Qualified improvement properties (QIPs), which encompass many improvements made to existing commercial buildings, are now depreciated over 15 years and are eligible for bonus depreciation due to the Coronavirus Aid, Relief, and Economic Security (CARES) Act.

Qualified improvement properties (QIPs), which encompass many improvements made to existing commercial buildings, are now depreciated over 15 years and are eligible for bonus depreciation due to the Coronavirus Aid, Relief, and Economic Security (CARES) Act.

Improvement assets are a big part of many businesses—especially retailers and restaurants that are always performing refresh remodels and opening new locations. These favorable depreciation changes to QIP can provide many taxpayers with the opportunity to increase depreciation losses and defer current federal tax liabilities, providing immediate cash flow relief. Below, we’ll outline what QIP is, how to approach depreciation changes for improvement assets placed into service in 2018 and 2019, and key considerations.

What Is Qualified Improvement Property?

QIP was first introduced by Congress in 2015. Like the improvement property classifications before it, the purpose of QIP was to incentivize improvements to existing commercial buildings in exchange for accelerated tax depreciation benefits. For eligible improvement assets in service in 2016 through 2017, taxpayers could generally claim bonus depreciation on the QIP assets.

QIP includes interior and nonstructural improvements made to existing nonresidential buildings. However, it doesn’t include improvement expenditures related to elevators, escalators, structural modifications, or physical expansions of the building.

Although tax reform, often referred to as the Tax Cuts and Jobs Act of 2017 (TCJA), intended QIP to be 15-year depreciable property and eligible for bonus depreciation, a technical drafting error rendered it 39-year property. For any QIP assets placed into service in 2018 and 2019, taxpayers were stuck depreciating the entire cost of QIP assets similar to a building, over 39 years and with no bonus depreciation.

Changes Under the CARES Act

The CARES Act addressed the technical drafting error and now allows QIP assets to be depreciated over 15 years, making them eligible for bonus depreciation. These changes retroactively apply to assets placed into service in 2018. The IRS has released procedures for addressing and approaching depreciation changes for QIP assets in service in 2018 and 2019 for returns that have already been filed.

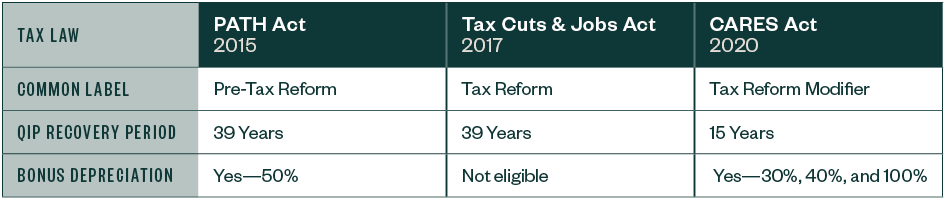

The table below illustrates the changes to QIP since introduced in 2015:

Approaching the Changes

The IRS released procedural guidance in Revenue Procedure 2020-25 for approaching cost recovery changes to QIP assets placed into service in 2018.

Companies may file automatic accounting method change requests with their current 2019 tax return to report the QIP cost recovery change and an adjustment for the allowable depreciation that should’ve been claimed under the new law. If a company has already filed its 2019 tax return, a method change request may still be filed within six months of the original due date of the return, regardless of if an extension was filed. The method change request could also be filed with the 2020 tax return.

Alternatively, a company can file an amended tax return or an Administrative Adjustment Request to report the cost recovery changes for QIP. In general, filing automatic accounting-method change requests will be less administratively burdensome and more streamlined for many companies.

Example

ABC Partnership operates a chain of restaurants. In 2018, the company spent $4,000,000 opening 10 new restaurant locations in existing commercial buildings. When opening a location, the company performs a remodel to replace interior finishes, plumbing fixtures, interior lighting, and to make interior layout changes.

Although these remodel activities were eligible to be classified as QIP, the entire $4,000,000 cost was treated as 39-year property and no bonus depreciation was claimed. For the 2018 tax year, the company claimed $100,000 of depreciation expense related to the 39-year property.

ABC Company can now file an automatic accounting method change request with its 2019 tax return, to change the depreciable life of the property to 15 years and to claim 100% bonus depreciation. The company includes an adjustment to depreciation expense of $3.9 million with its 2019 tax return.

Considerations

Classification Issues

When reviewing improvement assets for cost recovery changes, it’s important to remember that not all improvements are eligible to be classified as QIP. Taxpayers should consider the scope of work done for the improvement assets—to identify non-qualifying exterior work and structural modifications—to avoid overstating QIP and depreciation expense.

Timing

Additionally, it’s important to consider when construction began for the improvements. In cases where construction began prior to September 28, 2017, a bonus depreciation rate of 40% or 30% may apply. For improvement projects that began after that date, 100% bonus depreciation will apply.

State Differences

Many states, such as California, don’t recognize the QIP classification or allow bonus depreciation. Companies may consider cost segregation, to identify property costs that can be depreciated over five years or deducted as repair and maintenance expenses to offset more state income tax.

Alternative Depreciation System

For companies that made a real property trade or business election under Section 163(j)(7), the Alternative Depreciation System (ADS) must be used for QIP assets. Under ADS, QIP assets are depreciated over 20 years and aren’t eligible for additional bonus depreciation. However, new guidance from the IRS allows companies to revoke a Section 163(j) election to benefit from the accelerated depreciation benefits described above by amending the return on which the election was made.

We’re Here to Help

Fixed assets make up a large part of many businesses, and the changes in the CARES Act provides an opportunity for a check-in to be sure your company is claiming the depreciation it’s entitled to.

Given all of the recent tax law changes and approaches for implementation, it’s important to take the time for thoughtful planning as you continue to work through 2019 tax returns. This can help your company benefit from the depreciation and other changes that can help provide additional cash flow.

For assistance leveraging QIP and other strategies for depreciable property to create cash flow, contact your Moss Adams professional.