Many organizations don’t take a strategic approach to budgeting, which can lead to missed opportunities for improving operations and achieving organizational goals.

Here, we’ll outline a different approach to budgeting—one that lets you shift from thinking in terms of dollars and cents to focusing instead on your long-term priorities. The main steps include:

- Strategic planning

- Budgeting and fiscal management

- Decision-making

- Measuring outcomes

Below we’ll detail these steps—and how putting them together can help improve your utility at every level.

1. Start Planning Strategically

Too often, a budget is treated as a siloed document. It’s consulted quarterly, but it lacks integration with an organization’s goals overall—and progress on those goals. To see if you’re allocating funds to your top priorities, it’s important to make a budget that’s relevant and meaningful.

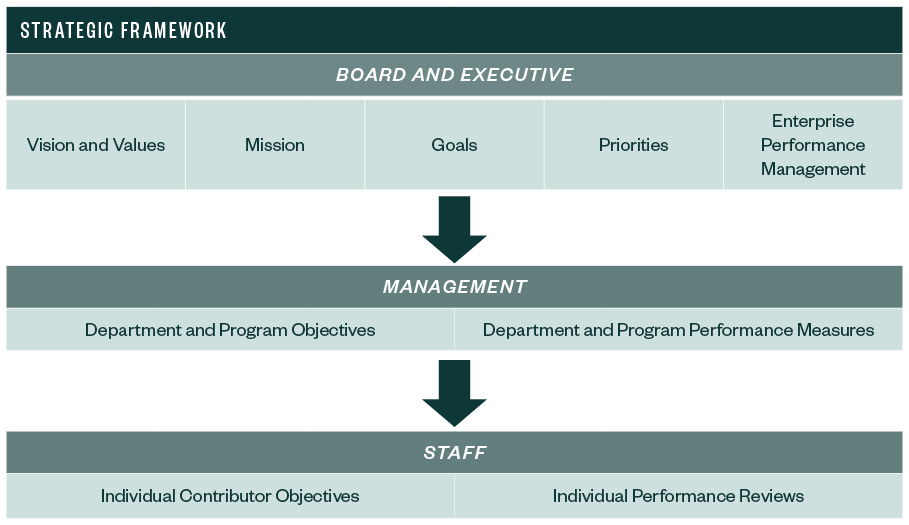

The Strategic Framework

One way to make sure money is going to your priorities is to connect your budget to a strategic plan. This can be formed by asking key questions at different levels of your organization.

Board and Executive Level

- Who are we?

- Where are we going?

- What are our goals?

- What are our values?

- What are our priorities this year?

- How do we want to achieve them?

Management Level

- What are our team’s specific objectives?

- What are cross-departmental objectives?

- What are program-level objectives?

- How are we going to achieve them?

- How are we going to measure those objectives?

Staff Level

The most effective operating environments leverage opportunities for improvement by bringing their strategic framework to the individual-contributor level. Key questions include:

- How does my work contribute to the organization’s strategic goals?

- Where are my objectives?

- How am I tied to the success of our organization?

Here’s a visual representation of the objectives at every level of an organization.

Strategic Framework Planning Inputs

A well-thought-out strategic plan will also factor in various inputs—similar to the inputs that go into your budget. These include:

- A financial forecast

- Enterprise risk management

- Programs and operations

- Members, stakeholders, partners, staff, and leadership

Questions to consider about these inputs include:

- What does our financial forecast look like?

- What are the areas where we might have risk exposure? What can we do to mitigate our risk?

- What's happening day-to-day at the program level?

- What are the needs of staff, stakeholders, ratepayers, partners, and leadership?

- What does leadership think about where we're going and what are the outcomes they hope the organization achieves?

The answers to these questions can be incorporated into your strategic plan, which will also impact your annual budget process.

2. Build Your Budgeting and Fiscal Plan

Once you have your strategic plan, you can start building your budget.

Key Considerations

Operating budgets are annual or biannual, but, as 2020 has taught us, things can drastically change quickly. That’s why it’s important for your budget to be a living document—as circumstances change, a flexible plan can help you respond and stay on course for your overall goals. Incorporating the following items into your budget can help you be more nimble should challenges emerge.

Timeliness and Rate Recovery

During times of hardship, your organization’s dollars can go out the door relatively quickly. Knowing your rate recovery—or how quickly you get dollars in the door—is important for staying on budget.

Cash Flow

It’s important to account for where your cash is going and how quickly—especially while contending with exigent circumstances. For example, during COVID-19, most—if not all—power utilities aren’t disconnecting for nonpayment, which will have an impact on cash flow for some.

Reserves

Another consideration is your reserves and how to maintain—or grow—them during challenging circumstances. Ask questions to determine their health, such as:

- What do our reserves look like?

- Are they very clearly defined?

- How are we going to manage our reserves, especially with different weight classes?

