On April 20, 2020, the Governmental Accounting Standards Board (GASB) issued Statement No. 94, Public-Private and Public-Public Partnerships and Availability Payment Arrangements.

The statement is intended to improve the accounting and financial reporting guidance for public-private and public-public partnership arrangements (P3s) and availability payment arrangements (APAs).

Background

Arrangements between governments and private entities or other government, referred to as P3 arrangements, have become more prevalent. Prior to the issuance of Statement No. 94, accounting guidance applicable to certain P3 arrangements was included in Statement No. 60, Accounting and Financial Reporting for Service Concession Arrangements. However, the existing guidance didn’t address all types of P3 arrangements. As a result, Statement No. 94 encompasses all guidance related to the accounting and financial reporting for P3 arrangements, including service concession arrangements (SCAs), and supersedes Statement No. 60.>

Key Provisions

Statement No. 94 establishes the definitions of P3s and APAs and provides uniform guidance on accounting and financial reporting for transactions that meet those definitions.

Public-Private and Public-Public Partnership Arrangements

Under the updated guidance, a P3 is defined as an arrangement in which a government transferor contracts with a governmental or nongovernmental operator to provide public services by conveying control of the right to operate or use a nonfinancial asset, such as infrastructure or other capital asset—the underlying P3 asset—for a period of time in an exchange or exchange-like transaction.

Some P3s are further considered a SCA if all of the following criteria are met:

- The transferor conveys to the operator the right and related obligation to provide public services through the use and operation of an underlying P3 asset in exchange for significant consideration.

- The operator collects and is compensated by fees from third parties.

- The transferor determines or has the ability to modify or approve which services the operator is required to provide, to whom the operator is required to provide the services, and the prices or rates that can be charged for the services.

- The transferor is entitled to significant residual interest in the service utility of the underlying P3 asset at the end of the arrangement.

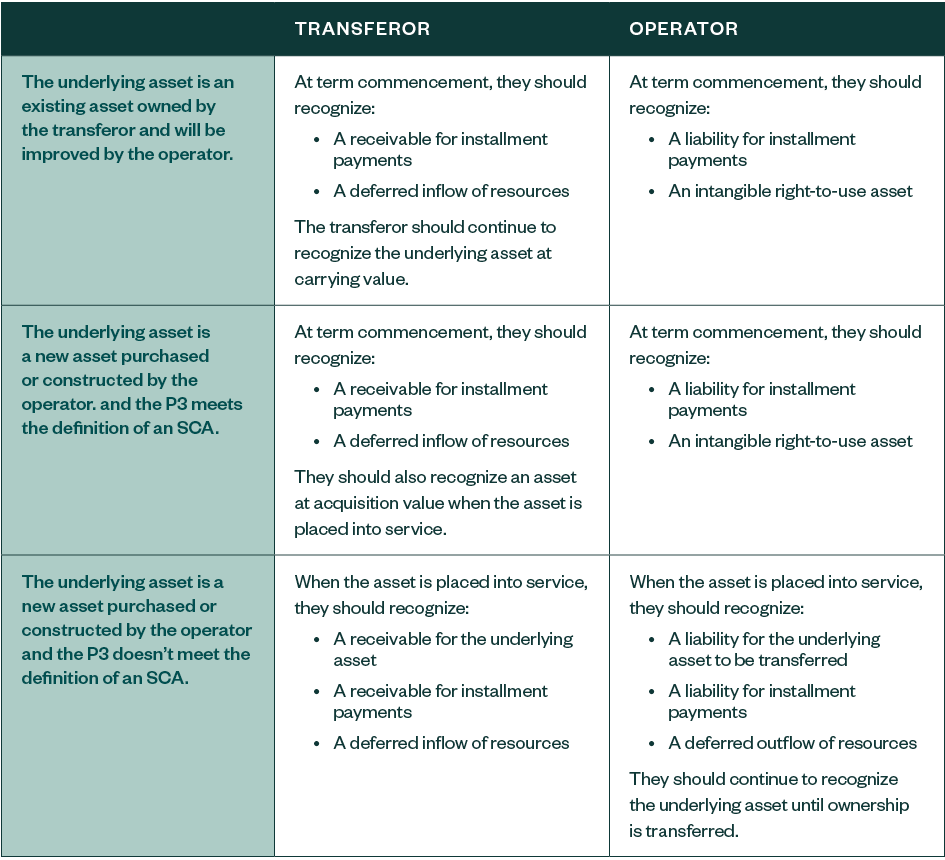

Recognition and Measurement

The recognition and measurement guidance for P3 arrangements is separated into three types for both a transferor and an operator, as summarized in the below table.

Statement No. 94 requires the accounting and financial reporting guidance in Statement No. 87, Leases, to be applied to a P3 arrangement when it meets the definition of a lease and if the following criteria are met:

- Existing assets of the transferor are the only underlying P3 assets.

- Improvements aren’t required to be made by the operator to those existing assets as part of the P3 arrangement.

- The P3 doesn’t meet the definition of an SCA.

Disclosures

Statement No. 94 also introduces new disclosure requirements for P3 arrangements.

A transferor should disclose the following about its P3 activities:

- A general description and the basis, terms, and conditions on which any variable payments not included in the measurement of the receivable for installment payments are determined.

- The nature and amounts of assets and deferred inflows of resources that are recognized in the financial statements.

- The discount rate applied to the measurement of the receivable for installment payments.

- The amount of inflows of resources recognized in the reporting period for variable and other payments not previously included in the measurement of the receivable for installment payments.

- The nature and extent of rights retained by the transferor or granted to the operator under the PPP arrangements.

- If applicable, provisions for guarantees and commitments, including identification, duration, and significant contract terms.

Similarly, an operator should disclose the following:

- A general description and the basis, terms, and conditions on which any variable payments not included in the measurement of the liability for installment payments are determined.

- The nature and amounts of assets, liabilities, and deferred outflows of resources that are recognized in the financial statements.

- The discount rate applied to the measurement of the liability for installment payments.

- Principal and interest requirements to maturity, presented separately, for the liability for installment payments for each of the five subsequent fiscal years and in five-year increments thereafter.

- The amount of outflows of resources recognized in the reporting period for variable payments not previously included in the measurement of the liability for installment payments.

- The nature and extent of rights granted to the operator or retained by the transferor.

- The components of any loss associated with an impairment.

- If applicable, provisions for guarantees and commitments, including identification, duration, and significant contract terms.

Availability Payment Arrangements

Statement No. 94 defines an APA as an arrangement in which a government compensates an operator for services that may include designing, constructing, financing, maintaining, or operating an underlying infrastructure or other nonfinancial asset for a period of time in an exchange or exchange-like transaction. In an APA, the payments by the government are based entirely on the asset’s availability for use, essentially as a means of procuring a capital asset or service.

Recognition and Measurement

Components of an APA that are related to the design, construction, or financing of a nonfinancial asset in which ownership of the asset transfers to the government by the end of the contract should be reported as a financed purchase by the government of the underlying nonfinancial asset.

Components of an APA that are related to providing services for the operation or maintenance of a nonfinancial asset should be accounted for as outflows of resources by the government in the period to which the payments relate.

Effective Dates

The statement is effective for fiscal years beginning after June 15, 2022, and all reporting periods thereafter. Early application is encouraged.

We're Here to Help

For more information on how the new guidance may affect your organization, contact your Moss Adams professional.