This article was updated June 16, 2020.

The Federal Reserve expanded the Main Street Lending Program (MSLP) on April 30, 2020. The MSLP was established under the Coronavirus Aid, Relief, and Economic Security Act (CARES) Act signed into law on March 27, 2020.

The $600 billion program is intended to facilitate lending to small- and medium-sized businesses through eligible lenders in the wake of the COVID-19 pandemic after funds from the Paycheck Protection Program (PPP) run out. Businesses eligible for the program include those with less than 15,000 employees or $5 billion in revenue in 2019.

This program provides regulated banks a funding facility to extend secured and unsecured loans that are sold to the Federal Reserve via 95% participations, with 5% ownership remaining with US Federal Deposit Insurance Corporation (FDIC) institutions.

Below is a list of frequently asked questions in regard to the eligibility and requirements for a MSLP loan.

What are the terms of the loan?

Businesses with up to 15,000 employees or less than $5 billion in 2019 annual revenue can apply for the MSLP, which has a five-year maturity term. Amortization of principal payments will be deferred for two years and interest payments deferred for one year, with unpaid interest being capitalized.

The eligible borrower must commit to the following terms:

- Refrain from repayment of the principal balance of, or paying any interest on, any existing debt until the eligible loan is repaid in full—unless the debt or interest payment is mandatory and due

- Won’t seek to cancel or reduce any of its committed lines of credit with the eligible lender or any other lender

- Follow compensation, stock repurchase, and capital distribution restrictions that apply to direct loan programs under section 4003(c)(3)(A)(ii) of the CARES Act, such as executive compensation and stock-buy-backs

However, an S corporation—or other pass-through tax entity—that’s an eligible borrower may make distributions to the extent reasonably required to cover its owners’ tax obligations in respect of the entity’s earnings.

The eligible borrower must also certify that:

- It has a reasonable basis to believe that, as of the date of origination of the eligible loan and after giving effect to such loan, it has the ability to meet its financial obligations for at least the next 90 days and doesn’t expect to file for bankruptcy during that period.

- It’s eligible to participate in the facility of the loan, including the conflicts of interest prohibition in section 4019(b) of the CARES Act.

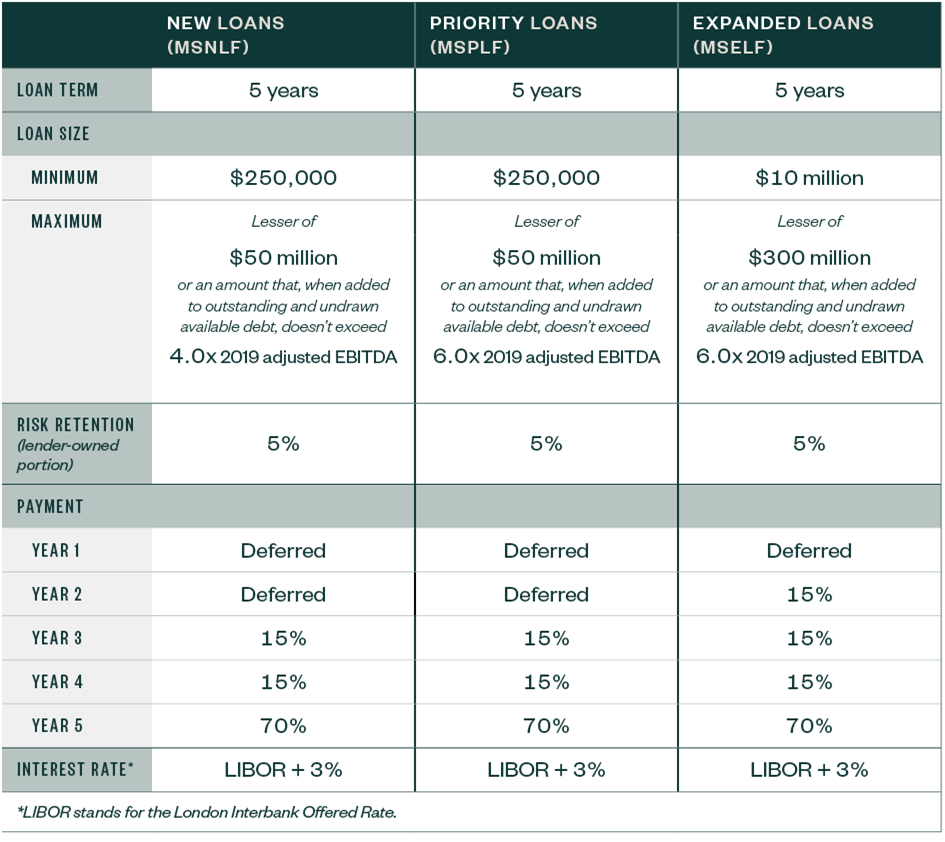

Main Street Lending Program Options

Below is an overview of the MSLP including types of loans available and their individual terms.

