A version of this article was previously published in the December 2020 issue of California CPA Magazine.

The COVID-19 pandemic and numerous natural disasters in 2020 have presented significant challenges to Californians’ ability to work and thrive. It’s also created challenges for tax professionals.

The tool kit below is intended to present a summary of relevant updates and changes impacting tax professionals for the 2020 tax season and 2021 tax seasons.

Income Tax Perspective

COVID-19 Relief Provisions

In response to the COVID-19 pandemic, the Franchise Tax Board (FTB) provided a number of relief measures that were available from March 12, 2020, through July 15, 2020, and have since expired. Please visit the FTB website for the latest information. Such measures included:

- Various extensions to file and pay certain returns and liabilities

- Delayed collection actions

- Extended deadlines to protest certain notices

It’s important to note, these changes also extended the statute of limitations for the FTB to make assessments in some cases.

However, it’s also important to recognize the FTB has issued guidance specifically excluding relief payments made by the federal government in connection with the federal Coronavirus Aid, Relief, and Economic Security (CARES) Act from California income tax; this includes:

- Increases in unemployment compensation benefits

- Early withdrawals from retirement accounts

- Stimulus payments received by individuals

In addition to the general CARES Act guidance, the FTB has addressed whether loans obtained under federal Paycheck Protection Program (PPP) guidelines—and forgiven by the government under the terms of the CARES Act—would also be forgiven for California tax purposes.

While the FTB initially indicated California wasn’t conforming to the PPP provision, the Governor of California has since signed Assembly Bill 1577, which specifically provided conformity to the exclusion of such forgiven amounts from gross income. Changes may be forthcoming, but it is uncertain when or if they’ll be announced soon.

Net Operating Loss (NOL) Suspension

One of the most impactful, forward-looking changes enacted in 2020, Assembly Bill (AB) 85 suspends the utilization of NOLs, for both corporate and individual taxpayers with taxable income of more than $1 million, for tax years beginning January 1, 2020, and ending on or before December 31, 2022. AB 85 was signed into law on June 29, 2020, and took immediate effect.

The state’s general 20-year NOL carryforward may be extended by taxpayers impacted by the NOL suspension for up to 3 years if the losses cannot be utilized as a result of the NOL suspension.

Under existing law, California removed the ability to carry losses generated beginning with the 2019 tax year back to the prior two years, which was otherwise permitted for losses generated in tax years 2013 through 2018.

Business Tax Credit Limitation

In addition to the NOL suspension provisions, AB 85 also placed a limit on the use of business tax credits for tax years 2020 through 2022. Specifically, the use of business tax credits will be subject to a $5 million annual limitation for those years.

The limitation is applied on a combined group basis; this means a reporting group is collectively subject to the limitation rather than each of its members.

Income Tax Credit

Small Business Hiring Credit

On September 9, 2020, Senate Bill 1447 was signed into law. It established a $100 million funding pool for a new hiring credit available to California small businesses. In this context, small businesses are defined as those with 100 or fewer employees as of December 31, 2019, that experienced a 50% decrease in Q2 2020 gross receipts as compared to 2019 Q2 gross receipts.

For each new employee hired by qualified small businesses prior to December 1, 2020, the new credit provides a $1,000 incentive that can be utilized against income tax or sales and use tax liabilities. The total credit that can be claimed by each small business is capped at $100,000.

Any taxpayer interested in applying for the credit must submit a credit reservation request to the California Department of Tax and Fee Administration (CDTFA) between December 1, 2020, and January 15, 2021.

The credit has been established on a first come, first served basis. Taxpayers who may qualify should strongly consider reviewing their eligibility for the credit. Verifying the available funding prior to submitting their claim to the CDTFA is advisable as well.

Please note the deadline for this credit was January 15, 2020.

