In early 2019, the National Association of College and University Business Offices (NACUBO) released a study showing noteworthy changes to endowments. The changes may affect fiscal year (FY) 2018 annual returns for higher education institutions.

In early 2019, the National Association of College and University Business Offices (NACUBO) released a study showing noteworthy changes to endowments. The changes may affect fiscal year (FY) 2018 annual returns for higher education institutions.

Background

The 2018 NACUBO-TIAA Study of Endowments® (the study) surveyed 802 public and private institutions of higher education, covering $616 billion in endowment assets. Study results indicated a decline in annual returns from endowments in 2018, contributing to a continued decline in long-term returns from endowments.

This decline could lead to a larger budget gap, which could negatively impact operating budgets and institutional aid. For more information on the study, visit the NACUBO website.

Implications for Institutions

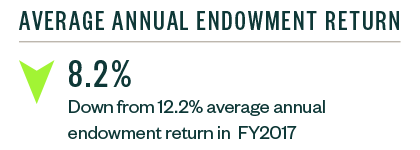

The study showed the average annual return, net of fees, for FY 2018 declined to 8.2%. This is a large decrease when compared to the FY 2017 12.2% average return, net of fees.

While institutions are said to be targeting a 7.2%, 10-year, long-term investment return, the average 10-year, long-term investment return landed at 5.8% for FY 2018.

The study also revealed average FY 2018 endowment spend was identical to FY 2017—4.4%, with private institutions averaging 4.7% endowment spend and public institutions averaging 3.8% endowment spend. Of this spend, respondents noted using 49% of funds on scholarships and student financial aid.

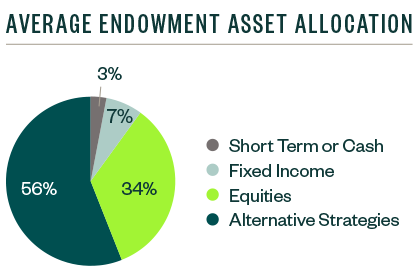

Within the endowments themselves, alternative strategies continue to hold strong. Endowments in the study saw an inflow of $9.9 billion in FY 2018, with the median gift at $3.7 million—up from $3.2 million in FYE 2017.

Looking Forward

With continued market volatility and a trailing 10-year long-term investment return that will continue to include the great recession of 2007 to 2009 for another year, FY 2019 may bring continued slides in investment performance.

We’re Here to Help

For more information about the 2018 NACUBO-TIAA Study of Endowments® or what findings could mean for your organization, contact your Moss Adams professional.