By understanding the nature of SEC comments and taking the appropriate steps to comply, life sciences companies have an opportunity to significantly reduce initial public offering (IPO) filing delays.

By understanding the nature of SEC comments and taking the appropriate steps to comply, life sciences companies have an opportunity to significantly reduce initial public offering (IPO) filing delays.

In our report, Under the Microscope: An Analysis of SEC Comment Letter Trends Among Middle-Market and Pre-IPO Life Sciences Companies, we looked at S-1, 10-K, 10-Q, and 20-F filings made by life sciences companies during a 12-month review period in 2017 and 2018.* Comments were analyzed by frequency as a way of identifying the most prominent topics under SEC scrutiny.

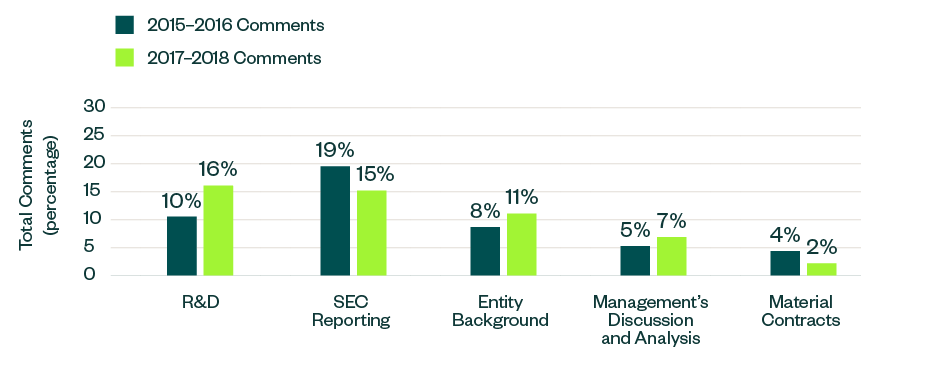

Comments relating to R&D clinical trials saw the most growth in 2017–2018. Comments relating to entity-related disclosures and management’s discussion and analysis (MD&A) also saw an increase in focus, while comments targeting reporting guidelines and information on material contracts dipped slightly.

Initial Findings

Comment Categories

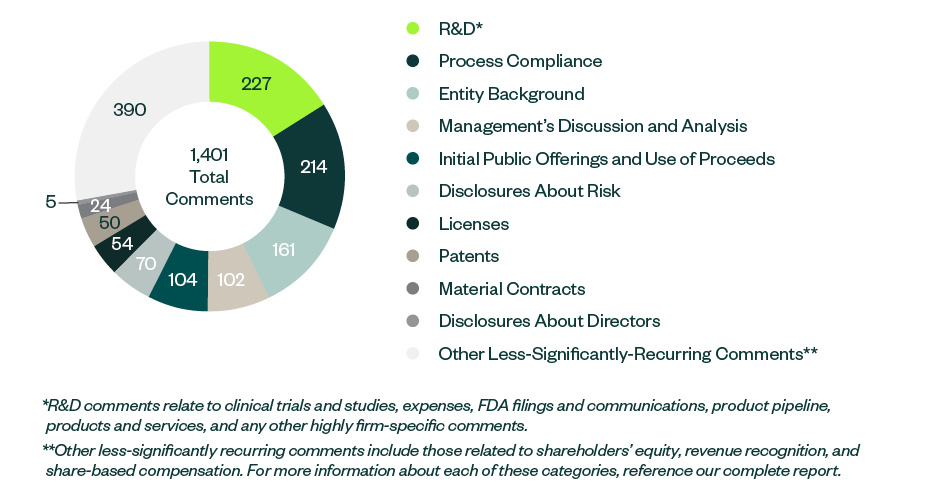

R&D remained the most prominent category to receive SEC comments—with the majority directed toward companies’ clinical trials—followed by comments relating to process compliance, disclosures on entity backgrounds, the IPO, MD&A, and any current or anticipated risks related to the business.

Information around shareholders’ equity, licensing agreements, patents, and proxy disclosures on company directors and officers collectively constituted a large percentage of SEC scrutiny.

The following infographic depicts a breakdown of 1,401 total SEC comments, according to category and frequency.

Significant Changes

The below topics showcased a positive or negative variance, measured as a ratio to the total number of comments. This includes categories such as R&D, process compliance, entity background, MD&A, and material contracts.

Out of these topics, comments related to R&D, entity-related disclosures, and MD&A saw an increase in focus in 2017–2018 by 6%, 3%, and 2%, respectively. Meanwhile, those targeting reporting guidelines and information on material contracts dipped by 4% and 2%, respectively.

