At the July 17, 2019, Financial Accounting Standards Board (Board) meeting, the Board voted to add projects to its agenda to amend the effective dates for private companies, not-for-profit organizations, and smaller reporting companies (SRCs) for recently issued standards related to the following topics:

- Financial Instruments – Credit Losses, Topic 326

- Leases, Topic 842

- Derivatives and Hedging, Topic 815

- Insurance, Topic 944

Key Provisions

During the meeting, the Board discussed how the difficulties encountered in transitioning to a new standard are magnified for smaller public business entities (PBEs) and nonpublic business entities such as private companies, not-for-profit organizations, and employee benefit plans.

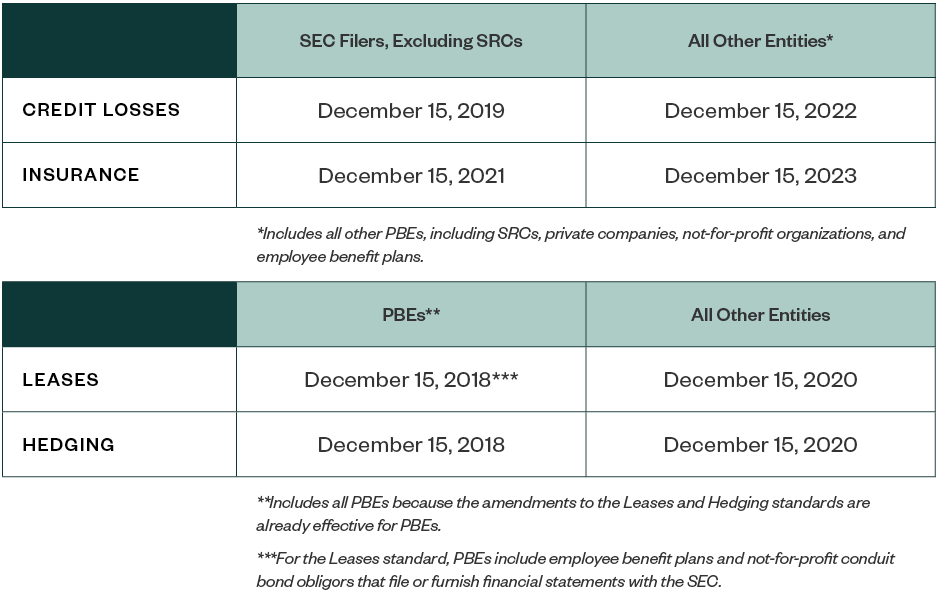

As a result, the Board voted in favor of developing an exposure draft in which a two-bucket approach would be proposed to stagger the effective dates for selected major standards, including the recent amendments to Credit Losses, Leases, Hedging, and Insurance.

- Bucket One: SEC filers, excluding smaller reporting companies as defined by the SEC.

- Bucket Two: All other entities—all other PBEs including SRCs, private companies, not-for-profit organizations, and employee benefit plans.

As discussed during the meeting, entities in bucket two would have an effective date of at least two years after the effective date established for bucket one.

Potential Effective Dates

As deliberated in the meeting, the updated effective dates are expected to be for fiscal years beginning after the following dates.

All dates and provisions described above are subject to change pending the drafting and issuance of a final Accounting Standards Update.

We're Here to Help

For more information on how these changes may affect your business, contact your Moss Adams professional.