This article was updated November 13, 2020.

Multnomah County voters approved a new personal income tax to fund preschool programs. The tax, effective January 1, 2021, is on individuals who live in Multnomah County or who don’t live in the county but receive income from Multnomah County sources. The tax is 1.5% on income over $125,000 (single) and $200,000 (joint) and 3.0% on income over $250,000 (single) and $400,000 (joint). The tax rates are scheduled to rise to 2.3% and 3.8% after five years.

The new revenue-raiser joins several existing taxes, including a measure passed in May 2020 to fund supportive services for persons who are homeless or at risk of becoming homeless that also becomes effective January 1, 2021.

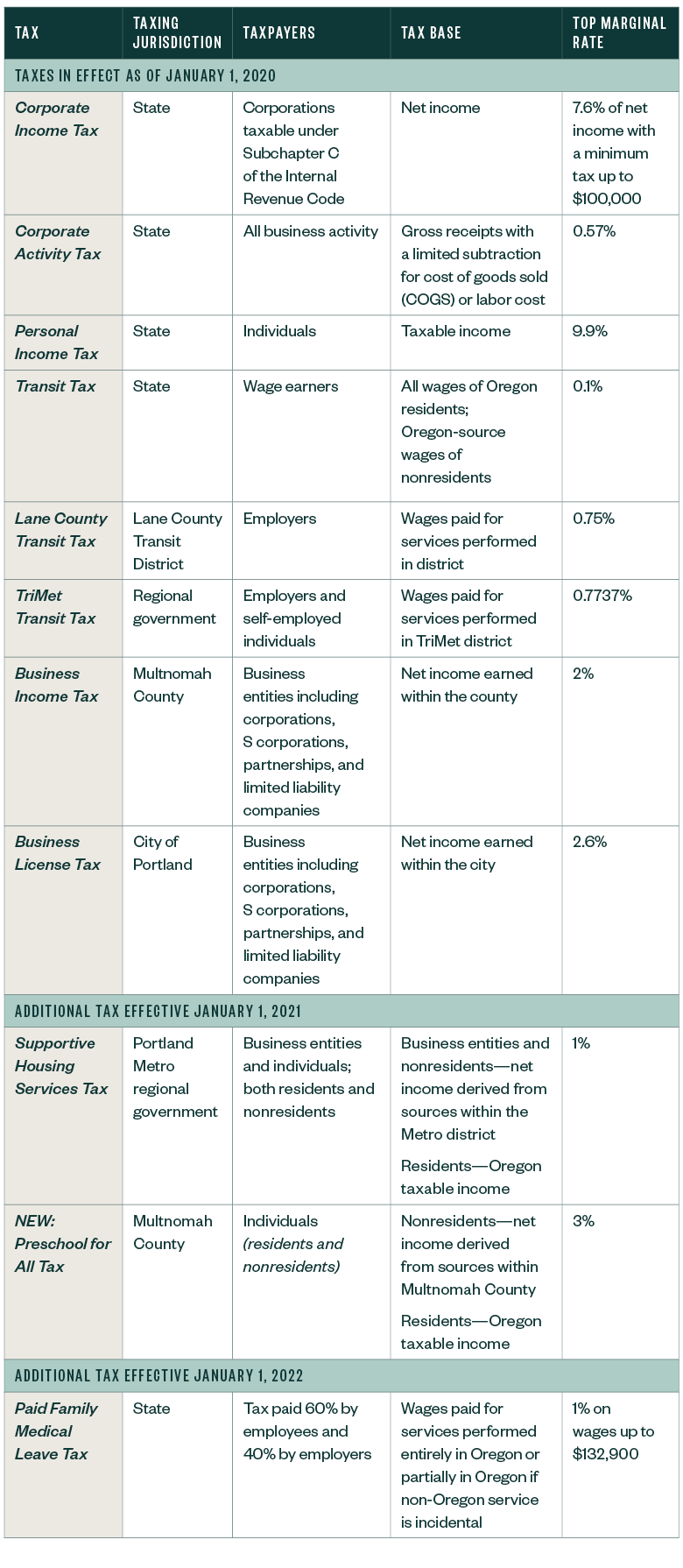

Here, we outline this new addition and how it fits in with Oregon’s already complex tax landscape.

Oregon State & Local Taxes

The chart below shows certain current Oregon and local taxes, including the newly passed one.

Local Portland governments are imposing several additional taxes with more limited application including:

- CEO surcharge

- Gross receipts tax on certain large retailers

- Heavy vehicle use tax

Implementation Considerations

While most of the taxes listed above have been effective for several years with established policies, the Metro Supportive Housing Services and Multnomah County Preschool for All taxes introduce new taxing mechanisms. Several implementation considerations and ambiguities remain to be clarified before the January 1, 2021, effective date, including taxation of income generated by pass-through entities and the status of taxable income of nonresidents.

The COVID-19 pandemic adds additional considerations as many employees who may have worked in Multnomah County or the Metro district in early 2020 may now be working remotely from homes outside the taxing jurisdictions. Further clarification will be needed.

Employers may be required to include the Supportive Housing Services and Preschool for All taxes in their withholding calculations, and all businesses will likely be required to make estimated payments for the tax. Businesses that operate within and without the Metro district must develop procedures to document in-district and out-of-district activities.

Changing Locations

Some taxpayers may be considering changing business locations and individual residences during this time for a variety of reasons. Relocations can cause significant shifts in your tax burden and can bring audit scrutiny—along with unanticipated tax consequences. Even if you’re not planning a current move, modeling where future growth should occur is an important analysis along with ensuring you’re structured efficiently should an exit event be on the horizon.

We’re Here to Help

Determining business and personal income subject to these taxes depends on many variables, including the business being conducted and the various sources of personal income.

To discuss how this tax impacts your business or if you’re considering a move to another state or another city in Oregon, please contact your Moss Adams professional.