On May 29, 2020, the Centers for Medicare and Medicaid Services (CMS) published the proposed rule for fiscal year (FY) 2021 Hospital Inpatient Prospective Payment System (IPPS). The provisions of the rule, unless otherwise noted, affect discharge dates on or after October 1, 2020.

On May 29, 2020, the Centers for Medicare and Medicaid Services (CMS) published the proposed rule for fiscal year (FY) 2021 Hospital Inpatient Prospective Payment System (IPPS). The provisions of the rule, unless otherwise noted, affect discharge dates on or after October 1, 2020.

Each year, CMS publishes updates to the regulations for inflation factors, wage index adjustments, and other patient-care related payment adjustments. Below is an overview of the FY 2021 IPPS proposed Medicare Disproportionate Share Hospital (DSH) and uncompensated care (UC) provisions.

Background

Section 1886(r) of the Social Security Act requires that subsection (d) hospitals that would otherwise receive Disproportionate Share Hospital (DSH) payments receive two separate payments after 2014. The payments include:

- 25% of the pre-Affordable Care Act (ACA) amount.

- An additional amount based on three factors estimated by The Centers for Medicare and Medicaid Services (CMS). These factors and estimates are reported each year in the IPPS payment rulemaking issuance.

Eligibility

Eligible program participants include:

- General short-term acute care subsection (d) hospitals

- Subsection (d) Puerto Rico hospitals eligible for DSH

- Medicare dependent, small rural hospitals eligible for DSH—because they’re paid the IPPS federal rate

- IPPS hospitals participating in the Bundled Payments for Care Improvement Advanced Initiative

- IPPS hospitals participating in the Comprehensive Care for Joint Replacement Model eligible

Organizations that aren’t eligible include:

- Maryland hospitals

- Sole community hospitals paid the hospital-specific rate

- Hospitals participating in the Rural Community Hospital Demonstration Program

Proposed Changes

CMS is proposing updates to the Medicare DSH estimate as well as the three factors used to compute uncompensated care payments.

Medicare DSH

CMS used the most recently available projections of Medicare DSH as calculated by the CMS Office of the Actuary from cost reports to estimate what DSH would have been absent the ACA.

Calculation

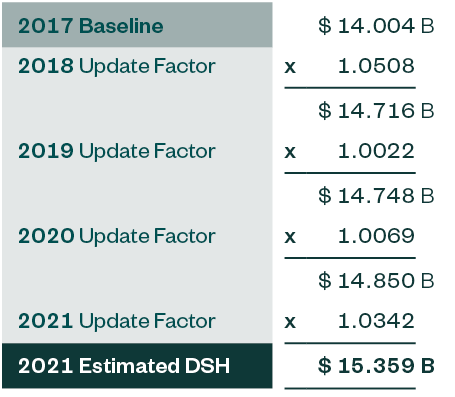

The DSH estimate begins with a baseline year and then trends forward by a number of factors—IPPS updates, discharge adjustments, case-mix adjustments, and other adjustments—applied to the 2018 through 2021 periods. The baseline starting point for 2021 is from 2017 and is $14.004 billion.

From the chart above, the FY 2021 estimate of what DSH would have been absent the ACA is $15.359 billion. It’s important to note that 2021 estimated DSH is $1.224 billion less than 2020 estimated DSH.

Empirically Justified Medicare DSH

The resulting empirically justified Medicare DSH amount is $3.840 billion, which is 25% of $15.359 billion.

Update Factors Comparison

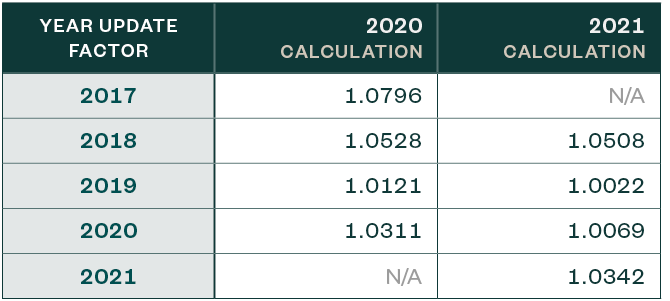

While the baseline DSH amount in the current and prior year is roughly the same, the projected update factors are significantly different.

Considerations

One of the most notable changes year-over-year appears to relate to the Medicare fee-for-service discharge assumption. It’s worth noting that this is one of the items that comprise the factors above, which are detailed in the proposed rule. The amounts assumed for 2019 and 2020 are significantly less than what was assumed for 2019 and 2020 in the FY 2020 IPPS final rulemaking.

