The IRS has issued final regulations on the 1.4% excise tax certain colleges and universities must pay on their net investment income (NII).

After receiving comments on proposed regulations issued in July 2019, the US Department of the Treasury (Treasury) and IRS made several changes to the final regulations, such as:

- Excluding certain types of income from NII

- Introducing a broader definition of a reasonable cash balance

- Allowing capital loss carryovers

The final regulations were issued on September 18, 2020, and go into effect in the first tax year following the publication date in the Federal Register. For colleges and universities with a year-end of June 30, the regulations will be effective for tax years starting on July 1, 2021.

Background

The final regulations provide guidance on Internal Revenue Code (IRC) Section 4968, which was enacted as part of the tax reform reconciliation act of 2017, referred to as the Tax Cuts and Jobs Act (TCJA). Under IRC Section 4968, applicable educational institutions are subject to a 1.4% excise tax on their NII.

An applicable educational institution is a private college or university that had:

- At least 500 tuition-paying students in the preceding tax year

- More than 50% of those students located in the United States

- An aggregate fair-market value of assets that was at least $500,000 per student at the end of the preceding tax year

Assets used directly in carrying out the college’s exempt purpose aren’t included in this calculation.

Definitions

Several terms weren’t defined in IRC Section 4968 but are defined in the final regulations.

Student

The proposed regulations defined a student as, “A person enrolled in a degree, certification, or other program…leading to a recognized educational credential.” Some commenters suggested the definition should include all students attending the institution, even if they aren’t enrolled in a credentialed program.

Acknowledging that some students may be attending a college to improve job skills or for personal enrichment, the Treasury and IRS changed the definition of student in the final regulations. Now a student is, “A person who is enrolled and attending a course for academic credit from the institution and who is being charged tuition at a rate that is commensurate with the tuition rate charged to students enrolled for a degree.”

Number of Students

For purposes of determining the number of students, an institution uses the daily average number of full-time students—with part-time students counted on a full-time-equivalent basis. The college itself can determine the standards for defining part-time students, full-time students, full-time equivalents, and daily average.

The standards, though, may not be lower than the minimum standards set by the US Department of Education (ED) in the Higher Education Act of 1965.

Tuition Paying

The term is defined in the final regulations as the payment of any tuition or fees by a student to enroll or attend a course of instruction at the institution. Tuition and fees don’t include payment for supplies and equipment or room and board.

Scholarships or grants from the institution or from the federal, state, or local government aren’t considered tuition paid on behalf of the student, while scholarships from nongovernmental third parties are considered tuition payments.

Additionally, the student is considered tuition-paying if they still have to pay tuition after receiving a scholarship from the institution or government and after applying any work-study program operated directly by the institution.

Located in the United States

A student is located in the United States if the student lived in the United States for any portion of the time when the student attended the institution. This can be determined using any reasonable, consistently applied method.

Assets for the Institution’s Exempt Purpose

Determining assets used directly in carrying out an institution’s exempt purpose is based on specific facts and circumstances.

Included Assets

The final regulations cite several examples of assets that meet this definition if they’re used directly in the administration of an institution’s exempt activities. These include:

- Administrative assets, like office supplies and equipment

- Real estate or a portion of any building used by the institution

- Property, like art, owned by the institution and on—or held for—public display

- Fixtures and equipment in classrooms

- Research facilities and related equipment

- Any property the institution leases at no cost or nominal rent

- Patents, copyrights, and other intangible property, the income from which is excluded from NII

- The reasonable cash balance needed to cover current operating expenses

The proposed regulations stated that an institution’s reasonable cash balance would equal 1.5% of the fair-market value of the institution’s noncharitable-use assets, similar to the rules for private foundations in calculating their minimum investment return. However, commenters noted that universities’ operations are vastly different from those of private foundations, affecting the amount of cash needed to operate.

Under the final regulations, universities may use any reasonable method to determine the reasonable cash balance. One method cited is to use an amount equal to three months of the operating expenses allocable to program services. An amount larger than that may also be considered reasonable, if established by the facts and circumstances.

Excluded Assets

Examples of assets that aren’t used directly to carry out an institution’s exempt purpose are the following:

- Assets held for the production of income or for investment—such as stocks, bonds, or endowment funds—even if the income is used to carry out exempt purposes

- Property, such as offices or equipment, used to manage the institution’s endowment funds

Net Investment Income

NII for institutions is determined under rules similar to those that determine NII for private foundations. Generally, NII is the sum of gross investment income and capital gain net income less allocable deductions.

