When the economy is uncertain, increasing cash flow is a key way to help strengthen your company’s financial footing—especially if it’s asset rich and cash poor.

Although many forest-products companies are capital intensive—with large investments in heavy equipment—tax legislation and COVID-19 relief initiatives could provide important opportunities to free up cash, accelerate deductions, reinvest, or simply weather the storm.

Below, we review four key tax-relief and cash-flow opportunities available to most forest products companies as well as related implementation and filing requirements.

Background

While historically there have been some opportunities for forest-products companies to increase depreciation deductions, recent tax law changes, including release of the Coronavirus Aid, Relief, and Economic Security (CARES) Act and reinstatement of the net operating loss (NOL) carryback provisions, provide ways for companies to:

- Accelerate deductions

- Strengthen cash flow

- Bolster their economic position

Taxpayers who own real estate or invest heavily in fixed assets could also benefit from favorable depreciation methods.

Cost Segregation Study

In its essence, cost segregation is a tax deferral strategy. The purpose of a cost segregation study is to frontload depreciation deductions into a taxpayer’s early years of owning the property.

Even though cost segregation is commonly used as a tax deferral strategy, many taxpayers don’t fully benefit from this opportunity. Instead, they often end up paying federal and state income tax sooner than needed and miss a chance to significantly reduce their current income taxes.

How It Works

In effect, cost segregation studies work by identifying shorter-lived assets within the real estate assets that qualify for shorter recovery periods. These recovery periods are normally five, seven, and 15 years for most forest products companies. By themselves, or when these lives are coupled with bonus depreciation, the result is accelerated depreciation deductions.

For example, a newly constructed sawmill facility may have specialized electrical, mechanical, and foundations systems incorporated into the building structure that can be more appropriately allocated to the equipment they support. Rather than being incorporated into 39-year assets, they should be separately segregated to the shorter-life equipment.

Key Benefits

Cost segregation has become increasingly valuable in recent years due to changes in bonus depreciation and qualified property. Tax legislation in 2017 increased bonus depreciation to 100% for property that was acquired and placed in service after September 27, 2017, and before January 1, 2023. It also made used property eligible for bonus depreciation, but only for property acquired in an arm’s-length transaction from unrelated parties.

The CARES Act provided a retroactive technical correction to qualified improvement property (QIP) placed in service after December 31, 2017. The correction allows taxpayers to treat interior, nonstructural, and nonresidential improvements to existing spaces as a 15-year property eligible for bonus deprecation. Prior to the technical correction, the property had a 39-year life.

In effect, any asset identified as QIP can be deducted fully in the first year if placed in service in a year with 100% bonus deprecation.

The correction also allows for a 20-year recovery period for those who use the alternative depreciative system (ADS) for tax purposes. Although ADS doesn’t allow bonus depreciation, carving out QIP provides an advantage by reducing the recovery period from 40 years to 20 years.

To learn more about these QIP changes and potential impacts, watch our webcast. For more information about cost segregation and potential benefits, visit our Cost Segregation Services web page.

Fixed-Asset Study

Because many forest-products companies are capital intensive, fixed-assets management can be cumbersome—assets can be booked conservatively or without the appropriate tax-law knowledge. A fixed-asset study can help simplify this process and reveal important deduction-acceleration opportunities.

How It Works

Similar to a cost segregation study, a fixed-asset study is designed to reduce federal and state tax liabilities. However, it’s applied in a broader scale—as opposed to focusing on a single real estate asset.

This type of study is accomplished by reviewing a company’s depreciation schedules and applying the appropriate tax laws to all fixed assets. Incentives are found in each asset’s eligibility for accelerated depreciation through bonus, QIP, or a correction to the asset’s methods or lives.

Key Benefits

If a fixed-asset study reveals a taxpayer can accelerate deductions on assets previously placed in service with improper tax lives or methods, this can lead to immediate tax deductions for the owners.

It can also open opportunities for disposing assets by identifying capitalized repairs or assets that mistakenly remain on the fixed-asset schedule—even after the physical asset is abandoned or removed. This can also be beneficial for personal-property tax reporting.

To learn more about how a fixed-asset study could benefit your business, visit our Fixed-Asset Consulting page.

Partial Disposition Election Studies

With the release of the final tangible property regulations (TPR) in 2014, an opportunity arose in the dispositions of assets, which generally occurs after a company undergoes an improvement project.

Although taxpayers can no longer file a method change to correct previous tax years for identified partial disposition elections (PDE), they can still benefit from the potential tax deductions for current-year improvements or amend prior year returns.

