Every privately held business is different and so is every business owner. Regardless, a transition is one milestone every owner will eventually approach. Mapping out your plan in advance can help your business not only survive, but also potentially thrive with an investment return.

Here are some key considerations to help effectively transition your business.

The Importance of Planning

There are two main takeaways as you begin your planning process:

- Start early. Great planning can empower you to build a lasting legacy. It should be comprehensive, considering the needs of the business, owners, and family.

- Be flexible. Things change. With the luxury of time, you can make adjustments to your business and personal finances as you go.

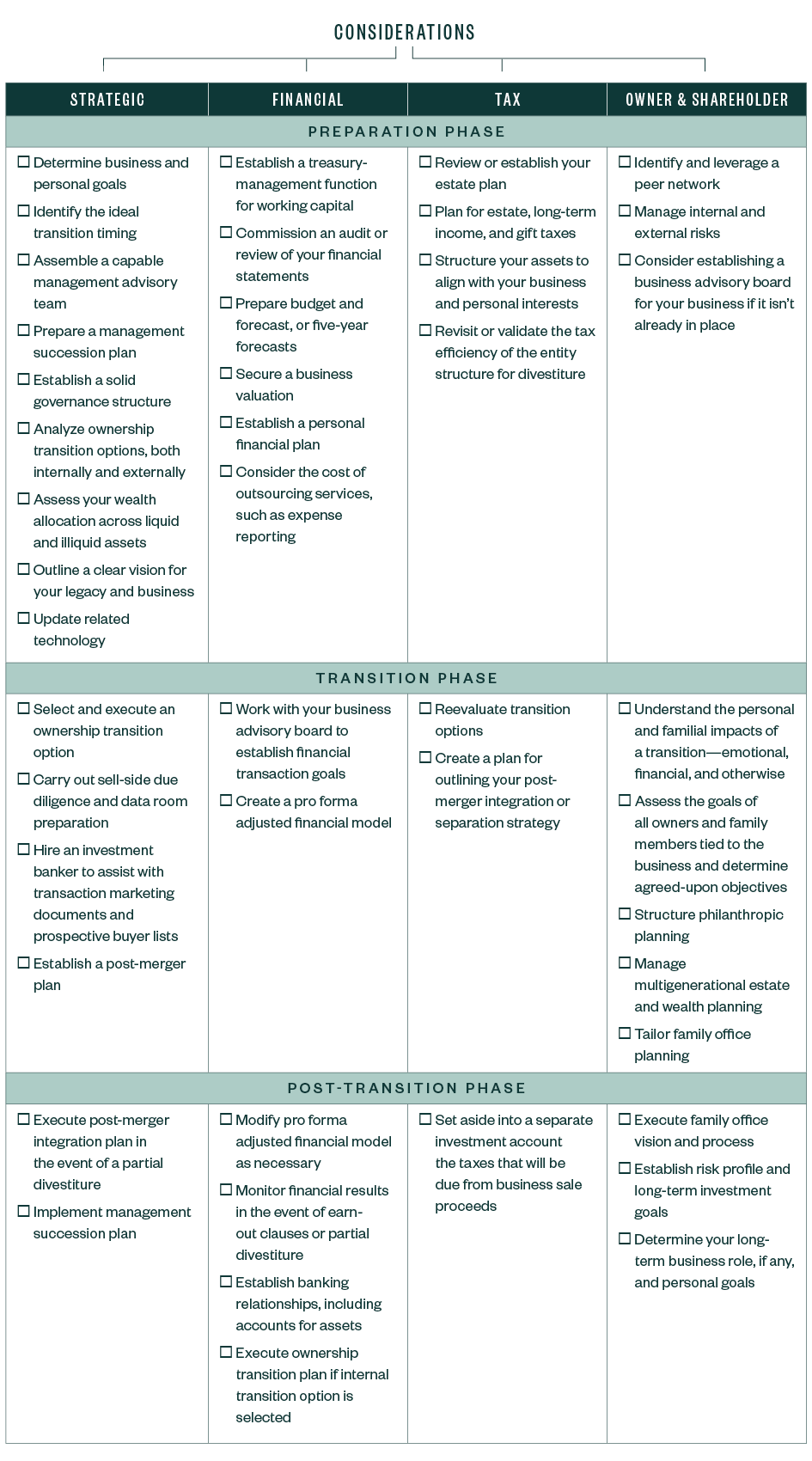

Following are strategic, financial, tax, and owner and stakeholder considerations to assess before, during, and after your transition process.

Planning Process and Strategies

You can also view or download a PDF version of the above checklist.

We’re Here to Help

Although it’s ideal to plan years in advance for transition, life and business environments can be unpredictable. You can’t always see into the future, so your transition plan should be able to evolve and be somewhat flexible.

It’s never too early to plan, whether you want to transition in five or 10 years. There’s a great deal of value, both personal and business related, that can be derived from the groundwork to help secure a clearer future.

For additional insight and next steps on the planning process and strategies for your particular situation, read our article or contact your Moss Adams professional.