A version of this article was published in the December 2019 edition of California CPA Magazine.

The 2019 tax busy season brought challenges for many California businesses and individuals, largely due to state conformity questions relating to the 2017 tax reform reconciliation act, commonly referred to as the Tax Cuts and Jobs Act (TCJA).

The 2019 tax busy season brought challenges for many California businesses and individuals, largely due to state conformity questions relating to the 2017 tax reform reconciliation act, commonly referred to as the Tax Cuts and Jobs Act (TCJA).

Although the 2019 busy season has come to an end for most practitioners, there are many 2019 filing requirements that will continue to impact California taxpayers in 2020. Here’s an overview of federal tax changes, California’s conformity requirements, and additional considerations for taxpayers during the 2020 busy season.

California Conformity

As of December 2019, the TCJA turned two years old. As noted in the 2018 tax season guide, California didn’t conform to most federal tax-law changes introduced in the TCJA. This added complexity for taxpayers that needed to calculate the correct amount of tax owed to the state of California.

Although California enacted a bill that realigns the state’s tax code and adopts certain elements of the TCJA, there are still many areas of the TCJA with which California doesn’t conform or only selectively conforms.

Doesn’t Fully Conform

In the 2018 tax season guide, we addressed tax-law changes that California taxpayers should watch out for. California still doesn’t conform with many of those federal tax laws, including the following:

- Qualified Business Income Deduction. California doesn’t conform to Internal Revenue Code (IRC) Section 199A, which allows certain owners of sole proprietorships, partnerships, trusts, and S corporations to deduct 20% of qualified business income.

- Full-Expensing Deduction. California hasn’t and still doesn’t conform to IRC Section 168(k), which allows the additional first-year depreciation deduction for the cost of certain tangible business-use personal property assets.

- State and Local Tax Deduction. For federal tax purposes, an individual’s deduction for the aggregate amount of state and local taxes (SALT) paid during a calendar year is limited to $10,000—or $5,000 in the case of a married individual filing separately. California doesn’t conform to the federal limitation and doesn’t allow a deduction for SALT paid in the calculation of income.

Now Conforms

In an effort to reduce taxpayer compliance burdens, California Governor Gavin Newsom signed Assembly Bill (AB) 91 legislation on July 1, 2019—selectively aligning parts of California tax law to the TCJA.

A few important conformity changes are highlighted below. Unless otherwise noted, the legislation is effective July 1, 2019, and applies to tax years beginning on or after January 1, 2019.

Accounting Methods for Small Businesses

The TCJA increased the average annual gross receipts thresholds, allowing more taxpayers to use simplified methods of accounting. AB 91 conforms to these changes. Specifically, AB 91 follows the TCJA in increasing the following average annual gross receipts:

- The cash method of accounting. The average annual gross receipts threshold increased from $5 million to $25 million for taxpayers that are permitted to use the cash method of accounting.

- The accrual method of accounting. The average annual gross receipts threshold increased from $5 million to $25 million for farming corporations that are exempt from using the accrual method of accounting.

- Uniform capitalization (UNICAP) provisions. The average annual gross receipts threshold increased from $10 million to $25 million for resellers and $0 to $25 million for producers to be exempt from UNICAP provisions.

In addition, California now conforms to TCJA changes that exempt businesses with average annual gross receipts of $25 million or less from rules that require taxpayers to maintain inventories. Instead, these taxpayers can account for items that are either:

- Nonincidental materials and supplies

- In accordance with a taxpayer’s method for financial accounting

California also now exempts certain taxpayers’ construction contracts from the required use of the percentage-of-completion method. To qualify for the exemption, the taxpayer must have average annual gross receipts that don’t exceed $25 million. These changes apply to personal income taxpayers and corporate taxpayers.

All of these accounting-method changes are effective for tax years beginning on or after January 1, 2019. Taxpayers can make an election to have these provisions apply to tax years beginning on or after January 1, 2018. These elections must be manually filed on paper.

Net Operating Loss Carryback

California will follow the federal changes that disallow net operating loss carrybacks for losses sustained in tax years beginning on or after January 1, 2019. The state retains a 20-year carryforward period under this legislation.

These changes apply to both personal and corporate taxpayers.

Like-Kind Exchanges

California will follow the federal treatment of IRC Section 1031, like-kind exchanges, enacted by the TCJA. Like-kind exchanges of tangible personal property no longer qualify for tax deferred treatment in California, except for individual taxpayers with less than $250,000 of federal adjusted gross income or $500,000 for head-of-household and joint filers.