It’s important to note that the discharge factor assumption attempts to factor in how many beneficiaries will be enrolled in Medicare Advantage plans.

Uncompensated Care Factor 1

Factor 1 is the difference between the CMS estimate of what DSH payments would’ve been under the pre-ACA formula and the 25% empirically justified amount.

Therefore, Factor 1 is projected to be $11.519 billion, which is $919 million less than the 2020 Factor 1.

Uncompensated Care Factor 2

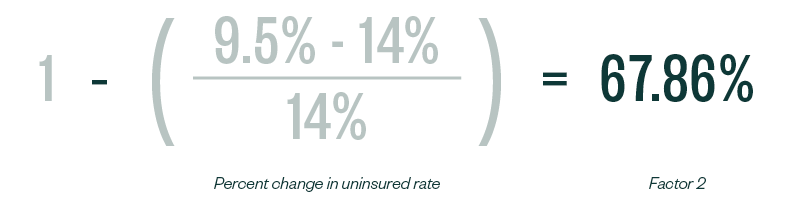

Factor 2 is 1 minus the percent change in the percentage of individuals who are uninsured by comparing uninsured individuals based on the most recent period where data is available to the percent of uninsured individuals in 2013.

Data Source

The source of the most recent period data are estimates produced by the CMS Office of the Actuary (OACT) as part of the development of the National Health Expenditure Accounts (NHEA).

OACT estimates the uninsured rate in 2013 was 14%. For calendar years (CY) 2020 and 2021, OACT estimates the uninsured rates are 9.5% and 9.5%, respectively.

The CY values are then converted to the payment year using a weighted average approach. The weighted average is 9.5% because the estimated uninsured rate for CY 2020 and CY 2021 are the same.

Calculation

Factor 2 is then computed using the following formula:

Therefore, Factor 2 for FY 2021 is 67.86%—a slight increase from 67.14%, the computed estimate of the uninsured rate for 2020 Factor 2.

Considerations

It’s worth noting that this proposed rule was submitted to The Office of Management and Budget (OMB) in January 2020 for review and clearance. It’s difficult to ascertain to what extent the projected uninsured rate was adjusted as a result of the economic reality of the COVID-19 pandemic.

This is certainly an item that should be probed with CMS through the comment process as one would expect that the uninsured rate in FY 2021 will increase from most recent years based on current economic circumstances, especially the level of unemployment, and that should be reflected in this estimate.

Uncompensated Care Pool

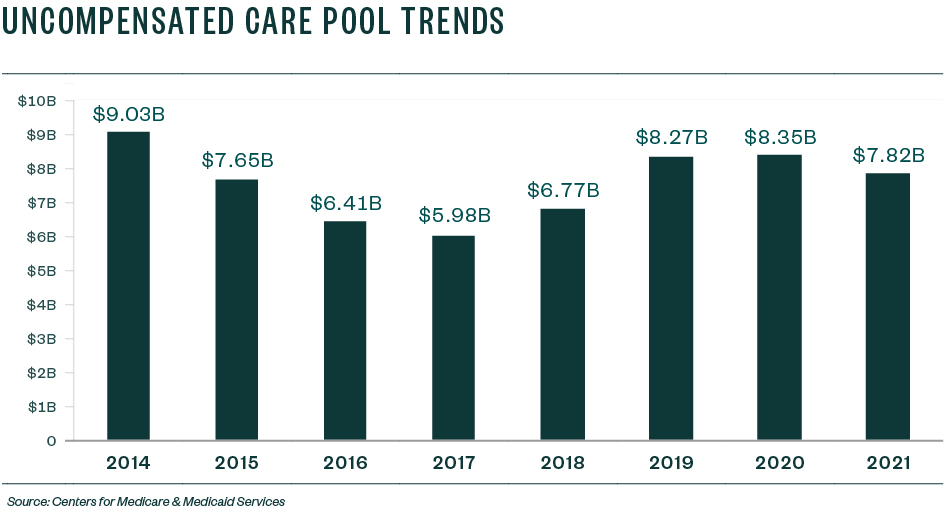

When Factor 2 is applied to Factor 1 ($11.519 x .6786), the result is an uncompensated care pool amount of approximately $7.817 billion to be shared by 2,401 qualifying hospitals based on their Factor 3 calculation.

