The IRS has issued additional guidance on the new Employer Paid Family and Medical Leave Credit IRC 45S, created as part of tax reform. These updates could affect employer policies, qualified wages, and how the credit is reported for the first time, starting with the 2018 tax return.

The IRS has issued additional guidance on the new Employer Paid Family and Medical Leave Credit IRC 45S, created as part of tax reform. These updates could affect employer policies, qualified wages, and how the credit is reported for the first time, starting with the 2018 tax return.

Employer Policy Changes

Employer policies must have been in place no later than December 31, 2017 for 2018 calendar year filers. Policies must also not exclude any class of employees from being eligible for a paid family and medical leave. Short-term disability is considered a qualified paid leave policy whether self-insured by an employer or provided through a short-term disability insurance policy from an outside vendor. An employer may use any reasonable method to determine whether an employee has been employed for one year or more.

Qualified Wages

Qualified wages are normal gross wages paid to the employee for services performed. Overtime—with the exception of regularly scheduled overtime—and bonuses are ineligible when determining the $72,000 wage cap for qualified employees. Wages paid by a third-party payer, including an insurance company, a professional employer organization, or a Certified Professional Employer Organization, to qualifying employees for services performed for an eligible employer are considered qualified wages. However, only the eligible employer, and not the third-party payer, may take the credit. This is different from the treatment of other wage credits such as the Work Opportunity Tax Credit.

Reporting

Only an eligible employer for whom qualifying employees perform services may claim the credit with respect to wages paid.

Section 280C denies a deduction for wages or salaries paid for the taxable year equal to the amount of the credit. An employer’s deduction for wages paid is reduced by an amount equal to the amount of the credit. An eligible employer must file IRS Forms 8994 and 3800 with its tax return to claim the credit. An employer may elect to carryforward the credit up to 20 years as a general business credit.

Changes in State Law

A new Washington state law went into effect January 1, 2019, requiring employers and employees to pay into a state mandated paid leave program through payroll deductions. The state program allows for 12—18 weeks paid leave for any leave taken beginning January 1, 2020. This law change doesn’t impact a taxpayer’s ability to claim this credit for the 2018 and 2019 tax years.

Some states have mandated paid leave laws which limit eligibility, including:

- California

- New Jersey

- New York

- Rhode Island

- Washington, DC

In these states, the credit is equal to the applicable percentage of the amount of wages normally paid to a qualifying employee during any period—up to 12 weeks—the employee is on family and medical leave. However, the wages are first reduced by any paid time off or sick time used, then reduced by the amount of wages paid under the state mandated program.

Credit Calculation

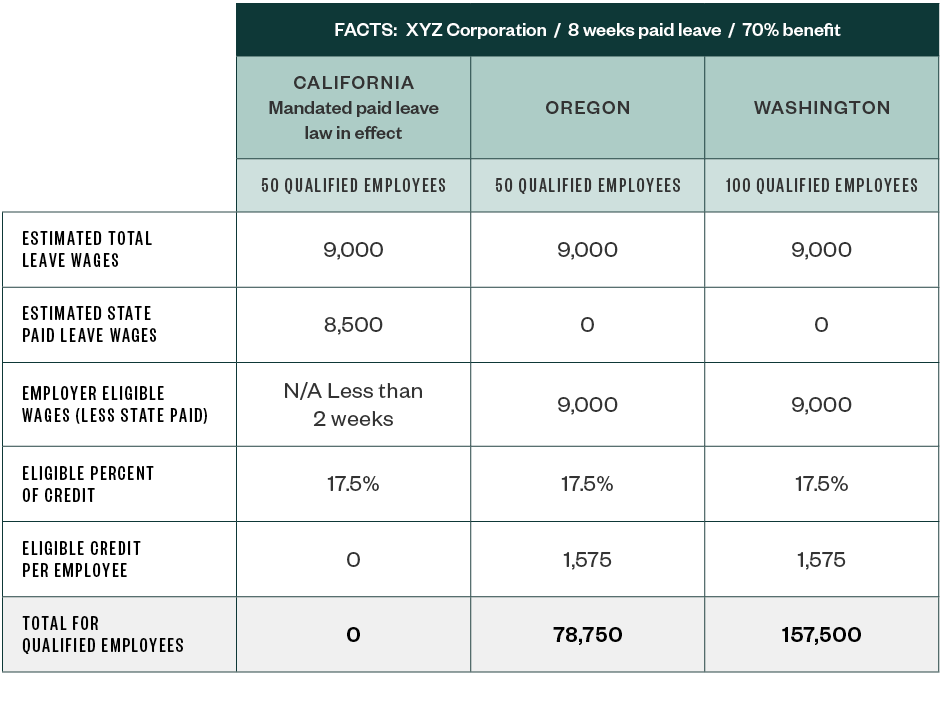

This process can be complicated and may vary for each employee and each state they’re performing services in. Below is a high-level example of how this credit can be calculated in states with and without mandated paid leave laws.

We’re Here to Help

Automated technology and platforms such as MaxCredits®—a web-based screening tool created by Moss Adams—can help take the administrative burden off employers when trying to leverage certain hiring and wage-based incentives such as the Work Opportunity Tax Credit, Disaster credits, state-level hiring and jobs credits, or zone-based credits. For more information about these types of credits and how MaxCredits can maximize opportunities for employers, contact your Moss Adams professional.