Cost Containment

This is a common issue for those who lack a strategically informed budget. Planning ahead can help you figure out how to find a balance to contain costs without sacrificing safety.

Reassessment of Capital Spending Plans

Budgets and strategies have changed to keep pace with the demands of 2020. Going forward, expect to continue reassessing capital spending plans as new events emerge.

Board Fiscal Management Activities

An ideal board is engaged and understands the organization's goals but doesn’t get too in the weeds. Here are some financial management activities companies can expect boards to review on an annual basis:

- Audit results

- Annual budget

- Quarterly financials

- Mid-year budget revision

- Updated fiscal policies

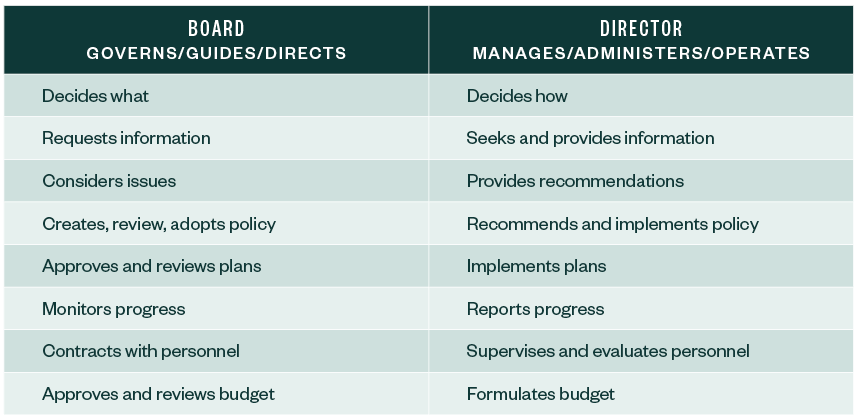

Communication

Communication is key to finding balance with your board and making sure their involvement is constructive. At the board level, decisions can be made around what will be done from a broad policy direction. At the management level, questions can focus on ways to execute and implement what the board has put forward.

Here’s a graphic that can help you communicate about, and ultimately define, roles.

Connecting the Budget and Strategic Plan

The relationship between a budget and strategic planning is similar to a slinky; whatever you do to one end impacts the other. If your budget or strategic planning document changes, the other needs to be revised accordingly. It’s critical that one document informs the other and continues to do so as they evolve. This will help you know whether you’ll achieve your strategic vision if you hit on all the objectives you’re measuring.

3. Make Informed Decisions

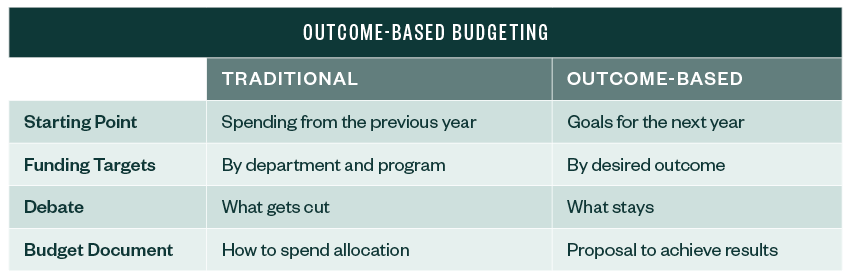

One approach to connect your budget and strategic plan is to use outcome-based budgeting.

Outcome-Based Budgeting

With traditional budgeting, an organization typically looks at their spending for the previous year and adjusts for changes, such as personnel needs or special projects.

Outcome-based budgeting takes a different approach. You start with the goals set out in your strategic planning document and work from there to figure out what resources are needed to achieve these goals.

Conversations will look different when using this approach—particularly for the management team. Target funding conversations will be different as well. Instead of thinking by department, you’ll need to think about priority outcomes across your whole organization.

Ultimately, this approach transforms the budget from a document that states how you’re spending your money to a proposal you can show to the board to help achieve your organization’s goals. This can be a very powerful tool that can facilitate conversations about priorities and impacts that don’t typically arise during a traditional budgeting process.

Prioritization

Because outcome-based budgeting focuses on priorities, the question emerges: how do you decide what to spend money on?

To figure this out, there are a few prioritization exercises you can use. They can be a positive, constructive, and effective way to engage your staff, board, and other stakeholders. Options include:

- Point or vote allocation. Priorities are determined by a vote.

- Trade-off rankings. This approach poses hypotheticals such as, “If you had to choose between the second and third programs up for discussion, which would you choose?”

- Two-four-eight consensus. With this method, you decide the number of people—two, four, or eight—needed to reach a consensus, and a decision is made once there’s buy-in from the decided number of people.

- Budget allocation. With this approach, decision makers are asked to decide how to allocate a hypothetical $1,000. It’s much easier to conceptualize this amount than, for instance, a multimillion-dollar budget, so this method can help people think through what’s most important to them.

