As 2018 concluded, oil prices dropped after an extended steady climb that began midway through 2017 and continued for the first three quarters of the year. The energy sector largely tracked the direction of oil prices throughout the year, though many stocks lagged prices on the way up.

As 2018 concluded, oil prices dropped after an extended steady climb that began midway through 2017 and continued for the first three quarters of the year. The energy sector largely tracked the direction of oil prices throughout the year, though many stocks lagged prices on the way up.

Significant volatility hit global equity markets and the oil market in the fourth quarter as concerns of slowing economic growth weighed heavily on both stock and oil prices.

Continued unrest in the oil market, energy sector, and broader market should be expected in the near term as investors attempt to price in the implications of increasing US oil production, rising US interest rates, various geopolitical issues, and a potential slowdown in global economic growth. In the near-term, the government shutdown dampened economic growth, further pressuring oil and gas prices.

The Energy Sector

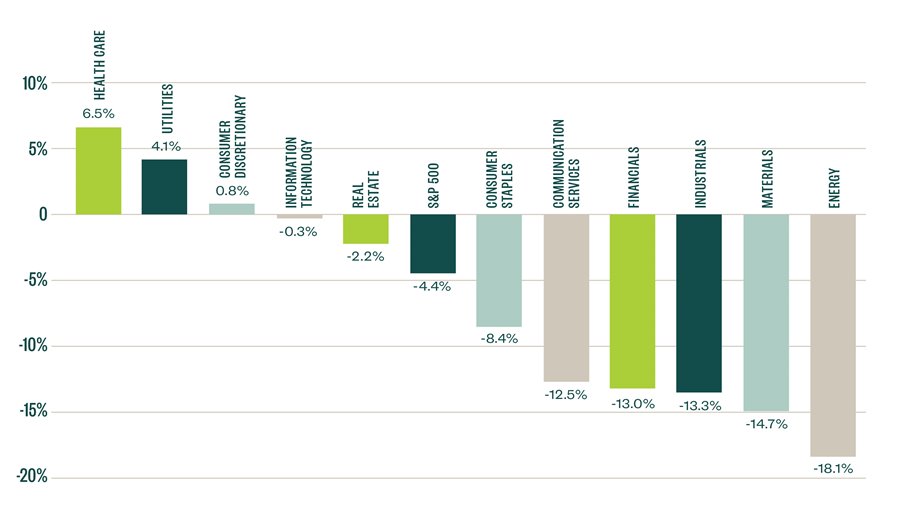

After a dislocated and volatile 2017, the energy sector mostly followed the path of oil prices in 2018. The sector increased about 8% at its peak in October before falling precipitously, ending the year down 18.1% and making 2018 another tough year for energy investors. Though most sectors in the S&P 500 were negative for the year, energy performed the worst.

2018 S&P 500 Sector Performance

The energy sector is attractive from a valuation perspective given the sharp decline in prices. This is particularly evident when looking at historical enterprise to earnings before interest, tax, depreciation, and amortization (EV/EBITDA) multiples and price-to-earnings (P/E) ratios.

Higher and steadier oil prices and evidence of growing cash flows, however, will likely be needed to entice many investors back to the energy sector. If US energy companies are able to build excess cash flow, the pace of shareholder-friendly activities such as dividends and buybacks could accelerate.

Oil Market

Oil prices extended their gradual climb from 2017 through most of 2018 hitting $76 in early October, a four-year high and 26% increase from the beginning of the year.

Early in the fourth quarter, though, oil prices began a hasty decline. West Texas Intermediate (WTI) crude ultimately ended the year at $45.15, down 25% for the year. In November alone prices plunged 22%, marking the worst month for oil prices since the global financial crisis in 2008.

