On August 10, 2020, the Centers for Medicare & Medicaid Services (CMS) published the final rule for fiscal year (FY) 2021 Inpatient Rehabilitation Facility Prospective Payment System (IRF PPS) in the Federal Register. The regulations are effective October 1, 2020.

Each year, CMS publishes updates to the regulations for inflation factors, wage adjustments, and other patient-care related payment adjustments. Below is an overview of the FY 2021 IRF PPS, including finalized changes and other relevant updates.

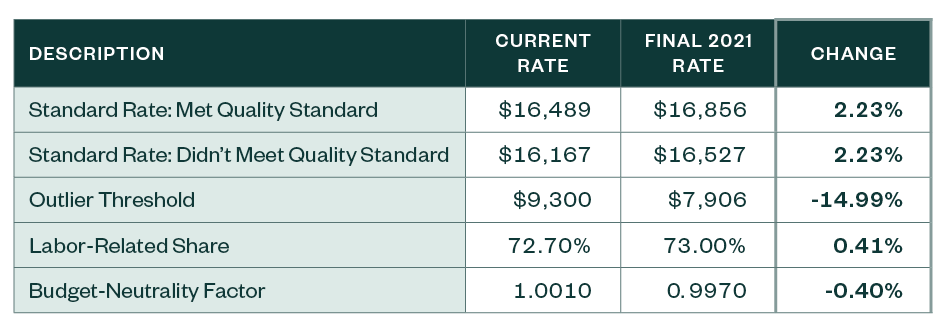

Finalized Changes to IRF Payments

CMS has finalized the following updates to inpatient rehabilitation facility payment rates.

Other Notable Updates

Core-Based Statistical Area Designation

The FY 2021 IRF PPS final rule adopts as proposed the most recent Office of Management and Budget (OMB) Core-Based Statistical Area (CBSA) delineations and applies a 5% cap on any wage index decrease, compared to FY 2020, in a budget-neutral manner.

As a result, the following changes will occur:

- 34 counties currently classified as urban will become rural.

- 47 counties currently rural will become urban.

- Some counties will move from one CBSA to another.

Coverage Requirements

The final FY 2021 IRF PPS rule puts forward the following amendments as proposed to inpatient rehabilitation facility coverage requirements:

- Removes the post-admission physician evaluation requirement

- Codifies existing documentation instructions and guidance

- Allows nonphysician practitioners to perform certain requirements that rehabilitation physicians were required to perform

Additional Updates

Other provisions of the final rule include updates as proposed to the following:

- The case mix group (CMG) relative weights and average length of stay values for FY 2021, in a budget-neutral manner

- The IRF PPS payment rates for FY 2021 by the final market-basket increase factor—based on the most current data available—with a final productivity adjustment required by Section 1886(j)(3)(C)(ii)(I) of the Social Security Act

- Descriptions of the calculation of the IRF standard payment conversion factor for FY 2021

- The cost-to-charge ratio (CCR) ceiling and urban and rural average CCRs

- Descriptions of the method for applying the reduction to the FY 2021 IRF increase factor for IRFs that fail to meet the quality reporting requirements

Economic Impact

The overall economic impact of this rule is an estimated $260 million in increased payments from the US Federal Government to IRFs during FY 2021.

Next Steps

Providers need to review whether the appropriate IRF rates have been loaded into their patient accounting system used to bill Medicare. Once these revised rates are incorporated, best practice would be to validate that the rates are calculating appropriately. This can be accomplished by pulling a paid claim and running it through the IRF pricer that can be downloaded from the CMS website.

We’re Here to Help

For more information about the rule and the implications for you and your hospital, the revised rates, or assistance during the course of your validation review, contact your Moss Adams professional.