oil companies’ stock prices may appreciate correspondingly. Given the large discrepancy between oil price and energy stock price movements in 2017, there could be some upside potential in this asset class in 2018.

However, a stronger than expected US Dollar could challenge this outlook—since the Dollar is highly correlated to oil prices—and an unexpected surplus of oil could always shock the market, impacting oil and energy stock prices negatively.

Energy Sector

For the first nine months of 2017, energy-related equities performed poorly. Many energy companies were down as much as 10% to 20%, demonstrating investors had largely checked out of the asset class.

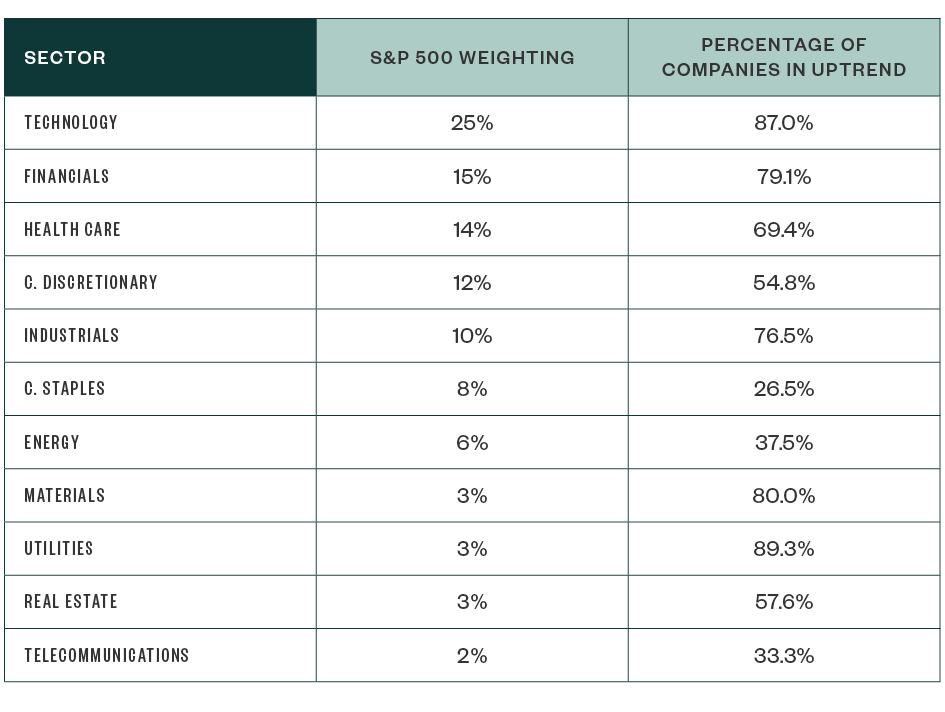

By comparison, technology and financials have been the standout sectors this year. Given their large weightings in the S&P 500 and strong positive performance, it’s not surprising that buying interest in energy equities was so low.

It wasn’t until late in the third quarter and the fourth quarter of 2017 that energy stocks began to quietly improve. The slight rally was mostly in response to rising oil prices.

Q4 Sector Overview

Oil Market

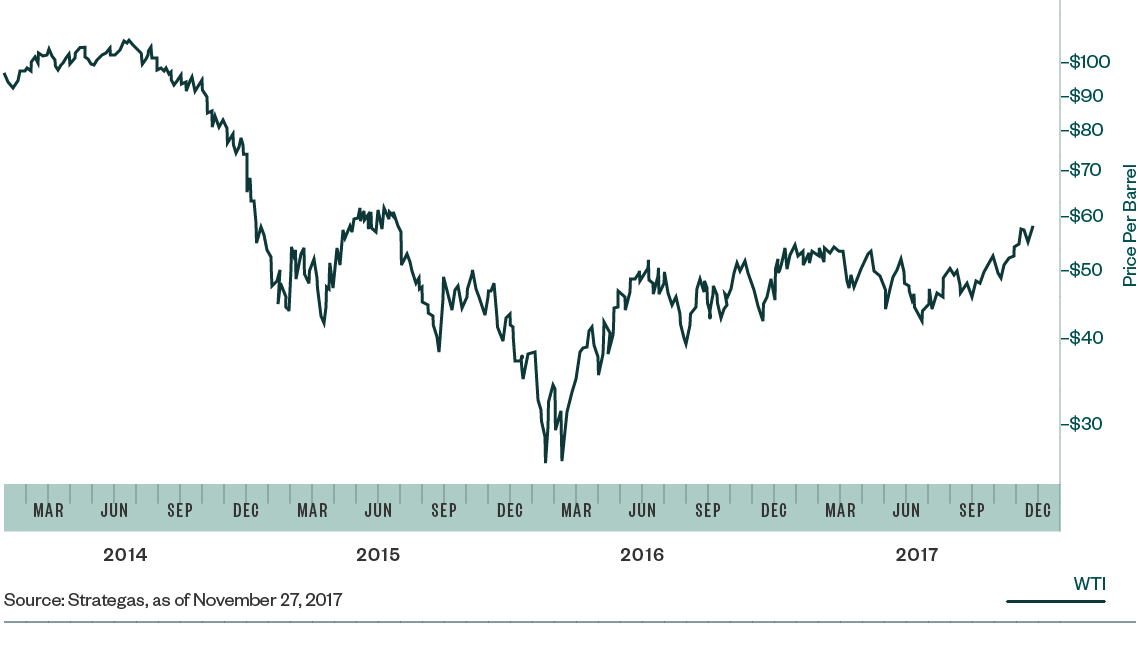

Since 2014, oil prices have been in a bear market, with an apparent bottom in 2015. Though there has been some price recovery this year, oil prices remain well below their 2014 highs.

