It’s never too soon to start teaching your kids healthy financial habits. Financial responsibility can help them lead more fulfilling lives and let you and your family plan for the future—especially if your family owns valuable assets or operates a family business.

Below, we cover healthy spending, saving, and investing habits; ways to talk about money; and financial strategies to help your family thrive.

Savings

Being open with your kids about unexpected financial stressors, their impacts, and ways you were—or weren’t—financially prepared can help provide context for the importance of saving money.

A three-to-six-month emergency fund provides freedom, security, and options—helping reduce stressors in times of hardship or economic instability. It can also provide leeway if you suffer a job loss, letting you look for an opportunity that’s the best fit, rather than accepting the first offer.

When to Start

Teaching your kids about healthy saving habits will set them up to be financially responsible adults. And the earlier you start their financial education, the better—even preschoolers can understand basic financial concepts.

Get started by teaching them about prioritization, emphasizing how saving now will help them achieve their future goals. Once your kids better understand the importance of savings, you can help them:

- Make a financial plan that focuses on their wants, starting with any money they’re gifted or earn.

- Determine if something is valued too high or too low. This will help them better understand the value of money.

Strategies

There are a couple of different savings strategies you can discuss with your kids.

50-30-20 Rule

They can follow a 50-30-20 rule:

- 50% for must-haves

- 30% for wants

- 20% for savings

10-30-60 Rule

Or, they can follow a 10-30-60 rule:

- 10% for giving

- 30% for saving

- 60% spending

Every time they receive money, they’ll set aside the agreed-upon savings percentage in a safe spot at home until they have enough to open a savings account.

Types of Savings Accounts

When your kids are getting started, a basic, low-interest, savings account at any bank will do. Together, you can explore the different interest rate offerings and select a suitable account.

Once they’ve accumulated more money, you can help them invest in a more-advanced saving account—like a money-market or investment account—with a higher interest rate.

Go over your kid’s monthly bank statement with them, so they can see how their savings are growing.

Spending

Smart spending is a huge part of money management. Your kids may ask you for spending money, and that’s a perfect time to start a conversation.

Set Goals and Make a Plan

The key to smart spending is to avoid spending money you don’t have. To help your kids develop this habit, show them how to evaluate their existing finances, set goals around buying things they want, and put aside money for unanticipated expenses. You can do this effectively by applying one of the saving strategies noted above.

Start the conversation and encourage your kids to come up with their own ideas about how to deal with money.

Earn Money

You can also help your kids establish goals if they want to have more spending money. Encourage them to come up with ideas, such as washing a neighbor’s car or tutoring a friend’s younger sibling.

Manage Unanticipated Expenses

If a purchase can’t wait—such as replacing a broken phone—and your child doesn’t have the money to pay for it, you can discuss other solutions. Maybe you work out a loan they’ll need to pay back with interest.

Investing

Teaching your kids to invest beyond a savings account can help them learn how to earn more money at a faster rate. That said, it’s important to teach them this approach comes with some risk.

Below are some investment choices you can discuss as well as the potential benefits and risks.

Investment Options

Stock in a Company

This is a partial ownership in a single public company. While some companies offer great potential, this is a riskier investment approach because the success—or failure—of the company impacts the entire amount you invest.

Notes or Bonds

A note or bond is a way for governments or companies to borrow money with agreed-upon repayment terms. If you buy a corporate bond, you’ll lend the company money for a specified time—say 10 years—and the company will pay you back, plus interest, in 10 years.

Notes and bonds are low risk, but there’s always the possibility that the company won’t have the money to pay you back.

Mutual Funds

A mutual fund invests in multiple stocks, notes, and bonds simultaneously. The mutual fund’s value changes based on the collective increase or decrease of the companies the mutual fund includes.

This structure means the overall mutual-fund increase may be slower than an individual company, but there’s also less risk for it to decrease. Mutual funds are professionally managed by a person or team that picks the companies included in the portfolio.

Practical Application

To help your kids understand the concept of investing, you can play a game together. You’ll need internet access and a way to track your investments—like an excel spreadsheet or pen and paper—before getting started.

Game Time

First, help your child find a company to invest in—for example, one that makes their favorite electronic device. Then, visit an online stock market index to find out if the company’s stock can be purchased on the open market. If it can, pretend to buy $100 worth of their stock by entering it on your spreadsheet.

Next, decide how often you’d like to check the value of your stock. When you check it, record the value and see if your investment has increased or decreased. It will likely fluctuate, but ideally it will increase over time.

You can also decide when to sell stock, move to a new company, or try different investment choices. This can open up the conversation and help your kids understand how investing could increase their savings for future spending.

