Much like the end of 2014, the current pricing environment for oil and gas has created the need for companies to evaluate many aspects of their business and operations, including their 2018 financial reporting.

Much like the end of 2014, the current pricing environment for oil and gas has created the need for companies to evaluate many aspects of their business and operations, including their 2018 financial reporting.

Reserve volumes have been significantly impacted by commodity prices. As prices decrease, wells become uneconomic more quickly, resulting in fewer volumes lifted. Lower volumes coupled with decreased prices lower a company’s overall reserve value, including wells that become altogether uneconomical.

Significant recovery in the near future is uncertain, and this trending decline could have substantial impacts on companies’ 2018 year-end financial reporting. Here’s a look at oil and gas trends and what declining prices could mean for your company.

Background

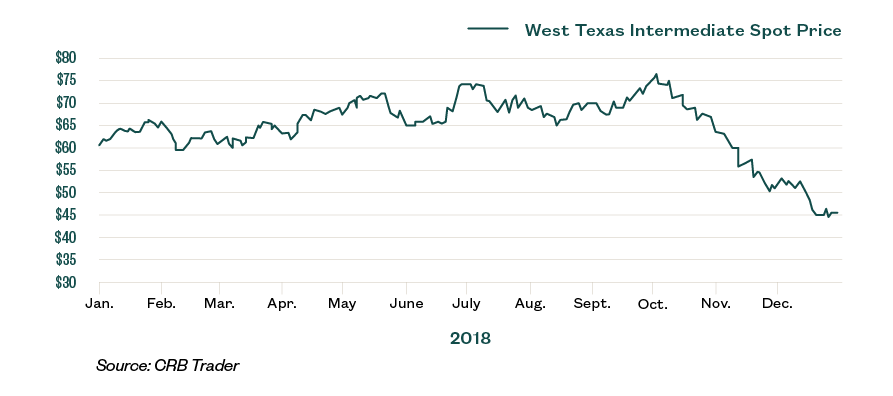

After floating between $42 and $50 per barrel in most of 2017, crude oil (WTI) began climbing in the fourth quarter of 2017 and entered 2018 just above $60 per barrel. That trend continued through the beginning of the fourth quarter of 2018 when oil peaked at $76. Exploration and production (E&P) companies began making new investments and deploying capital, and the M&A markets were increasing.

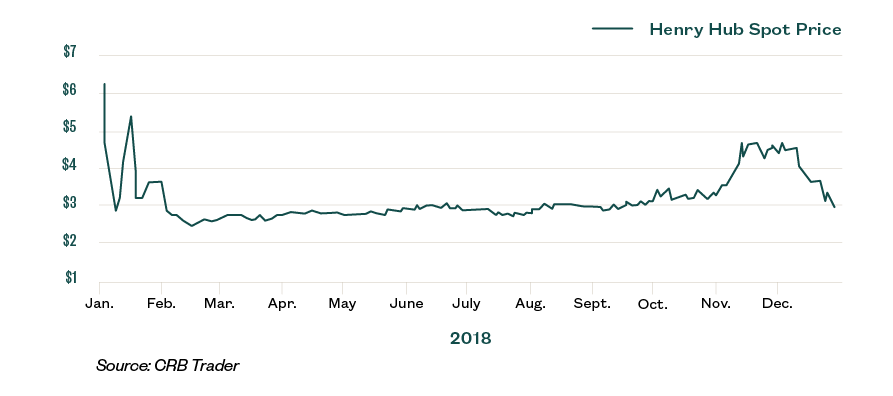

Since its 2018 peak, the price of crude oil has again been trending downward and closed 2018 at $45 barrel. Somewhat similarly, natural gas prices steadily increased from $2.50 per one million British thermal units (MMBtu) to $3.50 per MMBtu, spiked in the fourth quarter, and then dropped back to $3 by year-end.

As of February 12, 2019, crude oil futures were trading between $53 and $56 through 2020. Natural gas futures were trading between $2.60 and $3.

