As COVID-19, commonly referred to as the coronavirus, disrupts activity across the economic landscape, companies that were otherwise healthy may soon face cash flow issues.

As COVID-19, commonly referred to as the coronavirus, disrupts activity across the economic landscape, companies that were otherwise healthy may soon face cash flow issues.

Companies that were unprofitable and illiquid at the beginning of the year will likely find it difficult to obtain new capital over the next several months, while companies that were profitable and generating cash flow have numerous options to protect the viability of their business.

Below, we explore how focusing on a business recapitalization plan can help your company prepare for a rapid reduction in cash flow by taking the following potential steps:

- Building a detailed 13-week cash flow statement

- Negotiating with your lenders or new lenders

- Evaluating the merits of a recapitalization of your business

- Presenting your company to and managing negotiations with junior capital sources

Business Liquidity Assessment

Your business should begin by assessing the following variables related to your cash flow:

- Immediate liquidity, including cash and accounts receivable that are reasonably collectable

- Cash burn rate, including a forecast of monthly cash consumption

- Debt service obligations, including your ability to meet scheduled debt and lease payments

Building a 13-week cash flow forecast can help you understand your company’s working capital position and needs. This type of model can allow your management team to run what-if scenarios to help fully assess the company’s ability to fund its obligations through an immediate 90-day period.

For information on how to assess your immediate working capital situations, read our Business Recovery Plan article.

Debt Covenants

Many companies may soon find themselves vulnerable to violating loan covenants, perhaps for the first time.

Most credit agreements have fixed charge coverage and debt-to-earnings before interest, taxes, depreciation, and amortization (EBITDA) ratios, among others. A material decrease in EBITDA will likely trigger a breached covenant.

When this happens, the loan agreement commonly provides a 90-day cure period to resolve the violation. This means you may have the option to renegotiate the agreement, repay the principal, or take other actions.

The US Department of the Treasury and the Federal Reserve are assessing alternatives to enable lenders to relax enforcement of loan covenants. By injecting liquidity, loan guarantees, and other stimulus measures into the banking system, authorities seek to buy time to carry lenders and their customers until the economy stabilizes.

Intermediate Term Capital Solutions

If your lenders aren’t flexible in providing an extended cure period, your company can attempt to refinance its debt with a new senior lender, such as a bank or asset-based lender.

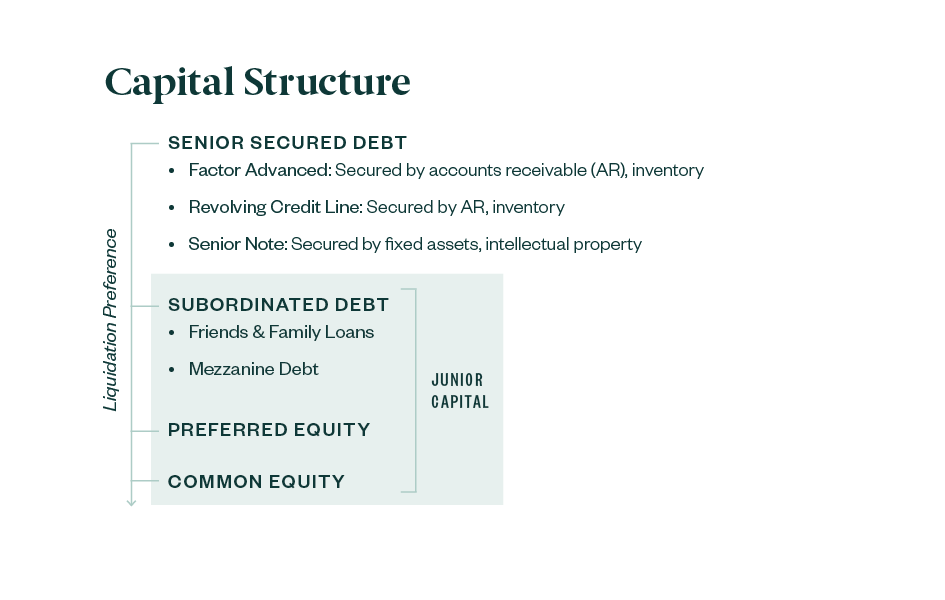

If such attempts aren’t successful, your management team can pursue a recapitalization of the company’s balance sheet by tapping into junior capital. Types of junior capital include:

- Subordinated debt

- Preferred equity

- Common equity

While senior debt providers have seniority in the liquidation preference of a company’s assets, junior capital sources are in a subordinate position. The liquidation preference is illustrated below.

In return for taking a subordinate position to those higher above in the capital structure, capital costs increase from senior to subordinated debt to preferred equity to common equity.

Higher risks associated from an unsecured position in the capital structure require higher returns.

Protect Your Business with Recapitalization

Recapitalizing a balance sheet typically replaces shorter-term debt obligations with longer-term capital.

Whereas senior credit facilities require present period repayment obligations, subordinated debt can have terms of up to seven years with flexible repayment schedules.

Preferred equity commonly comes with a preferred dividend, but this can be negotiated to allow Payment-in-Kind (PIK), where the dividend is added to the face amount of the security.

Common equity rarely requires a dividend or scheduled payments.

We’re Here to Help

Thousands of junior capital sources are now actively canvassing the market for companies that were profitable prior to COVID-19, but tapping into their resources can be a complex process Our professionals can help you navigate these options by building detailed cash flow statements, preparing necessary materials, and guiding you through negotiations.

To learn more about how to assess your business’ finances and map out alternatives during this continued disruption, contact your Moss Adams professional. During this unparalleled time, we’re closely monitoring the COVID-19 situation as it evolves so we can provide up-to-date guidance and support to help you combat uncertainty.