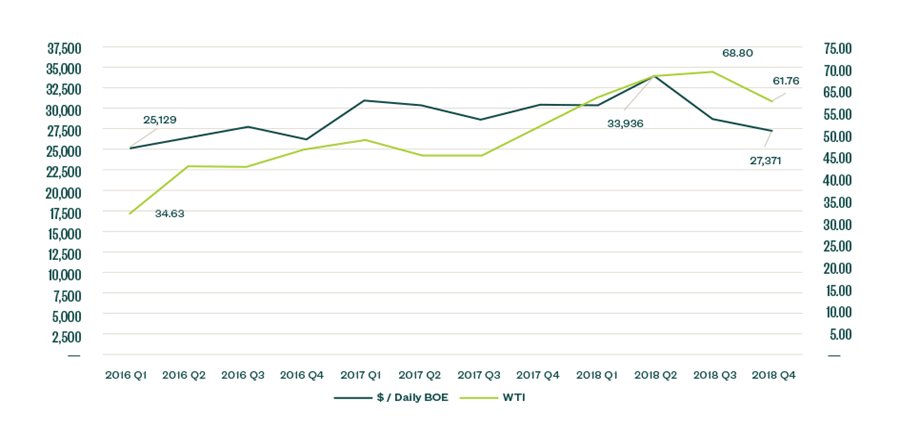

Dow Jones Oil and Gas Index vs. S&P 500 with WTI Overlay (Quarterly Average)

While low oil prices generally aren’t helpful for companies in the energy sector, they provide a tailwind for broader corporate profit margins and economic growth. Cheaper oil lowers the cost of transportation, food, and raw materials for businesses and allows consumers more disposable income.

Mergers & Acquisitions Activity

In 2018, 426 transactions were announced with a combined visible deal value of more than $85 billion. Since 2016, transactions have been driven by cautious optimism, increasing volumes, and prices paid. A sharp drop in oil prices in the last quarter of 2018, however, caused pull-back in deal prices.

Announced deals in 2018 were primarily driven by buyers of Permian Basin properties. More than 110 deals were announced in the region with a total purchase price of nearly $30 billion. Those were followed by 78 deals in the Rocky Mountain region, with purchases totaling approximately $6.5 billion, and 65 deals near the Gulf Coast, with a purchase price of approximately $11 billion. Offshore Gulf of Mexico deals increased to 21 deals in 2018 for an announced value of more than $5 billion. That’s compared to 11 deals in 2017 with a combined visible value of $2.5 billion.

Deal Value in $ / Net Daily BOE vs. Historical WTI (Quarterly Average)

Looking Ahead

Global oil prices will drive investment capital globally over the coming years. Deal and drilling activity will likely be steady from 2018 rates barring any more downturn in crude oil prices. Continued drilling efficiencies, driven by technology, will likely influence recoverable reserves, allowing for respectable investment returns even at crude prices below $60.

Conventional resource and offshore plays, however, will likely continue to suffer with prices in that range. Unconventional resource plays, such as those happening in the Permian Basin, Colorado Rockies, and Marcellus Shale, are expected to continue steadily as longer-term project capital facilitates drilling activities.

Supply

Prices of energy stocks and oil are heavily dependent on the global supply and demand for oil and, even more so, the future expectation of that balance. Global oversupply concerns were a major driver of the extreme price drop in late 2018.

In January 2017, the Organization of the Petroleum Exporting Countries (OPEC) and Russia cut output to drain oil stockpiles which halted a punishing downturn in oil prices. In June 2018, Saudi Arabia and others agreed to restore some of that production, partly to prevent future price spikes.

Meanwhile, the United States pumped at record levels and recently surpassed Russia and Saudi Arabia as the world's leading producer. OPEC and Russia agreed on curtailments in late 2018, but to date prices have only been slightly buoyed by the announcements and the further meager supply cuts.