Potential Areas of Impact

Carrying Value: Full Cost Method

Companies following the full cost method of accounting are required to calculate a limitation on capitalized costs, known as the full cost ceiling, on a quarterly basis. In its simplest form, the net capitalized costs are compared to the PV10 value of a company’s reserves after considering tax effects. The PV10 value is the present value of estimated future oil and gas revenues, net of estimated direct expenses, discounted at an annual rate of 10%.

The pricing used to estimate reserves for a full cost company is mandated by Securities and Exchange Commission (SEC) regulations. This means the forecasted commodity prices included in the future cash flow estimates are equal to the average price during the 12-month period prior to the ending date of the period covered by the report. This is determined as an unweighted arithmetic average of the first-day-of-the-month price for each month within the period. The lower the PV10 value, the higher the likelihood that impairment will occur.

Many full cost companies may not see a write down for year-end 2018, but, should prices stay at their current lows or continue to decrease through 2019, the rolling quarterly calculations will result in a ceiling that also lowers each time.

Carrying Value: Successful Efforts Method

Companies following the successful efforts method of accounting use a two-tiered approach to assess impairment. First, management estimates expected undiscounted future cash flows from the properties whenever events or circumstances indicate an asset may be impaired. This should happen at least annually. If the asset’s carrying value exceeds this amount, an impairment indicator exists.

The second step is to measure the loss, which is the excess of the carry value over the estimated fair value. Given the current pricing scenario, a potential issue is created by this method because management is required to estimate whether future cash flows and reserve reports that run on forward-strip pricing will be lower than those run on an SEC-price deck.

While full cost companies are required to follow SEC pricing, a successful efforts company must determine what their best estimate of future pricing is, and they must be able to support this conclusion.

Proved-Undeveloped Properties

SEC Regulation S-X Rule 4-10 states a company can only classify reserves as proved undeveloped if it has the following:

- A development plan in place

- The intent and ability to drill the location within five years

However, in this pricing environment, many companies are slowing, delaying, or stopping their drilling programs. This is because lower pricing causes declines in revenues, which may strain financial performance and access to capital. This makes it harder to assert that an entity has the wherewithal to commit to funding a drilling program.

In response, some proved-undeveloped oil and gas reserves (PUDs) that were expected to be drilled in the next five years may be pushed back and will need to be reclassified to unproved reserves.

Unrealized Hedging Gains

While recent price declines may have helped companies benefit from their existing price swaps, newly entered contracts will likely be less favorable because forward markets have also declined. As a result, the current market-to-market gains offsetting the lower revenues could begin to diminish.

Many loan agreements require companies hedge a percentage of their production. Given that new contracts could have lower pricing, any short-term or sudden recovery of prices won’t immediately benefit all entities because they’ll be incurring losses under new derivative agreements.

Liquidity

If current pricing trends continue, cash from operations will decrease and obtaining outside financing will become more difficult. The borrowing base on many loan agreements is based on year-end reserves, and redetermination typically occurs in March or April, resulting in lower borrowing availability.

As debt covenants become harder to pass, the need for waivers will increase and some institutions may not be as willing to grant them. Highly leveraged companies that have relied on their reserves and operations may be unable to service their debt, and any covenant violations that aren’t waived may result in debt being callable.

If unable to meet their debt obligations, entities may be required to reclassify their debt from noncurrent to current, search for alternative financing, or even consider reorganizations or bankruptcies.

Effects on Going Concern

As a result of the above factors, some entities will experience substantial doubt about their ability to continue as a going concern.

A company’s management is required to assess if there’s substantial doubt about the entity’s ability to continue as a going concern through the one-year period following the date of report issuance. Many auditors will also ask their clients to provide additional support for their assessment.

Regardless of whether auditors include a going-concern emphasis paragraph in their opinion, many companies will need to include a liquidity footnote disclosing the nature of their issues and management’s plans to remedy them.

We’re Here to Help

For more information on the current pricing environment for oil and gas and potential impacts on your company’s 2018 year-end financial reporting, contact your Moss Adams professional.