On March 12, 2020, the Securities and Exchange Commission (SEC) issued a final rule, Release No. 34-88365, Amendments to the Accelerated and Large Accelerated Filer Definitions. The amendments expand the number of issuers that qualify as non-accelerated filers, resulting in certain issuers no longer being required to provide auditor attestation of internal control over financial reporting (ICFR).

All issuers will continue to be required to establish and maintain effective ICFR, and their principal executive and financial officers will continue to be required to certify their responsibilities related to ICFR.

The amendments are effective 30 days after publication in the Federal Register and will apply to an annual report filing due on or after the effective date.

Key Provisions

In June of 2018, the SEC amended the smaller reporting company (SRC) definition to include registrants with either:

- A public float of less than $250 million

- A public float of less than $700 million and annual revenues of less than $100 million

In conjunction with that change, the SEC eliminated the automatic exclusion of SRCs in the definitions of accelerated and large accelerated filers—resulting in some issuers being categorized as both SRCs and accelerated filers. The new amendments address this issue by better aligning the definitions of SRCs and accelerated filers.

Smaller Reporting Companies’ Eligibility and Exclusions

The final rule amends the accelerated filer definition under Rule 12b-2 of the Exchange Act of 1934 (Rule 12b-2) to exclude any issuer that’s eligible to be an SRC under the SRC revenue test. Accordingly, an issuer is categorized as a non-accelerated filer if the issuer has a public float of less than $700 million as of the last annual measurement date and annual revenues of less than $100 million in the most recently completed fiscal year.

Issuers meeting those thresholds aren’t subject to the accelerated filing deadlines or the internal control over financial reporting auditor attestation requirement. However, the amendments don’t change management’s responsibilities, and these issuers will still be required to establish and maintain the effectiveness of their internal control over financial reporting.

Issuers that qualify as an SRC under the public float test—but don’t qualify under the SRC revenue test—aren’t excluded from the definition of an accelerated filer. Therefore, some issuers with annual revenues greater than $100 million may continue to qualify as both SRCs and accelerated filers.

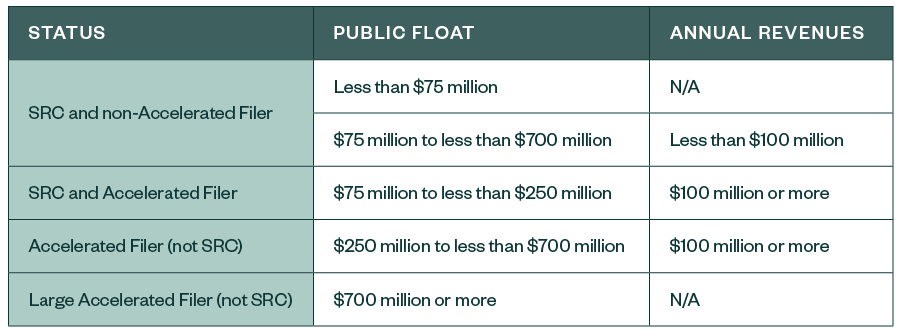

The amended requirements are summarized in the table below:

Transition Thresholds for Accelerated and Large Accelerated Filers

The amendments revise the thresholds for issuers to transition between filer statuses. Currently, under Rule 12b-2, an accelerated filer transitions to a non-accelerated filer once its public float falls below $50 million. A large accelerated filer transitions to a non-accelerated filer or accelerated filer once its public float falls under $50 million or $500 million, respectively.

Exit Thresholds

The amendments increase the transition thresholds under Rule 12b-2 so that the exit threshold for accelerated filers increases from $50 million to $60 million and the exit threshold for large accelerated filers increases from $500 million to $560 million. The revised thresholds are 80% of the initial qualification thresholds, which is consistent with the transition provisions for SRCs.

It’s important to note that, consistent with the current SRC transition rules, an issuer that previously determined it didn’t qualify as an SRC remains unqualified until it meets 80% of the initial thresholds for either the revenue or public float tests.

Therefore, an issuer with annual revenues above $100 million will generally transition to a non-accelerated filer once one of the following occurs:

- Public float falls below $60 million

- The entity becomes eligible to be an SRC under the SRC revenue test

SRC Revenue Test

A large accelerated filer becomes eligible to be an SRC under the SRC revenue test when revenue falls below $80 million and public float is below $560 million.

An accelerated filer becomes eligible to be an SRC under the SRC revenue test when revenue falls below $80 million. However, under the amended guidance, an accelerated filer that has less than $250 million in public float—and therefore qualifies as an SRC under the public float test—may transition to non-accelerated filer status as soon as its annual revenues fall below $100 million.

Other Amendments

Business Development Companies

The amendments also exclude certain business development companies (BDCs) from the accelerated and large accelerated filer definitions—because BDCs aren’t eligible to be SRCs, using annual investment income as the measure of annual revenue. Specifically, a BDC will be excluded from the accelerated and large accelerated filer definition if the BDC has a public float of less than $700 million as of the last annual measurement date and investment income of less than $100 million in the most recently completed fiscal year.

Similar to the SRC exclusion, BDCs excluded from the accelerated filer definitions will remain obligated to have management assess the effectiveness of internal control over financial reporting. BDCs continue to be ineligible to be SRCs.

The transition provisions for accelerated and large accelerated filer status that apply to other issuers will also apply to BDCs, except that BDC’s will substitute investment income for revenue.

New Check Box for Auditor Attestation

The amendments require issuers to include a checkbox on the cover page of annual reports—including Forms 10-K, 20-F, and 40-F—to indicate whether an auditor attestation of internal control over financial reporting is included in the filing.

We're Here to Help

For more information on how the amended accelerated and large accelerated filer definitions may affect your business, contact your Moss Adams professional.