Borrowing

Generally speaking, we want to teach our kids to limit borrowing—too much borrowing can lead to financial trouble. There are instances, however, that borrowing can be a useful financial tool or even a necessity; purchasing a home, for instance, could be considered a necessity.

What to Know

Talking to your kids about borrowing is as important as talking about saving. When you borrow money from a bank, you have to pay it back within a certain period of time—with interest. Explain to your kids that paying interest means you pay the lender more than the initial amount you borrowed.

Cost of Borrowing

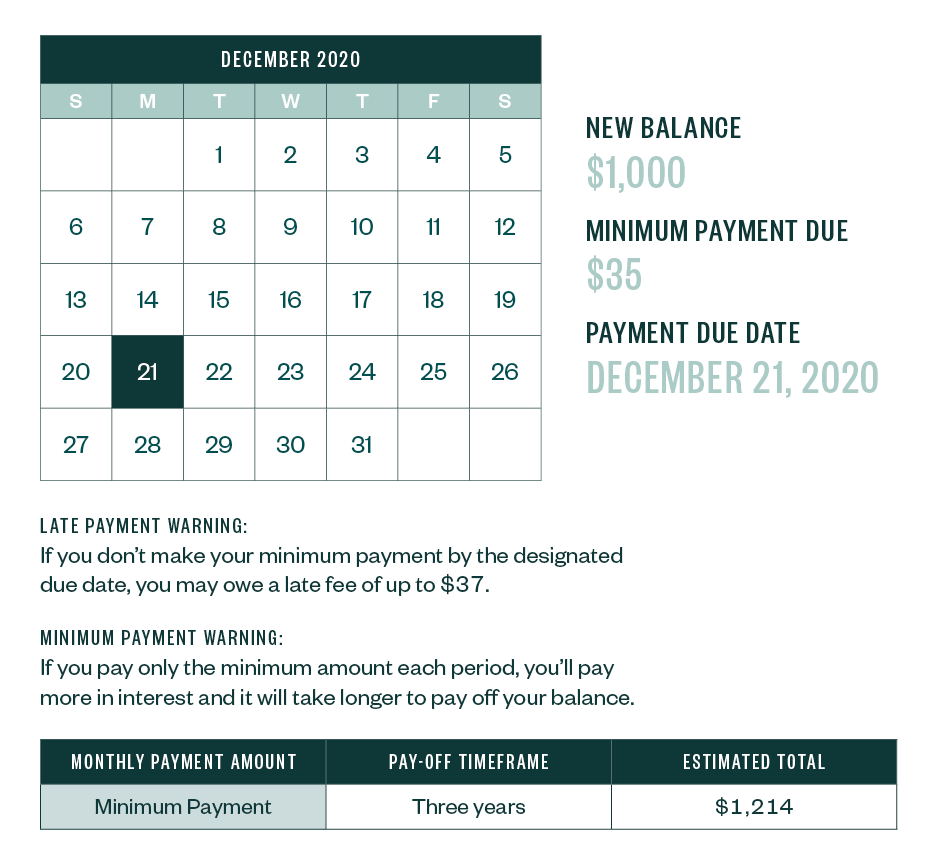

Borrowing money comes with a cost. The below credit card statement shows that if you borrow $1,000 and make monthly payments of $35, it will take three years to pay off the full balance—and accrue an additional $214 of interest increasing the overall cost by 21.4%.

Different Kinds of Loans

Loans that provide a return on investment or have a low interest rate are generally considered good loans. Loans with high interest rates and no return can be expensive and have long-term consequences. Here are a few examples.

Mortgage Loan

This is often considered a good loan because it can help you buy an expensive property that potentially increases in value over time. The interest on these type of loans is typically lower—anywhere from 3% to 7%, depending on market conditions.

That said, the actual interest rate at the time when you take out a loan will depend on may factors, including overall economic conditions, the loan amount, and the lender’s assessment of the borrower’s ability to pay.

Credit Card Loan

Credit cards aren’t bad if you spend within your budget and pay the full balance each month. However, if you spend outside your means, you can accumulate a great deal of debt fairly quickly. Credit cards typically have high interest rates of 20% to 25%, which means you can end up paying back much more than you originally spent.

Student Loans

Education can be expensive, so it’s important to have a repayment plan that shows the anticipated repayment time and accrued interest. Student loans typically have a moderate interest rate—usually around 6%—but the total amount owed can be quite high, allowing it to grow quickly.

We’re Here to Help

Money can be challenging for people of all ages, so it’s important to build a strong foundation as early as possible. To learn more about how to pass on a strong financial legacy and plan for the future, contact your Moss Adams professional.