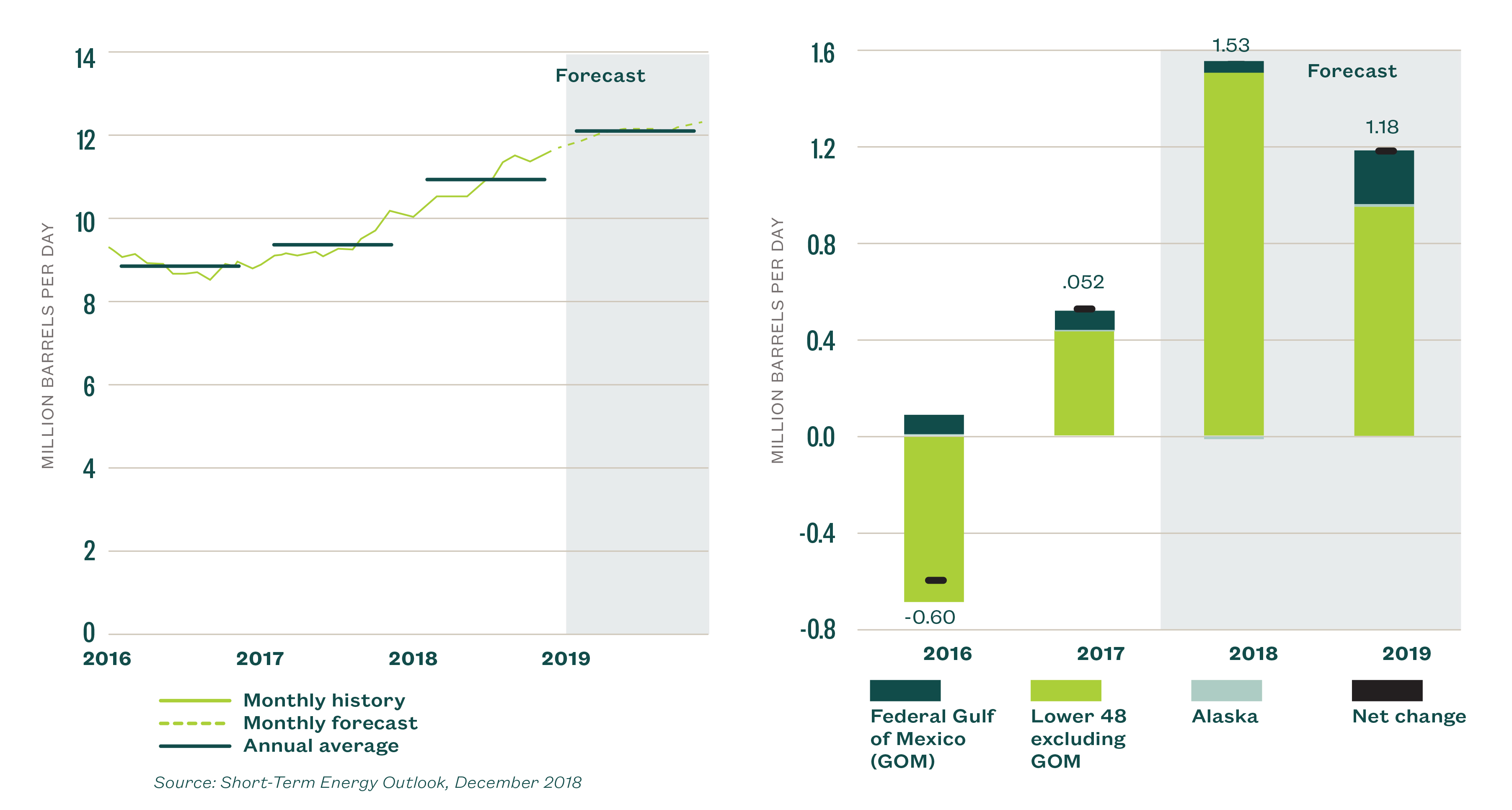

US Crude Oil Production

Oil prices fell late in the year. This was due to the combination of near record-level crude oil production from the world’s largest producers and unexpected waivers granted by the United States to eight countries to continue buying Iranian oil after imposed sanctions in early November.

The US Energy Information Administration (EIA) forecasts that US crude oil production will continue to increase to new record-high levels through mid-2019, which could put further downward pressure on prices.