Trends

From a trend perspective, the UC pool in 2014 was $9.033 billion and then steadily declined as the rate of the uninsured declined in the US, or at least was estimated to decline using CBO data.

Since the switch from CBO data to NHEA data metric in 2018, and as a result of changes to various factors that impact coverage decisions under the ACA, the rate of uninsured ticked up in 2018 and 2019 and nearly flattened in 2020 and 2021.

The size of the pool increased as pre-ACA DSH estimates have increased when more current fiscal years are used as the basis for computing the estimates of Factor 1, but for 2021, the pre-ACA DSH estimate decreased for the first time since the establishing of the UC pool.

Economic Impact

Based on CMS analysis, it’s projected that FY 2021 payments under this methodology will be $534 million less than FY 2020 and continue to have a redistributive effect based on each qualifying hospital’s uncompensated care costs relative to the total uncompensated care costs for all qualified hospitals.

Uncompensated Care Factor 3

Factor 3 is the percentage of each subsection (d) hospital’s amount of uncompensated care as a percent of the uncompensated care of all hospitals qualified for payment from the uncompensated care pool.

Factor 3 is applied to the product of Factor 1 and Factor 2 to determine the amount of uncompensated care payment each eligible hospital will receive.

As in FY 2020, CMS is proposing to use one year of Medicare cost report Worksheet S-10 data to derive Factor 3 for FY 2021. CMS is proposing to use FY 2017 data for FY 2021 for all hospitals except Indian Health Service hospitals and Puerto Rico hospitals.

Indian Health Service and Puerto Rico Hospitals

CMS is proposing to use a low-income insured days proxy utilizing 2013 Medicaid days and the most recent SSI days to calculate Factor 3 for Indian Health Service hospitals and Puerto Rico hospitals for one more year.

Additionally, CMS plans to review a restructuring of Medicare DSH and uncompensated care payments beginning in FY 2022 for Indian Health Service hospitals and tribal hospitals. CMS is contemplating a Medicare DSH payment that’s 100% of the calculated amount rather than 25% of the calculated amount.

Future S-10 Use

CMS also is proposing to use the most recent available single year audited S-10 data for Factor 3 in all subsequent years.

CMS expects the number of audits to increase in future cost reporting years, and as a result, believes that the best available data will be from S-10 data for cost reporting years for which audits have been conducted.

Considerations

Medicare Administrative Contractors (MACs) are currently performing Worksheet S-10 audits on all federal 2018 fiscal years. Given CMS Factor 3 proposals, it’s likely that CMS rolls forward their methodology by one year using the federal 2018 S-10 data during the 2022 rulemaking cycle.

Additional Uncompensated Care Proposals

Proposed Definition of Uncompensated Care

CMS is proposing to use the definition of uncompensated care as reported on S-10 Line 30 for FY 2021 and subsequent years. Line 30 includes both charity and bad debt, but doesn’t include Medicaid or other indigent program shortfalls.

Hospital Mergers

In cases where a merger takes place during a surviving hospital’s cost reporting period, annualizing the uncompensated care data of the acquired hospital could double count the data for the portion of the year that overlaps with the remainder of the surviving hospital’s cost reporting period.

To mitigate this double counting, CMS is proposing not to annualize the acquired hospital’s data.

Instead, CMS will use a multiplier that represents the portion of the uncompensated care data from the acquired hospital that should be incorporated with the surviving hospital’s data for the purpose of determining Factor 3 for the surviving hospital.

Newly-merged hospitals are hospitals that merge after the development of the final rule and will be treated as new hospitals. The newly-merged hospital’s final uncompensated care payment would be determined at cost report settlement where the numerator of Factor 3 will be from the surviving hospital only for the current fiscal year.

If less than 12-months, the data will be annualized.

Long Cost Reports

CMS is proposing a modification to the annualization of long cost reports, in which a hospital’s cost reporting period starts in one fiscal period and spans the entirety of the following fiscal year.

In this case, CMS would use the cost report that spans both fiscal years for purposes of calculating Factor 3.

All-Inclusive Rate Providers (AIRP)

In terms of cost-to-charge ratio trims, CMS is proposing that if the AIRP’s total uncompensated care costs are greater than 50% of its total operating costs on its 2017 cost report, uncompensated care costs would be recalculated using a cost-to-charge ratio of the hospital’s most recent prior year report that wouldn’t result in uncompensated care costs greater than 50% of operating expenses.

Cost-to-Charge Ratio Trim

CMS will use a similar process to the one used in FY 2018, 2019, and 2020.

