In June 2018, Governor Jerry Brown signed legislation extending the California Competes Tax Credit (CCTC) program for an additional five years.

In the CCTC program’s 2018–2019 fiscal year, the California Governor’s Office of Business and Economic Development is authorized to negotiate $180 million in tax credits over three application periods. However, the application process is very competitive.

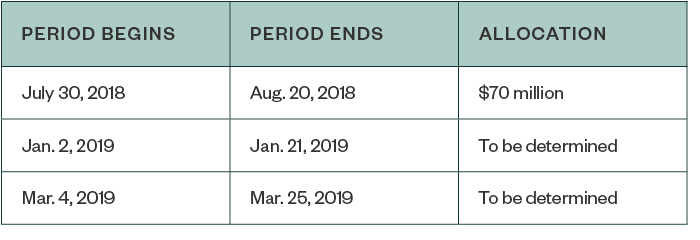

The first application period opens July 30, 2018, with $70 million in credit available. The remainder of the $180 million will be dispersed over two additional periods.

CCTC Application Periods

Eligibility

The CCTC is available to businesses located inside and outside of California that have plans to grow new full-time jobs in the state of California—regardless of size or industry. Specifically, the CCTC is available to businesses that are doing the following:

- Thinking about expanding and currently located in California

- Planning to start operations in California or relocate there

- Contemplating leaving California

We’re Here to Help

Since the CCTC’s introduction in 2014, we’ve represented clients through the highly competitive application and negotiation process and secured more than $40 million in CCTC awards. With $180 million program credits available during the 2018–2019 fiscal year, we encourage you to learn more about the process.

We’ll provide additional Alerts as more information about the credit and its allocation become available. In the meantime, visit our CCTC webpage, contact your Moss Adams professional, or email us at statetax@mossadams.com to learn more.