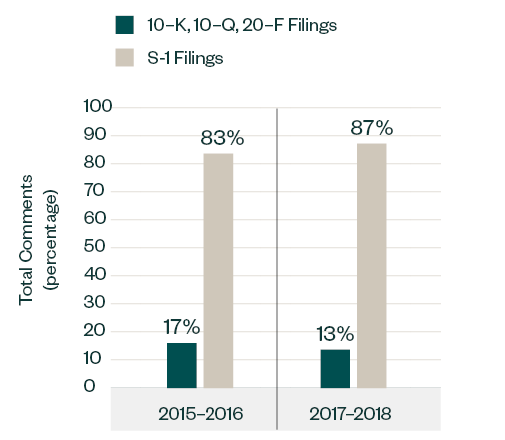

Filing Type

Similar to the 2015–2016 report, S-1 filings continued to lead in relation to SEC scrutiny. Of the total 1,401 comments analyzed in 2017–2018, 1,221 comments—approximately 87%—were directed at S-1 filings, up from 83% recorded in 2015–2016. The focus in the S-1 filing category somewhat varied among pre- and post-IPO candidates.

Topics such as process compliance, R&D, MD&A and entity-related disclosures were common for all types of applicants.

Comparatively, companies filing forms 10-K, 10-Q and 20-F saw greater emphasis on their financial statements, licensing arrangements, and patent statuses, similar to 2015–2016.

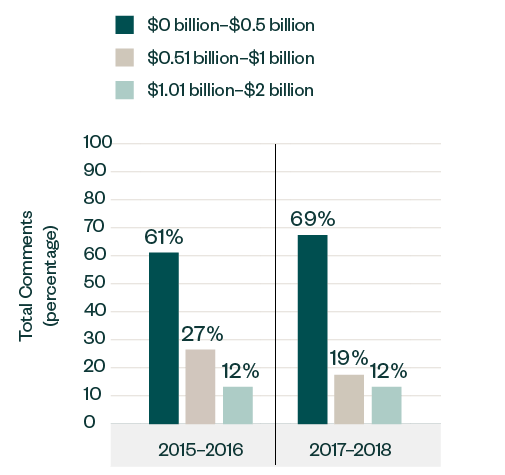

Market Capitalization Range

In terms of size, public companies with market capitalization below $500 million accumulated a significant portion of over 69% of the comments, up from 61% in 2015–2016.

Meanwhile, those with market capitalization ranging from $500 million to $1 billion witnessed a drop in the number of comments, shifting from a 27% share in 2015–2016 to only 19% in 2017–2018. The share of comments for those ranging from $1 billion to $2 billion remained consistent at 12%.

Results by Subindustry

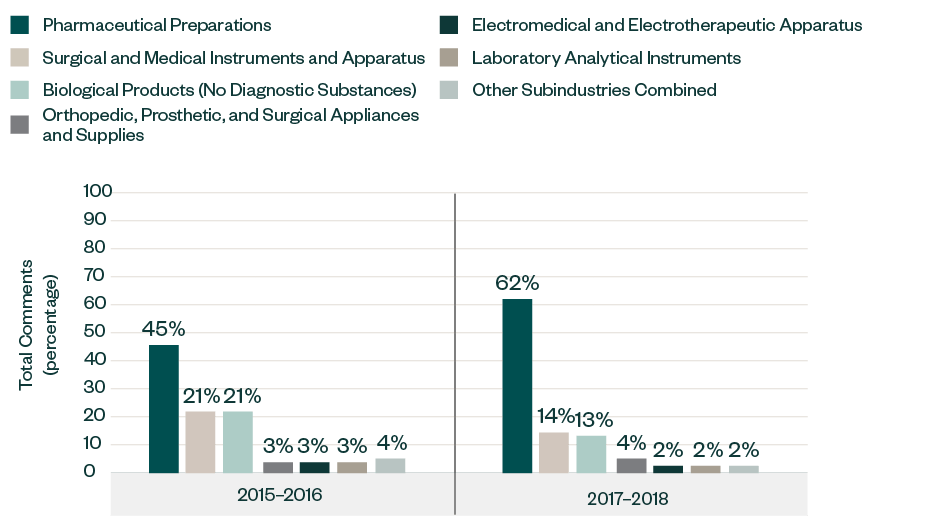

Similar to the 2015–2016 report, the majority of the comments in this category were directed toward companies in pharmaceutical preparations, with its share significantly increasing from 45% in 2015–2016 to 62% in 2017–2018.

Other prominent subindustries, such as surgical and medical instruments and apparatus and biological products, have each decreased from a respective share of 21% in the previous report to 14% and 13%, respectively. The breakdown of other sectors has remained quite consistent over the years, deviating within 1%–2%.

Additional Content

The SEC takes evolving market dynamics into consideration when determining registrants for review. In terms of content, the focus of comments continued to vary across subindustries, resulting in a somewhat similar pattern to that observed in the previous report.

For example, R&D was quite prominent for not only pharmaceutical and biological product companies, but also for orthopedics and prosthetics companies.

Information on entity background comprised almost 30% of the comments for companies in the subindustries of electromedical and electrotherapeutic apparatus, which is a significant increase from the 26% share in 2015–2016.

We’re Here to Help

For more information on SEC comments, read our full guide, which covers these topics in greater detail, or contact your Moss Adams professional.

*Data in this report corresponds with S-1, 10-K, 10-Q, and 20-F filings made by life sciences companies during a review period from May 1, 2017, to April 30, 2018.