The Financial Accounting Standards Board (FASB) issued proposed Accounting Standards Update (ASU), Revenue from Contracts with Customer (Topic 606) and Leases (Topic 842): Effective Dates for Certain Entities, on April 21, 2020. Comments on the proposed ASU were due by May 6, 2020.

The board discussed comments received and completed its redeliberations on the proposed ASU at the May 20, 2020, FASB meeting—as discussed below.

The board directed the FASB staff to draft a final ASU for vote by written ballot, but provided no indication as to when the final ASU will be issued.

Key Provisions

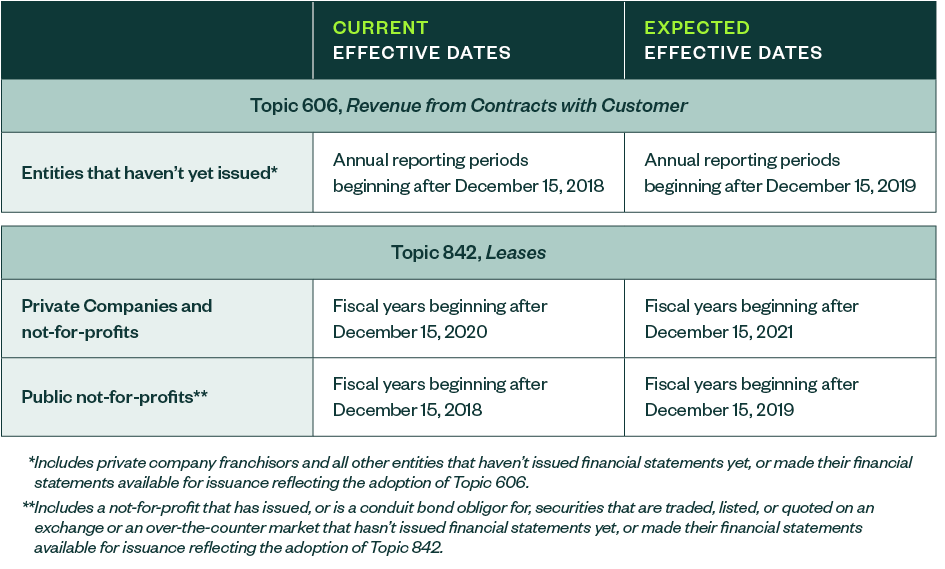

As originally drafted, the proposed ASU would defer the effective dates of Topic 606 by one year only for franchisors that aren’t public business entities. It would also defer the effective dates of Topic 842 by one year for private companies and not-for-profit entities.

This included not-for-profits that have issued, or are conduit bond obligors for, securities that are traded, listed, or quoted on an exchange or an over-the-counter market that haven’t yet issued financial statements—referred to as public not-for-profits.

For additional detail on the previously proposed ASU, refer to our prior Alert.

At the May 20, 2020, FASB meeting, the board made the following tentative decisions.

Revenue Deferral

The board voted to expand the scope of the proposed one-year deferral of Topic 606 to include all private entities and private not-for-profits that haven’t yet issued financial statements or made their financial statements available for issuance reflecting the adoption of Topic 606.

The board decided not to amend the effective date of ASU 2018-08, Not-for-Profit Entities (Topic 958): Clarifying the Scope and the Accounting Guidance for Contributions Received and Contributions Made.

Leases Deferral

The board affirmed its decision to defer the effective date of Topic 842 by one year for private companies and not-for-profit entities.

Additionally, the board clarified that public not-for-profits who’ve issued financial information—rather than financial statements—reflecting the adoption of Topic 842 are eligible to apply the deferral.

Effective Dates

A final ASU hasn’t been issued yet by the FASB. Therefore, the current effective dates for both Topic 606 and Topic 842 continue to be required for entities that issue US generally accepted accounting principles (GAAP) financial statements before the FASB’s issuance of a final ASU.

Based on the discussions at the May 20, 2020, meeting, the anticipated effective dates are expected to be amended as follows:

Early adoption will continue to be permitted.

All dates and provisions described are subject to change pending the drafting and issuance of a final ASU.

We’re Here to Help

For more information on how these changes may affect your business, contact your Moss Adams professional.