Gross Investment Income

Under the final regulations, gross investment income is income from interest, dividends, rents, payments with respect to securities loans, and royalties. However, gross investment income doesn’t include these payments if they’re unrelated business taxable income (UBTI) to the institution.

Excluded Income

Because the activities of educational institutions differ from private foundations, the final regulations provide the following exceptions to gross investment income under IRC Section 4968:

- Interest income from a student loan made by the institution or a related organization to a student attending the school. The loan’s terms aren’t required to be more favorable than commercial loans for the interest income to be excluded.

- Rental income from housing provided by the institution or a related organization to students attending the school.

- Rental income from housing for faculty and staff, if the housing is provided based on the staff’s roles for the institution.

- Royalty income from patents, copyrights, and other intellectual and intangible property developed from the work of students or faculty in their capacities with the school.

Non-excluded Income

However, the following income isn’t excluded from the gross investment income calculation:

- Royalty income from trademarks on the institution’s logo or name

- Royalty income from intellectual property donated or sold to the organization

- Interest income from faculty loans

- Rental income from former student, faculty, or staff housing that don’t require the tenant to vacate the property if their employment with the institution ends

- Rental income from dorms for periods outside the academic year, other than to current students

Capital Gains and Losses

Several changes were made to the proposed regulations to address how capital gain net income is calculated:

- The gain from the sale or exchange of exempt-use property is excluded from capital gain net income for the portion of the property used for the exempt purpose.

- Any appreciation in the value of donated property before the date when it’s donated isn’t included when calculating the gain on the sale of that property.

- If capital losses exceed capital gains, those capital losses may be carried forward and deducted from capital gains in a future year. This is a significant departure from the proposed regulations and private foundation rules.