Oil as a commodity has been a far better performer in 2017 than individual energy stocks. At the end of November 2017, West Texas Intermediate (WTI) crude oil was pricing at $57.40, which represents a 2.5-year high and a 7% increase for the year. Brent crude oil was at $62.63, a 10% increase for the year.

2017 WTI Crude Oil Prices

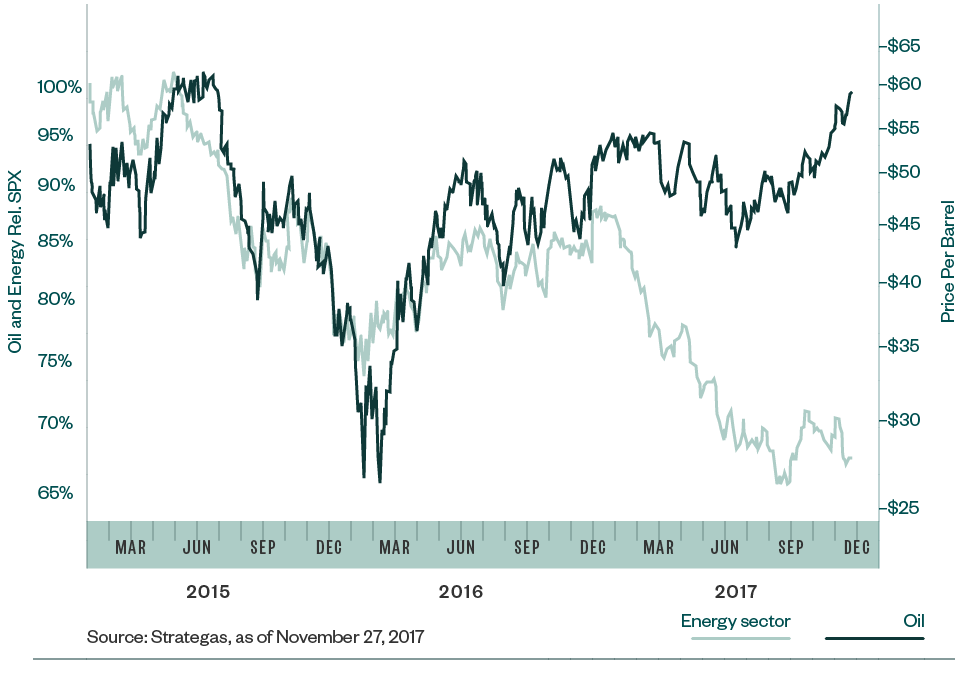

Oil and energy stocks typically correlate positively to price increases and positive market fundamentals. However, despite oil prices rising between 7% to 10% over the course of 2017, oil service stocks dropped nearly 27% from 2016 and the energy sector as a whole dropped about 7% from the same time period.

Some of this disparity can be attributed to the severe oil price volatility the market has experienced since 2014, which has likely scared off some participants. Many people are likely waiting for extended oil price stability before investing in oil again.

2017 WTI Crude Oil Prices Versus Energy Sector Performance Relative to the S&P 500

Looking Ahead

The following influencers are likely to affect oil prices and energy sector returns in 2018.

Global Demand

In both 2016 and 2017, global oil demand has been stronger than expected. It’s anticipated to grow by 1.2 million barrels per day each year through 2022, according to the International Energy Agency (IEA).

While most economies worldwide are growing and, subsequently, need more oil, the majority of the demand growth is coming from India, China, and other emerging markets.

Supply

Persistent oversupply has been one of the biggest issues for oil and gas companies in 2017, keeping oil prices low even as global demand increases. Much of the oversupply comes from continued US production; however, OPEC, a much larger oil producer than the US, has mostly adhered to their planned supply cuts this year and oil prices have since migrated higher.

OPEC

At the end of 2016, the Organization of the Petroleum Exporting Countries (OPEC) agreed to production cuts of 1.8 million barrels per day in an attempt to restrict supply and boost oil prices. At the end of November 2017, the cartel and other major producers, including Russia, agreed to extend production cuts through the end of 2018.

Inventories

In June 2017, the oil market had about 230,000 barrels of oversupply. By December, it only had about 70,000. The remaining oversupply is expected to dissipate by June 2018.

Capital Investments

Due to depressed oil prices, global oil and gas capital investment fell by 25% in 2015 and by another 26% in 2016—the first time the space has seen two consecutive years of capital investment declines. In 2017, there were modest signs of recovery led by higher investment in some US oil producing regions.

How It May Affect Supply

With demand expected to grow, markets don’t seem concerned about the capital investment declines or issues with future supply being able to meet the additional demand. It seems most believe that US producers will be able to fulfill any future needs.

However, given overall US production capabilities, it’s estimated that the US will only be able to supply about 70% of the world’s increased demand for oil through 2025.

In their 2017 Oil Report, the International Energy Agency (IEA) states:

In presenting our latest oil market analysis and forecast in Oil 2017, we are emphasizing an important message: more investment is needed in oil production capacity to avoid the risk of a sharp increase in oil prices towards the end of our outlook period, 2022. The oil market today seems remarkably sanguine about this issue, but this feeling might not persist for too long before the realization dawns that unwelcome price pressures might lie ahead.

Geopolitical Issues

Uncertainty exists in the geopolitical realm with significant issues existing in the United States, Iran, Syria, Saudi Arabia, and Russia, among others. When supply and demand are tightening this can be an increased risk to the oil market, typically seen in the form of supply disruptions.

We’re Here to Help

To learn more about your portfolio’s areas of opportunity or the potential impact of global events on the energy sector or oil and gas markets, contact your Moss Adams advisor.