This change is effective for exchanges completed after January 10, 2019, and the change applies to both personal and corporate taxpayers.

Limitation on Excess Business Losses

In general, California conforms to the IRC Section 461(l), disallowing deductions of excess business losses that are over:

- $250,000 for a single filer

- $500,000 for a joint filer

The federal change expires in 2026 and provides a net operating loss (NOL) carry forward for the amount greater than the limit.

However, California decouples from the federal expiration and NOL carry forward. Instead of being treated as a NOL, the disallowed excess business loss is treated as a carryover excess business loss that should be included in the following year’s excess business loss computation.

Additional Changes

AB 91 introduces several additional filing changes, including:

- Technical Termination of a Partnership. AB 91 adopts the TCJA’s repeal of the federal technical termination of partnership provisions.

- IRC Section 338 Election. For qualified stock purchased on or after July 1, 2019, a federal election made under IRC Section 338 will be the same for California purposes. This election treats qualified stock purchases of target corporations as asset purchases. In other words, a separate California IRC Section 338 won’t be allowed.

- Achieving a Better Life Experience (ABLE) Accounts. AB 91 eliminates the differences in federal and California ABLE qualification criteria and increases the contribution limits up to the federal poverty level. The bill allows taxpayers to roll over a IRC Section 529—college savings—plan to an ABLE account.

- Federal Deposit Insurance Corporation (FDIC) Premiums. In general, California conforms to IRC Section 162(r), which relates to the disallowance of Federal Deposit Insurance Corporation (FDIC) premiums.

- Excess Employee Compensation. In general, AB 91 conforms to the TCJA by revising the definitions of covered employee and publicly held corporation. This limits the amount these taxpayers may deduct for ordinary and necessary expenses. AB 91 also disallows the performance-based compensation and commission exceptions with respect to the limits for deductions relating to covered employees.

- Student Loan Debt. Generally, AB 91 confirms to IRC Section 108(f)(5) relating to the income exclusion of student loan indebtedness discharged on or after December 31, 2017.

Income Tax Credit

Earned Income Tax Credit

In 2018, the California Earned Income Tax Credit was extended to help low-income taxpayers. AB 91 raises the maximum earned income to $30,000. The bill also added a refundable young child tax credit of up to $1,000 per qualified taxpayer, per taxable year.

The Franchise Tax Board (FTB) web page details credit amounts, income limits, qualifications, and additional information.

California Competes Tax Credit

The California Competes Tax Credit (CCTC) program has been around since 2014. CCTC is an economic-development incentive that is intended to attract or retain businesses considering a significant new investment in California. It does this by providing successful applicants with a nonrefundable tax credit that reduces taxpayers’ personal income tax or corporation tax.

In the CCTC program’s 2019–2020 fiscal year, the California Governor’s Office of Business and Economic Development is authorized to negotiate up to $237.8 million in tax credits over three application periods.

Application Periods

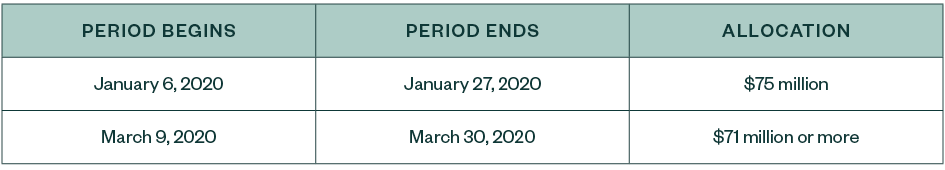

The first application period ended on August 19, 2019. The next two CCTC application periods for the program’s 2019–2020 fiscal year are as follows:

Disaster Loss Deductions

California taxpayers may be able to claim a disaster loss deduction for any loss sustained in the state during an event proclaimed to be a state of emergency by the California Governor. California hasn’t conformed to the TCJA in this regard, instead generally following the former federal law regarding the treatment of losses incurred due to casualty or disaster.

Extended Deadlines

The FTB automatically follows the IRS’s extended deadlines to file or pay taxes until the date indicated for the specific disaster. Taxpayers are advised to write the disaster name in dark ink at the top of their tax return to alert the FTB of the disaster to which the return is related.