Global Demand

In addition to oversupply concerns, worries surrounding the potential slowing of global economic growth in coming years is leading to related concerns about future oil demand.

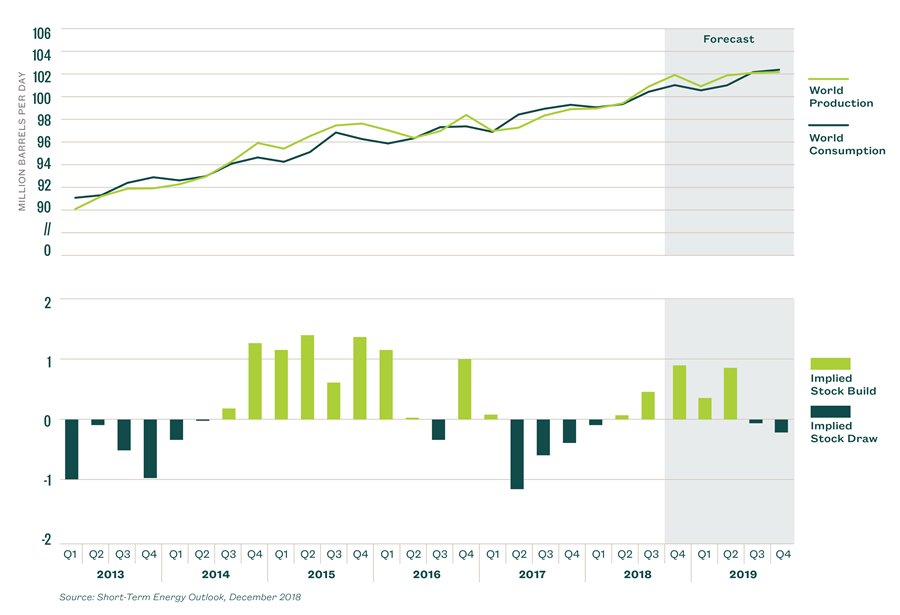

About 100 million barrels of oil were consumed around the world per day in 2018. The International Energy Agency (IEA) estimates oil demand will grow by 1.4 million barrels per day (b/d) in 2019.

World Liquid Fuels Production and Consumption Balance

While demand is expected to continue to grow in the long term, worries of slowing economic growth particularly in the United States, China, and other Asian nations, weighs on prices in the near term. Negative economic impacts from trade disputes and a strong US dollar (USD) can also act as headwinds to global demand.

Rising Interest Rates & the US Dollar

Thanks to a strong US economy in 2018, the Federal Reserve (the Fed) raised the federal funds rate a total of 1% through a series of 0.25% hikes throughout the year. The target range for the funds rate now sits at 2.25% to 2.5%, the highest since the 2008 financial crisis and much higher than the benchmark rates in most other developed nations.

Higher interest rates support a stronger currency. Nearly all global oil is transacted in USD, so when the USD is stronger (against the other large global currency, the Euro), it takes less dollars to buy an equivalent barrel of oil. Conversely, oil importers who benchmark their country’s currency must transact in increasingly expensive USD to buy oil. The following graph illustrates the relative strengthening of the USD since Q1 2018.

WTI vs. USD$/EURO Exchange Rate

Higher interest rates can also slow an economy if raised too high or quickly. In December, the Fed announced it anticipates only two hikes in 2019, a change from previous forecasts of four. A more measured rate hiking pace could slow the recent trend of USD strength and drive fear of an interest rate-induced economic slowdown.

Geopolitical Issues

Oil prices, equity markets, and future economic growth are all impacted by geopolitics. Significant uncertainty surrounds trade policy between the United States and China as well as interactions with Iran, Saudi Arabia, and Russia, among others.

Recent sanctions on Iran, if fully imposed, could reduce global oil supply. Continued escalation of tariffs and trade wars will also raise overall costs and slow economic growth.

We’re Here to Help

To learn more about areas of opportunity in your portfolio or the potential impact of global events on the energy sector or oil and gas markets, contact your Moss Adams advisor.