In doing so, a new contractual-swap fixed interest rate is set such that the mark-to-market value of the new swap with the new contractual rate and maturity date approximates the current mark-to-market value of the existing transaction.

Effectively, the contractual-fixed rate is a variable the counterparties will solve for in negotiating the new terms of the transaction. The new swap-fixed contractual rate will be higher than a new at-the-market swap, but it will be lower than the current swap rate.

Advantages

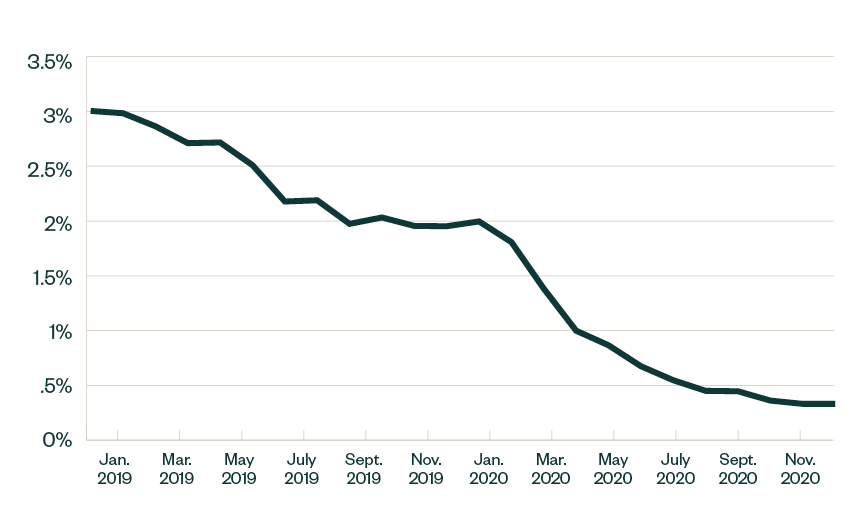

The immediate upside of a blend-and-extend strategy for borrowers is a reduction in short-term cash interest expense during a time when interest rates are extremely low. By spreading out a two-year liability over five years, a borrower pays out less cash each period even though the total term of the liability increases. Additionally, a longer-term transaction allows swap interest-rate protections to stay in place for a longer period of time.

For lenders, this could be an attractive option because it helps provide:

- Longer-term financial health and stability for the borrower

- Increased protection against low interest rates if economic instability and low interest rates continue

Disadvantages

The disadvantages of this strategy are more nuanced. For those who have elected hedge accounting treatment for existing swaps—and would like to continue this treatment—the existing hedge is required to be de-designated, and the modified instrument needs to be re-designated under the requirements of hedge accounting in Accounting Standard Codification (ASC) Topic 815, Derivatives and Hedging.

At the time of de-designation, the gain or loss related to the swap instrument generally must be frozen in other comprehensive income. It must then be amortized into earnings using a rational method—assuming the underlying interest payments remain probable of occurring. This could cause a significant disconnect between cash received or paid for interest and the related interest revenue or expense recognized in a given financial reporting period.

Additionally, because the newly blended-and-extended interest rate transaction is inherently entered into at an off-market rate, the blended-and-extended transaction won’t have a fair market value approximating zero at the inception of the hedging relationship. This will prevent the use of certain shortcuts available under the existing hedge accounting guidance. The inherent ineffectiveness of the blended-and-extended relationship must also be analyzed quantitatively during the re-designation process.

Other Alternatives

Given these complexities, some companies have elected to simply exit and extinguish an existing swap position and then immediately enter into a new transaction with an at-the-market swap rate. However, this alternative may burden the borrower with significant up-front extinguishment payments.

Some companies have also chosen to enter into hybrid transactions, wherein existing interest-rate swaps are replaced with a new interest-rate-swap transaction. In conjunction with the new transaction, extinguishment payments relating to the old swap are financed over the life of the new swap transaction.

Both of these scenarios also include unique and complex accounting implications whether or not the company elects hedge accounting for financial reporting purposes.

We’re Here to Help

Implementing a blend-and-extend approach can be complex, so it’s important to fully understand options before you get started. If you have questions about these transactions or would like to discuss next steps, contact your Moss Adams professional.