In the wake of recent notable closures of risk-bearing organizations (RBOs) and their management service providers, the California Department of Managed Health Care (DMHC) is expanding oversight of medical groups that take on multiple forms of risk regulated under California’s Knox-Keene Act. Your organization may need to determine if it requires a license to comply with the regulation.

Registration Requirements

Previously, licensure requirements were limited to health plans that assumed full financial risk for the provision of covered health care benefits to enrollees or subscribers even though that term wasn’t defined.

Effective July 1, 2019, DMHC will expand the licensure requirement to those entities that take capitation for both:

- Professional risk, the financial risk for professional medical services

- Institutional risk, the financial risk for hospital and ancillary services

Organizations that take part in other forms of institutional risk such as participating in risk pools and commercial accountable care organizations (ACOs) may now be required to obtain a restricted license. Centers for Medicare and Medicaid Services ACOs, however, aren’t subject to the new regulations. Organizations that meet the expanded definition may apply for an exemption, but they’re required to submit an application that includes many of the documents required for a license. This should be completed prior to July 2019.

For many organizations, what was perhaps previously a strategic move may have just become a requirement. This may not necessarily be a bad thing in the current environment and what’s expected in the future as care providers take on more risk for institutional costs and accountability creeps closer and closer to the power of the pen. Organizations that aren’t contemplating a risk strategy may find themselves lagging behind their competitors.

Licensing Process

Obtaining a license is no small undertaking. The extensive application process requires significant operational development. The financial analytics must be detailed and comprehensive, and the results achievable. They must also demonstrate constant maintenance of tangible net equity and working capital requirements while illustrating a thoughtful approach to revenue contracts and organizational structure.

Experts at the DMHC have been analyzing applications and dealing with RBO failures for a long time. While financial projections are the most critical component of that application, so too are details on governance, administrative infrastructure, and clinical coordination mechanisms. A disciplined approach that adequately addresses these and other core organizational development topics will not only increase your chances of success at obtaining a license, but also your success as a risk organization.

We’re Here to Help

Additional clarification from the DMHC is forthcoming given the number of existing contract scenarios. Our professionals are monitoring for additional guidance as it becomes available.

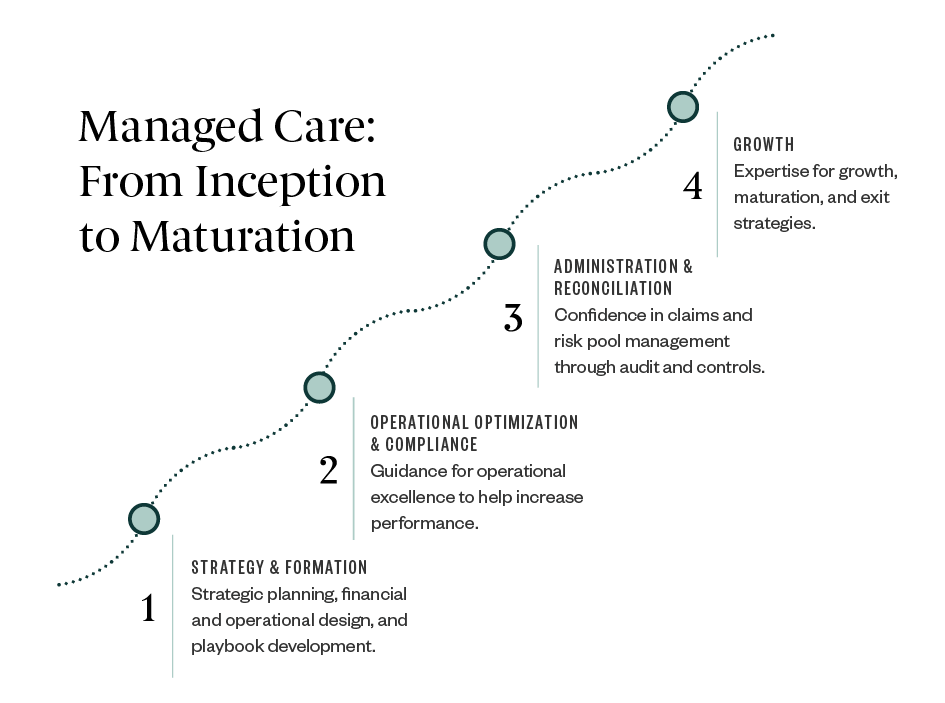

We regularly help organizations develop risk strategies and obtain California Knox-Keene licenses. Contact Karl Rebay at (949) 623-4193 or karl.rebay@mossadams.com to develop a strategy for your organization throughout the managed care life cycle, as pictured below, or to learn more about determining if you may be impacted by the new regulations.