It’s worth noting that these approaches can be helpful both for budget planning as well as crafting your strategic plan.

Making Adjustments

A budget is a plan made at a point in time, but new variables will inevitably emerge throughout the year. It’s important to prepare and adapt.

Extra-Budgetary Requests

Extrabudgetary requests can quickly throw an organization off course. As new spending areas emerge throughout year, it’s helpful to determine if they align with the overall mission and goals set out in the strategic plan.

If expenses don’t further your organization’s larger vision, they’re probably things you shouldn’t invest in. If they do align, you’ll need to think about what can be reprioritized. Throughout this process, it’s important to keep in mind that stakeholders and board members are more likely to sign off on expenses that achieve outcomes tied to the strategic plan.

Revenue Changes

Changes to your revenue stream can introduce significant challenges, so it’s important to consider how your organization will handle them while supporting its mission.

Scenario planning can help you prepare for these changes—while benefiting your overall operations. Utilities that scenario plan are typically better prepared if something unexpected happens that requires additional resources or causes a major cost constraint.

Determining options in advance, and with the big picture in mind, can help your organization adeptly react to issues rather than putting out fires. It can also put your organization in a stronger position after the challenges are addressed.

Salary Savings

Salary savings are a variable for many organizations that occur during position vacancies. Your organization can either:

- Treat this money as funds leftover at the end of the year that can be carried over

- Allocate these dollars elsewhere for the current year and figure out another way to modify salaries

While salary savings can be effective to meet one-time needs, it’s important to not rely on salary savings to address ongoing budget gaps.

4. Measure Your Outcomes

Another key element of budgeting thoughtfully is thinking about how to measure and communicate outcomes.

When thinking of what to measure, it’s good to again revisit the strategic plan. You want the higher level, board-driven priorities at the top, the program-level objectives set by managers, and the individual contributor outputs to all tie back to the strategic plan. You can even include performance measures and other reporting you’re already doing in your budget so you can see how it all connects.

Performance Measures

Here are some common performance measures to consider using for program metrics.

- Intermediate- or end-program outcomes and results

- Operations and maintenance expenditures, employee and board turnover rates, staff and leadership diversity

- Customer-service resolution rates

Here are some metrics for effectiveness and efficiency.

- Functional cost per full-time equivalent (FTE) for support services

- Functional cost per member or population served for direct services

It’s worth noting that while industry benchmarks can be helpful, they won’t give you the circumstance- and goal-dependent insight that tracking your own performance over time can, so it’s helpful to take the time to establish what your organization specifically needs to be tracking.

Power Specific Measures

There are of course certain measures that will be more impactful for the power sector than others. Although all those listed above are relevant, FTE is often the most useful to those in the industry. In addition, there are a few power-specific points to keep in mind.

- Construction costs. As many construction projects are unique, creating a budget and monitoring to actual costs is vital to ensuring projects are on track.

- Workload performance measures. These are often used but don’t provide great insight. For example, it isn’t useful knowing how many calls were received if that number doesn’t tie to any other data, such as time period, or to any desired outcomes, such as a reduction in calls.

- Operations and maintenance. Infrastructure and deferred maintenance is a challenge for many companies and a cost that adds up over time. So it’s worth reviewing how much money is going into these activities and evaluating if they’re making the impact that you want on the deferred maintenance backlog.

Dashboards

Once you have performance measures in place, the next step is to create a dashboard. Dashboards can be simple or complex, but they should all have a target—whether it’s monthly, quarterly, or annually—that shows how you’re performing against your strategic-plan goals.

Limiting Performance Measures

When dashboards get too detailed, readability and usability are often compromised. If you track too many performance measures it can be hard to tell from a quick look if you’re target for your goals.

If you find yourself tracking too many performance measures it also suggests that your targets aren’t closely tied to your strategic plan—you shouldn’t need 1,000 measures to let you know if you’re on track.

One way to help keep things simple is to use a red-yellow-green color-code system where red represents significantly off target, yellow is within range, and green is on track.

Sharing with Individual Contributors

Many utilities struggle to communicate and collaborate across separate departments. Sharing dashboards between employees and across divisions can help address this problem. If you’re doing budgeting and strategic planning right, and letting your top strategic goals drive your operations, you need to be sure that your driving force—your people—have constant alignment. Being able to see dashboards can help your people understand their role and move into a structured strategic alignment.

Outcome-Based Budgeting & Metrics

When you have the budget, dashboard, and strategic planning document you can have a conversation that is result-focused rather than expenditure focused. Ultimately, this leads to a more data-driven decision-making process and an organizational understanding of where you’re going, what you’re doing, how you’re funding it, and how that makes your organization effective.

We’re Here to Help

For questions about developing and implementing a strategy-driven budget, contact your Moss Adams professional.