Partnership Assets and Interests

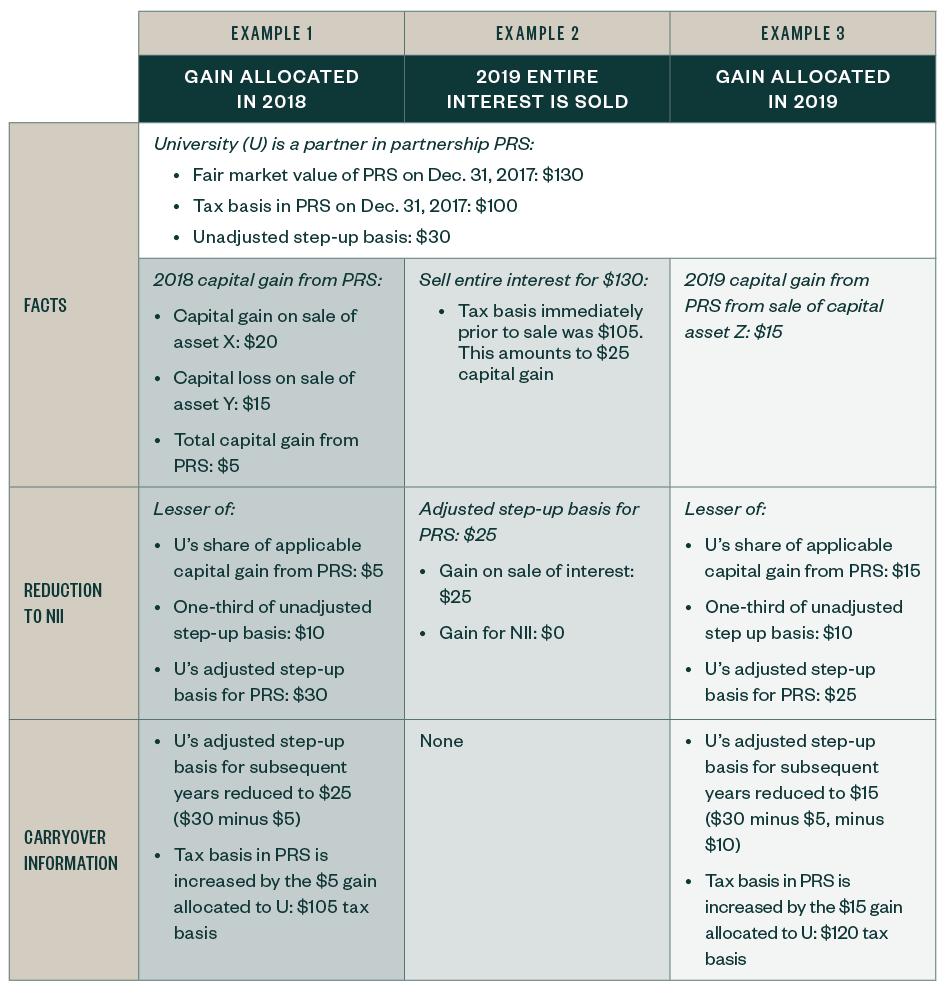

One of the most complex areas of the proposed regulations involved allowing institutions to use the fair-market value, as of December 31, 2017, as tax basis for assets held, including partnership interests. Questions revolved around an institution’s ability to step up assets held by the partnership (inside basis) so that appreciation of assets held in the partnership prior to December 31, 2017, weren’t subject to the NII excise tax.

The final regulations provide that inside basis is determined by the institution’s adjusted basis in the partnership itself (outside basis), thereby allowing the institution to use the fair-market value of the partnership interest as a proxy for the tax basis of the assets inside the partnership if the assets have appreciated.

Distributions of Gain or Loss

When a partnership sells an asset, the gain or loss is distributed to the partners on a Schedule K-1.

Final regulations provide that if an institution held an interest in a partnership on December 31, 2017, and that partnership distributes gain, the institution is allowed to offset its share of the gain by a portion of the built-in gain in the institution’s interest in the partnership as of December 31, 2017. The built-in gain is the difference between fair-market value and the outside basis on December 31, 2017.

A similar rule applies if the institution disposes of part, or all, of the directly held partnership interest. The following examples explain these complex provisions.

Related Organizations

Under IRC Section 4968, the assets and NII of an institution’s related organizations are considered assets and NII of the institution in its calculation of excise tax. IRC Section 4968 defines a related organization as any organization that:

- Controls, or is controlled by, the educational institution

- Is controlled by one or more people who also control the institution

- Is a supported organization or a supporting organization of the institution

Key Concerns

Commenters stated that, under the definition of control in the proposed regulations, institutions would need to account for assets and NII of some organizations they have no control over. In addition, classifying some organizations—like taxable entities—as related organizations would generally result in double taxation.

Final Exclusions

Based on commenters’ concerns, the final regulations state that the following organizations aren’t related organizations for purposes of IRC Section 4968:

- A taxable corporation

- A taxable trust, including a nongrantor charitable-lead trust—unless the trust is controlled by the institution

- A grantor charitable-lead trust

- A charitable-remainder trust

- A partnership

- An S corporation

- A decedent’s estate

Employee Benefit Plans

An employee benefit plan—or arrangement that is considered a funded plan—also isn’t considered a related organization. A benefit plan is funded when the assets are set aside from the employer exclusively to provide employee benefits, and those assets aren’t subject to claims by the employer’s creditors and may not revert back to the employer’s general assets.

For example, a Section 501(a) trust that funds a Section 401(a) qualified retirement plan wouldn’t be a related organization. However, an unfunded benefit plan, like a grantor trust used in connection with a Section 457(b) plan or an arrangement under Section 457(f), is treated as a related organization.

Control

While IRC Section 4968 doesn’t specifically define control, the final regulations provide separate rules for the various types of control relationships that may exist.

Assets and NII of Related Organizations

For the most part, all assets and NII of a related organization are considered assets and NII of an educational institution if the related organization is either:

- Controlled by the educational institution

- A supporting organization of the educational institution

However, a rule from prior guidance was retained that prevents assets and NII of the related organization from being taken into account by more than one educational institution.

For all other types of related organizations, only the assets and NII that are intended or available for the use and benefit of the educational institution are considered assets and NII of the educational institution.

Additionally, the exclusion for exempt-use assets applies to assets of related organizations that are:

- Used directly to carry out the institution’s exempt purpose

- Part of the related organization’s own exempt purpose, in the case of a 501(c)(3) related organization

We’re Here to Help

To learn more about how final IRC Section 4968 regulations could impact your private college or university, contact your Moss Adams professional.