How It Works

PDE studies are used to identify the basis of disposed assets that are lumped into a single asset, such as a building on a taxpayer’s depreciation schedule. Once a taxpayer renovates an existing building—demolishing portions of the building to accommodate new updates—they’re afforded the opportunity to write off the basis in the disposed assets. As long as there’s remaining basis in the building, a PDE study can be used to reduce tax liability and free up cash.

PDE opportunities can also be beneficial if a casualty occurs that results in a taxpayer receiving insurance proceeds. In this circumstance, a taxpayer generally must replace the damaged property within two years of the close of the taxable year in which any gain is realized to defer the gain from taxation. Through a PDE study, the damaged portion of the building can be disposed, creating deductions to reduce the gain realized from the insurance proceeds received.

Key Benefits

A PDE study could be a useful strategy to create significant deductions. Casualty losses—such as fires caused by dust-collection systems, kilns, excessive heat generation, faulty equipment, or electrical faults—may put a company in an unfavorable position.

In these events, a PDE study can be used to assign value to the destroyed portion of the building. It can then be used to create an immediate deduction that could offset insurance proceeds or be taken immediately as a tax deduction if the loss exceeds the amount of received insurance proceeds.

Example

A fire destroys a large portion of Company X’s sawmill building, which still has a net tax basis of $2 million. The insurance company assesses the damage and awards Company X insurance proceeds of $500,000.

Through a PDE study, it’s determined that the basis in the destroyed portion of the building is $400,000. When applying the results of the PDE study, the net gains realized would be $100,000 as opposed to the $500,000 without the PDE study.

Energy Efficient Commercial Building Deduction

The 2019 Omnibus Appropriations Bill HR 1865 law includes a December 31, 2020, tax-deduction extension for energy efficient commercial buildings and improvements. This deduction is known as the Energy Efficient Commercial Building Deduction (Section 179D).

How It Works

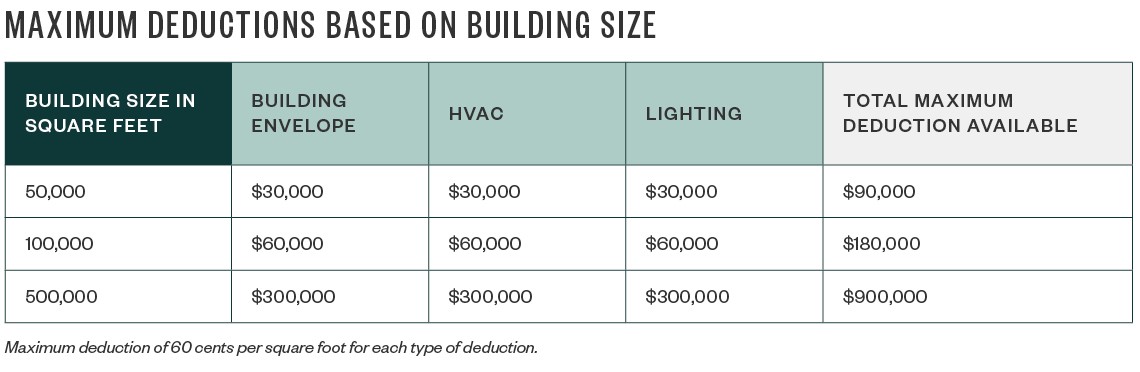

Under this provision, taxpayers are granted a tax deduction of up to $1.80 per square foot for certain energy efficient improvements that reach a specified threshold. Improvements made to interior lighting, heating, ventilation, and air conditioning (HVAC) systems and building envelopes can be evaluated as far back as January 1, 2006. If the thresholds are met, the deduction can be applied against a taxpayer’s current tax liability.

Key Benefits

Newly constructed buildings generally offer the greatest opportunity; however, improvements or retrofits to existing building systems can also offer an opportunity for the deduction.

For example, in the forest-products industry, it’s common to see lighting system upgrades to incorporate a more efficient lighting system. Retrofits such as these provide great opportunities to explore the deduction.

Example

To learn more about the extension and potential impacts, read our article.

Implementation Requirements

Many of these opportunities generally can be implemented on a cumulative catch-up basis. They can be applied on a current-year tax filing through an automatic accounting method change filed on a Form 3115. In some cases, refunds can be claimed on taxes paid in prior years—through NOL carrybacks—which could provide greater immediate cash-flow benefits.

To fully benefit from these opportunities, your company should carefully evaluate its options and review all related tax requirements. Modeling may be required, particularly when evaluating the timing of a study. The CARES Act may also require you to revisit prior elections to receive available cash-flow benefits.

We’re Here to Help

If you have questions about how these opportunities could apply to your business and potentially decrease its tax liability, visit our tangible asset incentive services web page or contact your Moss Adams professional.