CMS will establish a cost-to-charge ratio ceiling that’s three standard deviations above the national geometric mean cost-to-charge ratio of the applicable fiscal years used.

Uncompensated Care Data Trim Methodology

CMS will use the same methodology used in FYs 2019 and 2020. If a hospital’s uncompensated care costs for 2017 are greater than 50% of its total operating costs, CMS is proposing to use the data from the hospital’s 2018 cost report to trim the 2017 uncompensated care costs.

However, CMS won’t apply the trim methodology to hospitals that were subject to an S-10 audit because CMS believes there’s increased confidence that if high uncompensated care costs are reported by these audited hospitals, the information is accurate.

Interim Uncompensated Care Payments

CMS will continue to use the average of the three most recent years discharges for setting interim uncompensated care payments.

However, for FY 2021, CMS is proposing a voluntary process through which hospitals may submit a request for a lower per discharge interim payment amount if the hospital thinks it could be overpaid due to a spike in FY 2021 discharges.

This voluntary method should be considered if a significant recoupment, 10% of total uncompensated care payment or at least $100,000, would take place at cost report settlement if the per discharge amount wasn’t lowered.

Accounting Standards Update (ASU) Topic 606

Another item from the rule that impacts S-10 reporting is where there has been some clarification on the topic of implicit price concessions as it relates to the Accounting Standards Update (ASU) Topic 606.

Based on the Financial Accounting Standards Board (FASB) update under Topic 606, an amount representing a bad debt would no longer be reported separately as an operating expense.

Instead, it would be treated as an implicit price concession and is a reduction in patient revenue.

There was a question with the implementation of this new standard and how it could impact Worksheet S-10 non-Medicare and Medicare bad debt. However, CMS addressed this issue as they’re proposing to recognize the Topic 606 terminology and these implicit price concessions will be recognized as a bad debt on Medicare cost reports.

Next Steps

Data Review

It’s important that hospitals review their data associated with this proposed rule, including any tables, supplemental data files, and merger updates, and report any issues or data discrepancies in writing to CMS that need to be addressed within 60 days of the date this rule was put on public display.

Public comments can be submitted no later than 5:00 p.m. Eastern Standard Time on July 10, 2020. Reference CMS-1735-P in your comment submission.

Before submitting comments, consult with the rule’s submission instructions so you adhere to the proper method.

S-10 Audits

One major point that CMS addresses in this rule is the proposal to use the most recent available single year audited S-10 data for Factor 3 in all subsequent years.

This signals that the S-10 audits that occurred the last few years are here to stay, and that CMS expects there to be recent audits on these S-10s to pull for future Factor 3’s.

CMS also states that they expect the number of audits to increase in future cost reporting years, and as a result, believes the best available data will be from S-10 cost reporting years that have been audited.

Hospital systems need to designate an individual or a team of individuals to prepare the S-10 for filing and support it during the audit process. These S-10 reports take a considerable amount of time and resources to prepare.

For the 2015 and 2017 reviews, the MACs budgeted anywhere from 80-120 hours for each review; even more time could be needed to prepare an accurate S-10. To accurately report charity and bad debt and to maximize the uncompensated care reported on S-10, there needs to be coordination between the designated S-10 preparer and reimbursement staff, revenue cycle, accounting, and potentially policy, compliance, or legal if revisions are necessary to any policy.

The designated S-10 preparer will also need to stay abreast of any regulatory changes regarding the reporting of S-10 along with updates on audit findings to better prepare their hospital for future S-10 reviews.

2019 Focus

Providers should take another look at their federal 2019 cost reports to make sure they’ve accurately captured all uncompensated care on those cost reports and decide if they need to amend before these are most likely subject to an audit early next year.

CMS now requires hospitals submit the patient detail that ties to the charity amounts claimed on S-10, as well as the Medicare DSH totals at the time of the cost report filing. The cost report will be rejected if not included.

This requirement begins for cost reports starting on and after October 1, 2018. CMS hasn’t published an exact template for S-10, but hospitals will need to provide, at a minimum, the charity detail that ties to the cost report and include fields such as patient name, social security number, and write-off amount.

We’re Here to Help

CMS proposed additional changes in the FY 2021 IPPS proposed rule beyond those for Medicare DSH and uncompensated care. Learn more in our Alert that provides an overview of payment rate updates, wage index adjustments, Medicare bad debt updates, and other relevant changes.

For more information about the proposed rule and possible implications for you and your organization, contact your Moss Adams professional.