Tax reform, commonly referred to as the Tax Cuts and Jobs Act (TCJA), repealed Section 958(b)(4), which has ultimately caused many non-US payers to be converted into US payers for purposes of 1099 reporting and backup withholding. This conversion in classification of non-US to US is the result of new downward attribution rules required under the TCJA. The repeal has resulted in US subsidiaries of non-US parent companies being deemed to own and control foreign subsidiaries of the foreign parent, which is creating Controlled Foreign Corporations (CFCs) that didn’t previously exist.

Though many believe this consequence of the repeal of Section 958(b)(4) to be unintended, newly classified CFCs now have a new range of compliance and reporting obligations under US tax regulations, most of which fall under Form 1099 reporting.

Background and Repeal of Section 958(b)(4)

Section 958 provides the rules for determining stock ownership of CFCs. These rules include direct, indirect, and constructive ownership. In looking at the constructive ownership rules, Section 318 is applied with certain modifications. Prior to the enactment of the TCJA, Section 958(b)(4) prevented stock owned by a non-US person from being considered to be owned, via attribution, by a US person.

The legislative history from H.R. Conf. Report 155-466 shows the intent was to have a partial repeal of Section 958(b)(4) to target only certain “de-control” transactions. However, the final law has a total repeal of Section 958(b)(4). This has created a number of complications, including expanded 1099 reporting.

On May 20, 2019, and June 21, 2019, proposed regulations under Sections 954 and 958 were published to address certain issues related to constructive ownership for subpart F and Section 951A, Global Intangible Low-Taxed Income, but they’re limited to those issues.

Newly Created CFCs Under the TCJA Attribution Rules

The repeal of Section 958(b)(4) has created a situation in which there’s no longer a limitation on the downward attribution of stock ownership. Instead, under the revised attribution rules, a foreign subsidiary company that shares a foreign parent with a US company is now classified as a CFC. A CFC is defined as a foreign corporation that’s more than 50% owned by vote or value by a US shareholder.

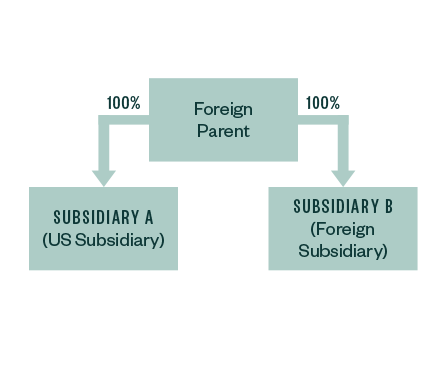

To illustrate the impact of the new attribution rules, consider the following circumstance, in which a foreign parent owns 100% of a US subsidiary and 100% of a foreign subsidiary.

Pre-TCJA

Prior to the TCJA, the US subsidiary wasn’t treated as owning shares of the foreign subsidiary because Section 958(b)(4) prevented such downward attribution. As a result, the foreign subsidiary wasn’t considered a CFC.

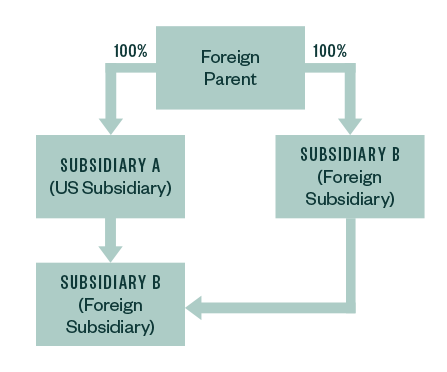

Post TCJA

Under the new TCJA attribution rules, however, because the foreign parent owns 100% of the US subsidiary and 100% of the foreign subsidiary, the US subsidiary is deemed to own the stock of the foreign subsidiary. That US subsidiary is consuming the foreign parent’s ownership of that foreign subsidiary. Accordingly, the foreign subsidiary is now considered a CFC.

1099 Reporting Background

Chapter 61 of the Internal Revenue Code (IRC) governs the requirements for Form 1099 reporting. Generally, IRC 61 requires a payer to file and issue a Form 1099 with respect to payments made to US nonexempt recipients in the course of a trade or business. Broadly, US nonexempt recipients include individuals, partnerships, estates, and trusts.

A payer making a payment to a US nonexempt recipient will be required to impose backup withholding at a rate of 24%, unless the payee has provided its US Tax Payer Identification Number (TIN) in the manner required, which will vary depending on the type of payment made.

Exceptions

Note that these are only general requirements, and there are exceptions that must be reviewed when assessing whether 1099 reporting is required. Exceptions relate to a variety of factors, including type of payment, the threshold, and the status of the payee.

Payments of Foreign Source Income

One exception to Form 1099 reporting and potential backup withholding, is for non-US payers making payments of non-US source income. In these cases—in which the payer’s only US connection is the payee’s US status—the exception substantially limits information reporting and withholding obligations of a non-US payer and shields them from expansive reporting requirements.

It’s important to note that CFCs are considered US payers and are bound by all 1099 reporting obligations as set forth in the IRC. That means they don’t qualify for this foreign source exception.

Unintended Information Reporting Consequences

With the repeal of Section 958(b)(4), newly created CFCs are now subject to a far broader obligation to report payments made to US persons on Forms 1099. For certain payers, the overall impact of being classified as a CFC could be significant.

As a newly classified CFC, a payer will be required to file Forms 1099 for both US and non-US source payments, which will greatly expand the 1099 reporting population. Second, a CFC will be required to backup withhold on worldwide income for payees that have not provided a US TIN. This could create significant work to collect TINs from the preexisting US payee population. Lastly, a new CFC will need to modify their payee onboarding procedures to ensure that they’re classifying payments made to US payees, collecting Forms W-9, TIN matching—a process only available through the IRS website to individuals who are US taxpayers, backup withholding (where necessary), and filing Forms 1099 and 945 (where applicable) each year. It is highly likely that the new obligations will require additional internal or external resources, which would present yet another challenge.

Imagine, for example, a non-US-based bank with subsidiaries located around the globe. Under the new rules, the US subsidiaries would be attributed ownership of the stock of the non-US subsidiaries, potentially making them all CFCs. These organizations, who’ve set up documentation, withholding, and reporting procedures and systems to accommodate the requirement to report only US source income paid to their US financial account holders, will now have to report worldwide income on Forms 1099.

The implications to global organizations in the business of making financial services payments are vast. An interesting question to consider is what would motivate the US Treasury to require this additional reporting, especially after the recently implemented FATCA regime that requires non-US financial institutions to report global income earned and account ownership by US persons.

Takeaways and Next Steps

The unintended consequences of the Section 958(b)(4) repeal are greatly concerning for many companies. Those in the industry have urged the IRS and US Treasury to reconsider this repeal, or at least provide clarification on the 1099 reporting obligations for newly classified CFCs.

While we wait for clarification from the government, multinational companies that have a combination of US and non-US entities within their corporate structure should analyze the status of each non-US entity.

If a new CFC is identified, that CFC must consider procedures and controls to comply with the new 1099 reporting obligation, and associated potential backup withholding obligations. A new CFC should look at their current payee population to determine the following:

- Types of payments made

- Whether a US TIN is on file

- Whether solicitation of Forms W-9 is required

- If the entity is eligible to utilize the IRS TIN matching program

- Whether backup withholding procedures must be enhanced or created

- How to file a potential new population of Forms 1099 in a timely manner

We’re Here to Help

For more information on how this update could affect you and your business, contact internationaltax@mossadams.com or visit our dedicated tax reform page or view our tax planning guide.