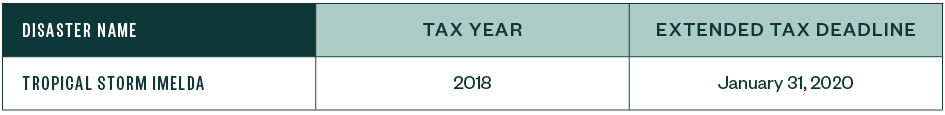

Tropical Storm Imelda

The FTB has announced that the federal postponement period for Tropical Storm Imelda will be recognized as follows:

Additional Designated Areas

The IRS disaster relief web page lists additional designated areas eligible for a postponement period. If a taxpayer qualifies for the postponement period, any interest, late-filing, or late-payment penalties that would otherwise apply will be cancelled. The FTB will also follow these stipulations.

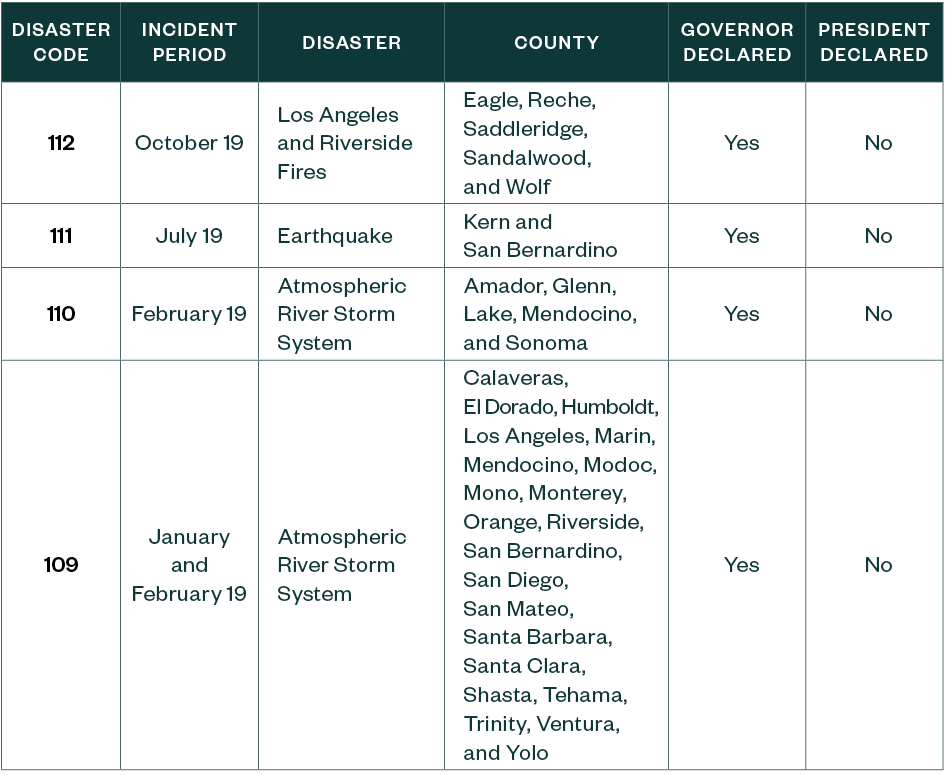

Other 2019 Disasters

Taxpayers may deduct a disaster loss for any loss sustained in a California city or county where the Governor declares a state of emergency. Here’s a list of California Qualified Disasters, published on the FTB website as of October 31, 2019.

For more information regarding California disaster losses, see the FTB website and Publication 1034, Disaster Loss How to Claim a State Deduction.

Additional Changes

The Dynamex Decision

On September 18, 2019, the Governor signed AB 5 into law. The bill served to codify the 2018 California Supreme Court decision in Dynamex Operations West, Inc. v. Superior Court of Los Angeles (Dynamex). As mentioned in last year’s tax season guide, the Dynamex decision created a new standard for evaluating independent contractor relationships, identified as the ABC Test.

The ABC Test

The ABC Test requires a hiring entity to demonstrate that all three of the following requirements are met for a worker to be properly characterized as an independent contractor:

- The worker is free from the control and direction of the hirer with the performance of the work, both under the contract for the performance of the work and in fact.

- The worker performs work that is outside the usual course of the hiring entity’s business.

- The worker is customarily engaged in an independently established trade, occupation, or business of the same nature as that involved in the work performed.

Exemptions and Revisions

AB 5 also introduced additional classification changes to expand and refine the provisions articulated in the Dynamex decision. Among these changes were exemptions from the ABC Test for some licensed professionals, including physicians, lawyers, and accountants, as well as a changes to the regulatory definition of an employee to make it more inclusive. These changes will likely make employer-employee relationships more common than independent contractor relationships.

