On August 29, 2018, the Financial Accounting Standards Board (FASB) issued Accounting Standard Update (ASU) 2018-15 Customer’s Accounting for Implementation Costs Incurred in a Cloud Computing Arrangement That is a Service Contract.

The ASU addresses the accounting for implementation costs paid by a customer in a cloud computing arrangement (CCA) that’s a service contract.

Background

The FASB previously clarified how to determine whether a hosting arrangement includes a software license or is a service contract when it issued ASU 2015-05 Intangibles – Goodwill and Other – Internal-Use Software (Subtopic 350-40): Customer’s Accounting for Fees in a Cloud Computing Arrangement (CCA).

ASU 2015-05 provides that if the CCA includes a software license, the arrangement is in the scope of the internal use software guidance in ASC 340, and an entity should use that guidance to determine which implementation costs should be capitalized. If the CCA doesn’t include a software license, the arrangement is a service contract and, generally, fees for the hosting arrangement are expensed as incurred.

However, the FASB didn’t address how to account for implementation costs related to a CCA that’s a service contract resulting in diversity in practice. ASU 2018-15 was issued to provide this guidance.

Key Provisions

Under the new standard, implementation costs incurred in a hosting arrangement that’s a service contract should be accounted for in the same manner as implementation costs associated with developing or obtaining internal-use software.

Specifically, the ASU amends ASC 350 to include in its scope implementation costs of a CCA that’s a service contract and clarifies a customer should apply ASC 350-40 to determine which implementation costs should be capitalized.

For example, while an entity would generally expense costs incurred during the preliminary project and post-implementation stages, as well as data conversion and training, costs associated with the application development phase would generally be capitalized. Please note that ASU 2018-15 doesn’t change the accounting for the service component of a cloud computing arrangement.

Capitalized implementation costs should be expensed over the term of the hosting arrangement, unless another systematic and rational basis is more representative of the pattern in which the entity expects to benefit from its right to access the hosted software.

The term of the hosting arrangement includes the fixed noncancellable period of the arrangement, plus all of the following periods covered by an option to:

- Extend if the customer is reasonably certain to exercise the option

- Terminate if the customer is reasonably certain not to exercise the option

- Extend—or not to terminate—which exercise is controlled by the vendor

Amortization should begin when any module or component of the hosted CCA service is ready for its intended use. Additionally, capitalized implementation costs associated with a hosting arrangement that’s a service contract should be reviewed for impairment in a manner similar to long-lived assets.

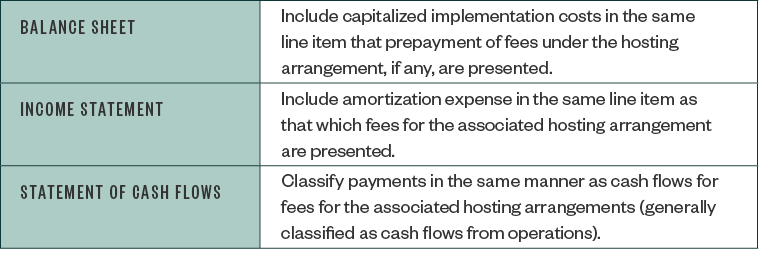

The guidance specifies the presentation of the capitalized implementation costs and the related amortization as follows:

Effective Dates and Transition

ASU 2018-15 is effective at the following different times based on an entity’s classification:

- Public business entities. Effective for annual periods beginning after December 15, 2019, including interim periods within those periods.

- All other entities. Effective for annual periods beginning after December 15, 2020, and interim periods within annual periods beginning after December 15, 2021.

Early adoption is permitted as of the beginning of any interim period if financial statements haven’t been issued or made available for issuance. The standard can be applied retrospectively or prospectively to eligible implementation costs incurred after the date of adoption.

We’re Here to Help

For any questions or to better understand how this new standard may affect your business, contact your Moss Adams professional.