Earned Income Tax Credit

In 2018, the California Earned Income Tax Credit was extended to help low-income taxpayers. In 2019, AB 91 raised the maximum eligible earned income to $30,000. The bill also added a refundable young child tax credit of up to $1,000 per qualified taxpayer, per taxable year.

The FTB’s web page details credit amounts, income limits, qualifications, and additional information.

California Competes Tax Credit

The California Competes Tax Credit (CCTC) program has existed since 2014. CCTC is an economic-development incentive intended to attract or retain businesses considering a significant new investment in California. It does so by providing successful applicants with a nonrefundable tax credit that reduces taxpayers’ personal income tax or corporation tax.

In the CCTC program’s 2020–2021 fiscal year, the California Governor’s Office of Business and Economic Development is authorized to negotiate up to $231.1 million in tax credits over three application periods.

Application Periods

The first application period ended on August 17, 2020.

The next two CCTC application periods for the program’s 2020–2021 fiscal year are as follows:

Disaster Loss Deductions

California taxpayers may deduct any presidentially-declared or governor-declared disaster loss caused by a disaster suffered in California. In this regard, the state generally follows federal law regarding the treatment of losses incurred as a result of a casualty or disaster though relevant non-conforming provisions still apply.

Extended Deadlines

The FTB automatically follows the IRS’s extended deadlines to file or pay taxes until the date indicated for the specific disaster. Taxpayers are advised to write the disaster name in dark ink at the top of their tax return to alert the FTB of the disaster to which the return is related.

The FTB announced the federal postponement period for several non-California-related disasters for the 2019 tax year will be as follows:

Additional Designated Areas

The IRS disaster relief web page lists additional designated areas eligible for a postponement period. If a taxpayer qualifies for the postponement period, any interest, late-filing, or late-payment penalties that would otherwise apply will be cancelled. The FTB also will follow these stipulations.

Other 2019 and 2020 Disasters

Taxpayers may deduct a disaster loss for any loss sustained in a California city or county where the Governor of California declares a state of emergency. The list of California Qualified Disasters is provided below as published on the FTB website on October 5, 2020.

For more information regarding California disaster losses, see the FTB website and Publication 1034, Disaster Loss How to Claim a State Deduction.

Update on Classification Changes

The Dynamex Decision

As noted in the 2019 tool kit, on September 18, 2019, the Governor of California signed AB 5 into law. The bill served to codify the 2018 California Supreme Court decision in Dynamex Operations West, Inc. v. Superior Court of Los Angeles (Dynamex). The Dynamex decision addressed standards for determining whether a worker can be considered an independent contractor or employee using what has been labelled the ABC Test.

The ABC Test

The ABC Test requires a hiring entity to demonstrate all three of the following requirements have been met for a worker to be properly characterized as an independent contractor:

- The worker is free from the control and direction of the hirer with the performance of the work, both under the contract for the performance of the work and in fact.

- The worker performs work that is outside the usual course of the hiring entity’s business.

- The worker is customarily engaged in an independently established trade, occupation, or business of the same nature as that involved in the work performed.

During the 2020 legislative session, the state legislature added some limited exemptions for a variety of creative professionals that may be classified as independent contractors in AB 2257.

Interest Rates

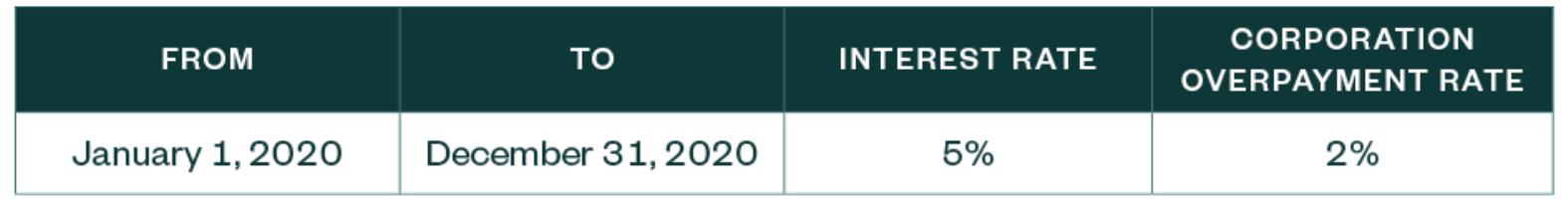

Effective January 1, 2020, the FTB pays 2% interest on corporate overpayments. This rate is effective through December 31, 2020.