AB 5 is applicable to both the California Labor Code and the California Unemployment Insurance Code and is effective retroactively.

Interest Rates

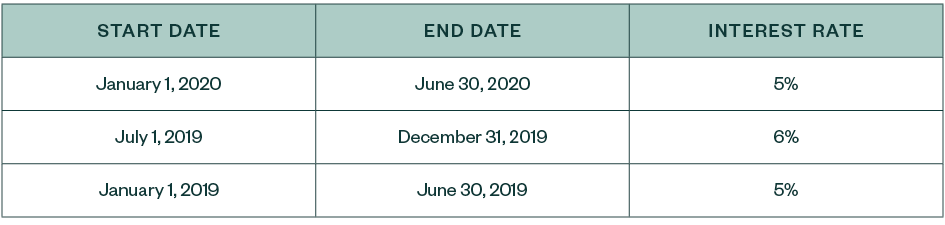

Effective January 1, 2019, the FTB will pay 2% interest on corporate refunds. This rate is effective through June 30, 2020.

The interest rate for personal income tax underpayments and overpayments, corporation underpayments, and estimate penalties are as follows:

For interest rates after June 30, 2020, the FTB will provide more information on their website once it’s available.

Doing Business and Economic-Nexus Thresholds

For California income tax purposes, doing business is defined as, “actively engaging in any transaction for the purpose of financial or pecuniary gain or profit.” For the taxable year beginning on or after January 1, 2019, a taxpayer is seen as doing business in California for a taxable year if any of the following conditions are satisfied:

- The taxpayer is organized or commercially domiciled in California.

- The taxpayer’s California sales exceed the lesser of $601,967 or 25% of total sales.

- The taxpayer’s real property and tangible personal property in California exceed the lesser of $60,197 or 25% of total real property and tangible personal property.

- The taxpayer’s compensation amount paid in California exceeds the lesser of $60,197 or 25% of total compensation paid.

The doing-business thresholds for taxpayers are indexed for inflation and revised annually.

Sourcing Rules for Self-Employed Individuals

The California Office of Tax Appeals (OTA) recently issued a precedential decision that affects California nonresident—out of state—sole proprietors whose taxable income is derived from sources other than tangible personal property.

The Bindley Decision

In the Appeal of Blair S. Bindley, the taxpayer was a self-employed Arizona resident who performed his services in Arizona for California customers. The taxpayer didn’t file a California personal income tax return because he believed the income was earned from where he performed the services in Arizona. The taxpayer received Form 1099s from two California entities.

The FTB was successful in arguing that the taxpayer’s income from services was subject to the California apportionment rules under application of California Code of Regulations Section 17951. Having the OTA make its decision in Bindley precedential allows the FTB to use the case as authoritative guidance when applying the ruling to other similarly situated taxpayers.

Sales Tax

Sales and Use Tax and Economic Nexus

California has expanded its sales-tax nexus provisions to eliminate a physical presence requirement and create an economic nexus standard. Effective April 1, 2019, sellers with California gross receipts of $500,000 or more in either the preceding or current calendar years will be considered to have nexus for sales and use tax purposes.

Marketplace Facilitators

AB 147 imposes a new sales and use tax collection responsibility upon marketplace facilitators. The bill was signed into law by California Governor Gavin Newsom on April 25, 2019.

These marketplace-facilitator provisions apply to marketplaces such as Amazon, Etsy, eBay, and other similar sales platforms. Sales platforms with nexus in California will be required to collect and report sales tax on behalf of those vendors who sell through their platform beginning October 1, 2019.

For purposes of the $500,000 economic nexus threshold in California, a marketplace facilitator will include all sales of tangible personal property made through its marketplace for delivery into California, including the seller’s own product sales and sales of products facilitated through its marketplace.

Manufacturing and R&D

On July 1, 2014, California implemented a partial state sales tax exemption for qualified taxpayers, based on primary lines of business associated with identified North American Industry Classification System (NAICS) codes. To qualify, these taxpayers must purchase qualified tangible personal property to be used in qualified manufacturing and R&D activities.

The tax exemption was originally set at 4.1875%, and it was reduced to 3.9375% on January 1, 2017—where it will remain through the sunset date, currently slated for July 1, 2030.

Next Steps

Federal tax changes and related conformity requirements will continue to impact California taxpayers. Stay tuned for future insights on these subjects or contact a tax or accounting professional to learn more.

We’re Here to Help

For questions about your 2020 taxes, please contact your Moss Adams professional.