With so many critical decisions to make, CFOs need access to accurate information and the agility to efficiently complete tasks. However, according to many CFOs, these necessities can be hard to come by—especially when navigating uncertainties introduced by the COVID-19 pandemic.

In NetSuite’s Brainyard Fall 2020 State of the CFO Role Survey, 120 executives provided insight into a broad variety of issues and their impacts on the finance function.

Below, we address the top five challenges CFOs are currently facing, steps to address them, and key ways an integrated, cloud-based solution like Netsuite can help increase efficiencies and automate workflows.

Key Challenges

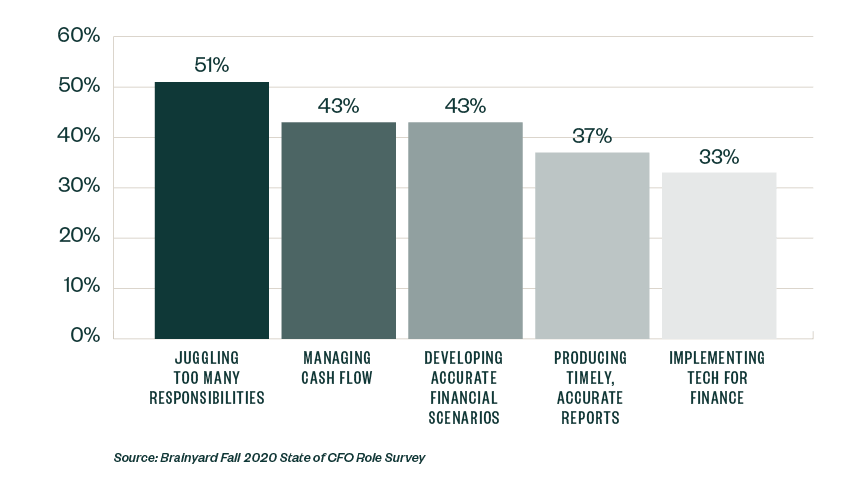

According to the survey, CFOs reported the following five issues as the biggest challenges they face.

Solutions

CFOs can potentially mitigate some of these challenges and reduce unnecessary stressors by working to apply the following tactics.

1. Streamline Responsibilities

Most CFOs are experts at handling tasks beyond the finance function while also managing it. That said, according to survey participants, a few key responsibilities are taking more time and energy than they should.

- Task juggling. Most CFOs manage large workloads and juggle too many responsibilities, leading to long work hours—54% of survey participants said they’re working 50 hours or more per week.

- Spending analysis. CFOs reported their cross-department spending plans are far from solidified. This could explain why CFOs are often preoccupied with financial planning and analysis; it takes up large chunks of their time and ends up being their primary focus—even more so than cash-flow management.

- Strategic planning. Adapting and strategizing with teams across departments, affiliates, and even countries can be challenging, especially if an organization doesn’t have access to information that is accurate, actionable, and readily available.

To combat these issues, CFOs need reliable, precise, and accessible data. This often requires creating a flexible infrastructure that reacts to an ever-changing environment, including new business models, products, and go-to-market strategies.

Implementing an advanced enterprise resource planning (ERP) system like NetSuite can help CFOs become the strategic business leaders every organization needs.

2. Manage Cash Flow

The pandemic forced many business leaders to worry more about cash flow than profit. While most companies are watching cash flow and cutting costs where it makes sense, many are also expanding product offerings and investing in additional marketing and business technology to navigate uncertainty and position themselves for success during the recovery.

If your company isn’t already gaining operational efficiencies and business insights from an ERP system, like NetSuite, now is the time to consider implementing one. Finance teams that use a cloud-based, automated system may have an easier time meeting the demands of their businesses while managing work-from-home requirements. Leaders can also have access to real-time data, which can provide insight into business performance, product demand, and margins as conditions change.

3. Develop Accurate Financial Scenarios

For finance and business users, manual spreadsheets usually fall short when it comes to scenario modeling, planning, budgeting, and forecasting. They also make it hard to perform true multidimensional planning that incorporates product, location, customer, expense, currency, and time. These disconnected, manual processes may support businesses with slow cycle times, but they’re no match for growing businesses or rapidly changing business conditions.

For organizations to make better decisions, they need their planning, budgeting, and forecasting processes to be collaborative and less resource intensive. Integrating plans, budgets, and forecasts across individual functions and business units creates close links between strategy and operations, enabling better and faster decision-making. With a cloud-based ERP like NetSuite, these processes become much faster and easier.

4. Produce Timely, Accurate Reports

Many finance and accounting professionals dread the arduous task of closing the books; inventory levels, project milestones, and fixed-assets statuses are often spread across multiple departments and systems throughout the organization. They may even include paper records.

The effort required to gather and organize this data in preparation for closing the books can be frustrating and time consuming. Whether done monthly or quarterly, the tedious task often prevents the accounting team from providing insight into other areas of the business.

Continuous accounting is a technology-driven approach that:

- Balances accounting workloads

- Provides more timely information

- Replaces month- or quarter-end deadlines with shorter, more frequent close-related tasks

By incorporating closing tasks into your routine, continuous accounting spreads out work over the entire month and can rebalance workloads. This can help the accounting team do the work for which it’s best suited without becoming overwhelmed or bottlenecked.

NetSuite delivers a complete financial management solution for companies ready to move from a standard, event-driven close process to a continuous accounting approach.

5. Implement Tech for Finance

The technology landscape is vast and continues to grow, which makes technology investment decisions difficult—especially as finance leaders look toward the future.

Although finance leaders have historically looked for all-in-one technology solutions that meet most of their needs, today’s specialized tools allow CFOs to pick and choose the best fit for every requirement. That said, strategically selecting the right technology, packages, services, and deployment-tactics tools from the best vendors can be a daunting task, especially given the number of options available.

To address these issues, a CFO and other identified leaders can start by working with a technology advisor. An advisor can perform an assessment of your company’s systems that:

- Provides a comprehensive roadmap of an entity’s current and ideal technology

- Reveals how an entity’s technology may need to evolve to support future business demands

Once an assessment reveals key business needs, the advisor can help narrow the list of potential solutions. Implementing any new system presents the perfect opportunity to review current processes and make improvements wherever possible.

CFOs’ roles and responsibilities have changed considerably over the past decade, evolving from a transactional role to a strategic business partner. In that time, finance leaders have assembled new tech stacks like NetSuite to meet the shifting demands of a complex business while supporting the needs of finance organizations.

We’re Here to Help

To learn more about NetSuite or how it could streamline your operations, visit our NetSuite Solutions page or contact your Moss Adams professional. As a NetSuite solution provider, Moss Adams delivers industry-specific insight and technical resources to streamline your selection and implementation processes, while providing ongoing support.

About NetSuite

From fast-growing startups to global enterprises, NetSuite powers businesses across a variety of industries. NetSuite provides cloud financials, customer relationship management (CRM), e-commerce, human capital management (HCM), and professional services automation management for all organizations from fast-growing midsize companies to large global organizations. Additionally, each component of NetSuite is modular, enabling it to be deployed and integrated with existing investments as required.

With more than 36,000 customers running NetSuite worldwide and dependent territories, some of the world's most innovative organizations trust NetSuite and take their financial and operational processes to the cloud.