The interest rate for personal income tax underpayments and overpayments, corporation underpayments, and estimate penalties are as follows:

For interest rates after December 31, 2020, the FTB will provide more information on their website as it becomes available.

Doing Business and Economic-Nexus Thresholds

For California income tax purposes, doing business is defined as, “actively engaging in any transaction for the purpose of financial or pecuniary gain or profit.” For the taxable year beginning on or after January 1, 2020, a taxpayer is seen as doing business in California for a taxable year if any of the following conditions are satisfied:

- The taxpayer is organized or commercially domiciled in California.

- The taxpayer’s California sales exceed the lesser of $610,395 or 25% of total sales.

- The taxpayer’s real property and tangible personal property in California exceed the lesser of $61,040 or 25% of total real property and tangible personal property.

- The taxpayer’s compensation amount paid in California exceeds the lesser of $61,040 or 25% of total compensation paid.

The doing-business thresholds for taxpayers are indexed for inflation and revised annually.

Sales Tax

Sales and Use Tax and Economic Nexus

California has expanded its sales-tax nexus provisions to eliminate a physical presence requirement and create an economic nexus standard. Effective April 1, 2019, sellers with California gross receipts of $500,000 or more in either the preceding or current calendar years are considered to have nexus for sales and use tax purposes.

Marketplace Facilitators

The marketplace-facilitator provisions apply to marketplaces such as Amazon, Etsy, eBay, and other similar sales platforms. Sales platforms with nexus in California were required to collect and report sales tax on behalf of those vendors who sell through their platform as of October 1, 2019.

For purposes of the $500,000 economic nexus threshold in California, a marketplace facilitator includes all sales of tangible personal property made through its marketplace for delivery into California; this includes the seller’s own product sales and sales of products facilitated through its marketplace.

Manufacturing and Research & Development (R&D)

On July 1, 2014, California implemented a partial state sales tax exemption for qualified taxpayers based on primary lines of business associated with identified North American Industry Classification System (NAICS) codes. To qualify, these taxpayers must purchase qualified tangible personal property to be used in qualified manufacturing and R&D activities.

The tax exemption was originally set at 4.1875%, and reduced to 3.9375% on January 1, 2017—where it will remain through the sunset date currently slated for July 1, 2030.

Small Business Hiring Credit

Businesses that apply and are approved for the Small Business Hiring Tax Credit can make an irrevocable election to apply the credit amount to offset California sales and use tax amounts.

If the sales and use tax offset election was made, the credit is to be claimed on returns filed with the California Department of Tax and Fee Administration (CDTFA). The first return on which the credit can be claimed will depend on your California sales and use tax filing frequency, outlined below:

- Monthly filers—the credit applies to amounts due and payable on returns commencing March 1, 2021.

- Quarterly filers—the credit applies to amounts due and payable on returns commencing January 1, 2021.

- Annual and fiscal year filers—the first return on which the credit may be applied are returns due on or before April 30, 2021.

If the credit amount isn’t used on the first return, it will roll forward and can be applied to future returns. The approved credit amount must be used on returns filed on or before April 30, 2026. Any unapplied credit amounts are considered forfeited and aren’t refundable.

We’re Here to Help

Federal tax changes and related conformity requirements will continue to impact California taxpayers in addition to the changing landscape of business and everyday life. As the state continues to expand, evolve, and response to these challenges, please contact your Moss Adams professional with any questions.