On November 15, 2019, the Financial Accounting Standards Board (FASB) issued two Accounting Standards Updates (ASUs):

- ASU 2019-09, Financial Services—Insurance (Topic 944): Effective Date

- ASU 2019-10, Financial Instruments—Credit Losses (Topic 326), Derivatives and Hedging (Topic 815), Leases (Topic 842): Effective Dates

The amendments defer the effective dates for the recently issued updates related to each of the above standards. Following are the key provisions and effective dates entities should know.

Background

During the July 17, 2019, board meeting, the FASB discussed how challenges encountered in implementing major standards are often magnified for smaller public business entities (PBEs) and nonpublic business entities.

As a result, the board voted in favor of developing a new two-bucket philosophy to stagger the effective dates of major standards between larger public companies and other entities.

- Bucket one. SEC filers, excluding smaller reporting companies (SRCs) as defined by the SEC.

- Bucket two. All other entities—all other PBEs including SRCs, private companies, not-for-profit organizations, and employee benefit plans.

Under the two-bucket philosophy, a major update would first be effective for bucket-one entities. The FASB would then consider a staggered effective date of at least two years after the bucket-one effective date for all other entities included in bucket two.

Updated Effective Dates

The amendments in ASU 2019-09 and ASU 2019-10 defer the effective date of the following recently issued updates:

- ASU 2016-13, Financial Instruments—Credit Losses, Topic 326

- ASU 2018-12, Financial Services—Insurance, Topic 944

- ASU 2016-02 and related updates, Leases, Topic 842

- ASU 2017-12, Derivatives and Hedging, Topic 815

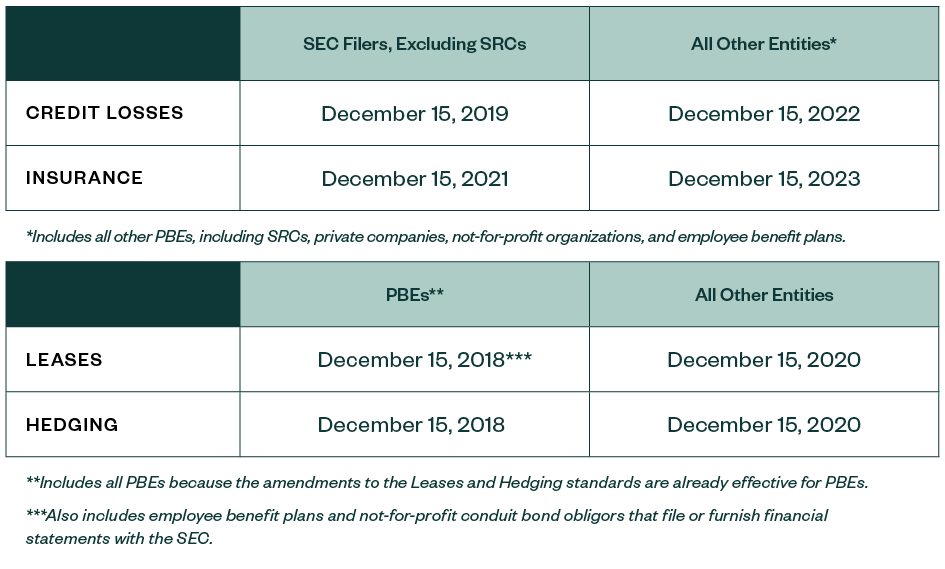

Consistent with the new two-bucket effective-date philosophy, the updated effective dates are for fiscal years beginning after the following dates.

For the purposes of applying the effective dates of the credit losses or insurance standards, an entity is required to use its most recent determination of whether the entity is eligible to be an SRC as of November 15, 2019, in accordance with SEC regulations. For example, for calendar-year-end companies, the determination date would generally be June 28, 2019—the last business day of the second quarter.

Early application of the standards continues to be permitted for all entities.

Goodwill Impairment

The amendments in ASU 2019-10 also defer the mandatory effective date for the elimination of step two from the goodwill impairment test in ASU 2017-04, Intangibles—Goodwill and Other (Topic 350): Simplifying the Test for Goodwill Impairment.

Maintaining the alignment of effective dates for the goodwill and credit losses updates allows an entity to adjust the carrying amount of its loan portfolios before testing for goodwill impairment. This eliminates the potential double counting of losses associated with the loans.

We’re Here to Help

For more information about these major standards, implementation, or what these changes might mean for your business, contact your Moss Adams professional.