How will EBITDA be calculated?

The earnings before interest, taxes, depreciation, and amortization (EBITDA) basis will be similar to the lender’s existing, internal process for calculating EBITDA and based off of 2019 actual adjusted EBITDA.

How long will the program be in effect?

The MSLP will be in effect until September 30, 2020, unless otherwise extended by the Federal Reserve.

What types of businesses aren’t generally eligible?

The following businesses aren’t generally eligible for the MSLP:

- Not-for-profit organizations

- Banks and lending companies

- Passive real estate businesses

- Life insurance companies

- Non-US companies

- Pyramid sale distribution plans

- Gambling companies

- Private clubs

- Government-owned entities

- Religious organizations

- Loan packagers

Can a business take more than one loan?

A business can only participate in one of the Main Street lending facilities and can’t participate in the Primary Market Corporate Credit Facility (PMCCF). A borrower that received a loan under the PPP may also receive a loan under the MSLP. All of the loans provided under this program will be full recourse and won’t be forgivable.

Is collateral required for Main Street Loans?

New loans (MSNLF), priority loans (MSPLF), and expanded loans (MSELF) can be either secured or unsecured.

Eligible lenders can require eligible borrowers to pledge additional collateral to secure an MSELF Upsized Tranche as a condition of approval.

What fees are associated with MSLP for borrowers?

Depending on the program loan, 75-100 basis points.

MSNLF and MSPLF

Eligible lenders will pay the Main Street SPV a transaction fee of 100 basis points of the principal amount of the MSNLF or MSPLF Loan at the time of origination, and may pass on this fee to eligible borrowers.

MSELF

Eligible lenders will pay the Main Street SPV a transaction fee of 75 basis points of the principal amount of the MSELF Upsized Tranche at the time of upsizing. Lenders may choose to pass on this fee to eligible borrowers.

How are collective bargaining agreements and businesses with union workers impacted?

Borrowers are prohibited from terminating any existing collective bargaining agreements during the course of the loan and for two years after the term of the loan has ended.

Participants must also remain neutral in any union-organizing efforts during the term of the loan.

How are maximum size restrictions counted?

Maximum size restrictions are based off of 2019 annual revenues. Employee counts should include all full-time, part-time, seasonal, or otherwise employed persons, excluding independent contractors.

Borrowers should use the average of the total number of persons employed by the borrower and its affiliates over the 12-months prior to the MSLP loan origination.

How are affiliates considered in the size restrictions?

Size restriction for affiliates will follow the Small Business Administration (SBA) guidelines for PPP loans. Please see the SBA’s compliance guide.

How will existing outstanding and undrawn available debt be calculated?

Existing, outstanding, and undrawn debt will be calculated as of the date of the loan application. It will be based on the amount borrowed, including unsecured or secured loans, from any of the following:

- Banks

- Private lenders

- Non-bank institutions

- Publicly issued bonds

- Private placement facilities

Unused commitments will also be counted, with some exceptions.

Calculations will be due on the date of the loan application.

What compensation, stock repurchase, and capital distribution restrictions apply?

S corporations and other tax pass-through entities are allowed to make distributions to cover owners’ tax obligations.

Eligible borrowers agree not to pay dividends, or make other capital distributions with respect to its common stock, until 12 months after the loan is no longer outstanding.

During the period of which the loan is outstanding—and up to 12 months after the date the loan is no longer outstanding—compensation limits are in effect. Executive compensation limits begin if they made over $425,000 in calendar year 2019.

Specific limitation details are available in the CARES Act. See our dedicated page for more details.

Do borrowers need to maintain employment levels consistent with the CARES Act limitations on borrower activity?

According to the MSLP guidelines, an eligible borrower participating in the MSLP must make commercially reasonable efforts to maintain its payroll and retain its employees during the time that the eligible loan is outstanding. These efforts include undertaking good-faith efforts to maintain payroll and retain employees in light of its capacities, the economic environment, available resources, and the business need for labor.

The US Department of the Treasury only specifically calls out the limitations for compensation, stock repurchase, capital distribution restrictions, and the restrictions outlined in the CARES Act that also apply for the MSLP.

What is the timing for the program?

At the time of this publication, the MSLP isn’t live. The Federal Reserve and Treasury solicited feedback on the program structure from investment and retail banks, reserve banks, and participating lenders through the end of April and are currently working to create the infrastructure for the program.

Key ambiguities in the currently disclosed portions of the program include:

- Use of proceeds

- Any union limitations

- Compensation and distribution restrictions

- Maintenance of employment levels

- Unsecured nature of loans

- Industry specific loan requirements

It’s unclear when the program will officially launch, particularly in light of the banking industry’s current focus on the PPP program, although there are expectations for a mid-June 2020 launch.

We’re Here to Help

If you have any questions about the MSLP and future actions your organization may need to take in regard to securing a loan, please contact your Moss Adams professional.

Special thanks to Devon Asmussen for his contributions to this article.