On June 3, 2020, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) 2020-05, Revenue from Contracts with Customer (Topic 606) and Leases (Topic 842): Effective Dates for Certain Entities.

The ASU reflects the FASB’s acknowledgement that entities could be facing limited resources due to the COVID-19 pandemic. It provides a one-year deferral of the effective date for certain entities applying the revenue recognition and leases standards.

Key Provisions

The ASU allows certain entities that haven’t yet applied the revenue recognition and leases guidance to delay their implementation by one year.

Revenue Deferral

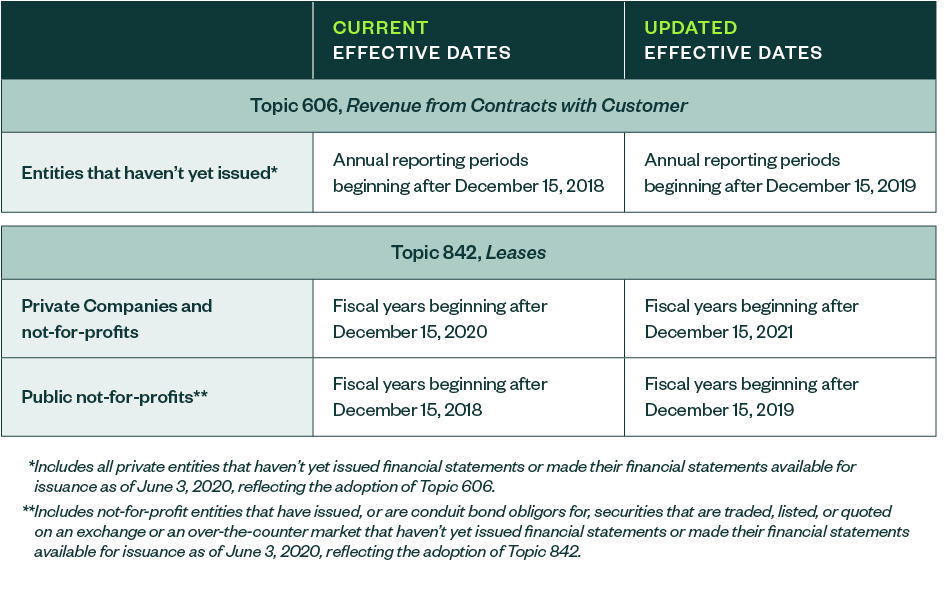

The effective date of Topic 606 has been deferred by one year for all private entities that haven’t yet issued financial statements or made their financial statements available for issuance as of June 3, 2020, reflecting the adoption of Topic 606.

The deferral of Topic 606 doesn’t apply to:

- Public business entities

- Not-for-profit entities that have issued, or are conduit bond obligors for, securities that are traded, listed, or quoted on an exchange or an over-the-counter market (public not-for-profits)

- Employee benefit plans that file or furnish financial statements with the Securities and Exchange Commission (SEC)

Leases Deferral

The ASU defers the effective date of Topic 842 by one year for private entities and public not-for-profit entities that haven’t yet issued financial statements or made their financial statements available for issuance as of June 3, 2020, reflecting the adoption of Topic 842.

Many public not-for-profits are subject to interim financial reporting requirements. Public not-for-profits that have issued interim financial statements reflecting the adoption of Topic 842 prior to June 3, 2020, aren’t eligible to apply the deferral.

The deferral of Topic 842 doesn’t apply to:

- Public business entities

- Employee benefit plans that file or furnish financial statements with the SEC

Effective Dates

The updated effective dates are as follows.

Early adoption continues to be permitted for both Topic 606 and Topic 842.

Public Business Entities

Certain entities may meet the definition of a public business entity solely because their financial statements or financial information are included in another entity’s filing with the SEC. This may be the case to satisfy the disclosures required by SEC Regulation S-X Rules 3-05 or 3-09.

At the December 2019 AICPA National Conference on Current SEC and PCAOB Developments, the SEC staff announced that it wouldn’t object to such entities that wouldn’t otherwise meet the definition of a public business entity from adopting Topic 842 for fiscal years beginning after December 15, 2020—consistent with the private company effective dates at that time. This announcement was codified by the FASB in ASU 2020-02.

The amendments in ASU 2020-05 didn’t change the effective dates previously codified by ASU 2020-02. The SEC Staff hasn’t yet provided guidance on the interaction of their previous statements with the deferral in ASU 2020-05. Entities who may be affected by this issue should continue to monitor future developments from the SEC.

We’re Here to Help

For more information on how these changes could affect your business, contact your Moss Adams professional.