Private foundations provide a strategic charitable planning option for individuals who want to manage and increase funds while they make a positive impact on their communities. That said, starting a foundation can be overwhelming, and choosing the right foundation structure for your long- and short-term goals is a key part of its overall benefit.

In our article, gain insight into foundation types, income classifications, tax requirements, donor deductions, and other key factors to help you establish a private foundation that aligns with your personal and financial goals.

The following questions are addressed:

- What Is a Private Foundation?

- How Do You Start a Private Foundation?

- What Are the Types of Private Foundations?

- How Much Does a Private Nonoperating Foundation Have to Distribute Each Year?

- What Is the Minimum Investment Return (MIR)?

- What Are Qualifying Distributions?

- How Is Income Classified for Private Foundations?

- What Is the Excise Tax on Private Foundations?

- Are Private Foundations Subject to Unrelated Business Income Taxes (UBIT)?

- When Can Donors Take a Charitable Tax Deduction?

What Is a Private Foundation?

A private foundation is a charitable corporation or trust that generally receives financial support from a limited number of sources.

Organizations that qualify for tax exemption under Section 501(c)(3) of the Internal Revenue Code are, by default, a private foundation unless they qualify as a public charity.

How Do You Start a Private Foundation?

To start a private foundation, the entity first needs to be formed.

Establish a Corporation or Trust

For a private foundation organized as a corporation, articles of incorporation should be created and filed with the state. Bylaws should also be created and approved by the board of directors.

For a foundation structured as a trust, a trust agreement should be drafted.

For either type of entity a conflict of interest policy should also be created.

It’s a best practice to engage an experienced attorney to draft all of these documents.

Apply for Tax-Exempt Status

Once the organization is legally formed, the foundation will need to apply for tax exemption with the IRS by filing Form 1023 or Form 1023-EZ for small foundations. A user fee is due with the application, which is $600 for Form 1023 or $275 for Form 1023-EZ, as of Spring 2021. Depending on the state the private foundation is organized or operates in, there could be a separate state exemption application or other registrations that needs to be filed.

Before applying for exemption, the following things should be determined:

- Type of foundation

- Exempt purposes and planned activities

- Board of directors or trustees

- Compensation potentially paid to any board members or foundation managers

- Four-year financial budget

- Potential grants will be given to individuals for study, travel, or other similar purposes

What Are the Types of Private Foundations?

The types of private foundations are private nonoperating foundations, private operating foundations, and exempt operating foundations.

The key difference between the types are the activities the foundation conducts and the applicable requirements.

Private Nonoperating Foundation

Most private foundations are private nonoperating foundations focused on grantmaking. They’re allowed to conduct charitable programs or activities themselves, but these aren’t often significant activities. Private nonoperating foundations are required to distribute a certain amount of money each year.

Private Operating Foundation

If a private foundation’s main activity is running one or more charitable programs, it can be classified as a private operating foundation.

A private operating foundation conducts charitable activities as opposed to solely making charitable grants. Because of this emphasis on charitable activities, a private operating foundation receives many of the same tax benefits as a public charity without needing to adhere to the public support test requirements.

A private operating foundation must pass both an income test and one alternate test—assets, endowment, or support test. It must pass these tests in any three years of a four-year period or in aggregate over that same four-year period. The four-year period ends with the current tax year. During the first three years of a private operating foundation’s existence, it must pass the tests on an aggregate basis.

Exempt Operating Foundation

An exempt operating foundation is a private operating foundation that is exemption from some private foundation requirements.

To qualify as an exempt operating foundation, an organization must:

- Qualify as a private operating foundation

- Have been publicly supported for at least 10 years

- Contain no officers who are disqualified individuals

- Its governing body must broadly represent the general public, and at least 75% must not be disqualified individuals

A disqualified individual for this purpose is a substantial contributor, their family members, and certain entities they own.

IRS Approval and Exemption

Most private foundations apply for their status and receive an IRS exemption letter stating they’ve been classified as such. However, a private foundation may switch between being a nonoperating foundation and operating foundation each year without IRS approval.

To learn more about how to qualify and retain your status as a private operating foundation, please read our article.

How Much Does a Private Nonoperating Foundation Have to Distribute Each Year?

Private nonoperating foundations are required to distribute approximately 5% of the average market value of their noncharitable use assets each year.

If the foundation distributes more than the distributable amount, often referred to as the required minimum distribution, the foundation can carry over the excess distribution amount for five years and use it towards future distribution requirements.

Conversely, if a foundation distributes less than the required minimum distribution in a year, this undistributed income amount must be distributed within 12 months after that year. If not distributed within that time frame, the undistributed amount could be subject to an excise tax.

What Is the Minimum Investment Return (MIR)?

Minimum investment return (MIR) is the required amount that must be distributed before certain adjustments, such as net investment income excise tax and unrelated business income tax, to reach the distributable amount.

The MIR is 5% of the sum of the average cash balance, the average fair market value of securities, and the fair market value of other investment assets—less acquisition indebtedness related to these investment assets.

What Are Qualifying Distributions?

Qualifying distributions by private foundations, in general, are any amounts paid to accomplish religious, charitable, scientific, literary, or other public purposes. A portion of administrative expenses can be also allocated and treated as qualifying distributions.

Qualifying distributions also include amounts paid for assets acquired to be used directly in carrying out a foundation’s exempt purpose and program-related investments.

Qualifying distributions may also include grants which may be given to individuals for travel, study, or other similar purposes, but require preapproval from the IRS. Approval can be requested with the application for tax exemption or separately if established after tax exemption is granted.

Grants could also be made to another private nonoperating foundation or for-profit organization, but the foundation must exercise expenditure responsibility. Failure to obtain preapproval or exercise expenditure responsibility may result in the grant being treated as a taxable expenditure and subject to excise tax. Grants to most public charities don’t require any additional steps.

How Is Income Classified for Private Foundations?

Net Investment Income

Net investment income includes income earned on investments, such as interest, dividends, and capital gains including gains on the sale of securities. Losses on the sale of securities may offset capital gains, but they can’t create a net loss. Rental income from investment properties is also treated as net investment income.

Gross investment income is reduced by expenses related to the income, such as investment advisor fees and foreign taxes and an allocation of administrative expenses. A net loss from investment activities can’t be carried forward to offset net investment income in future tax years.

Adjusted Net Income

Adjusted net income is generated from charitable activities. Related and allocable deductions are limited to the income generated, and any excess is treated as qualifying distributions.

Investment income and expenses are also included in adjusted net income.

Adjusted net income is generally reported by private operating foundations and factors into their income tests.

Disbursements for Charitable Purposes

All private foundations separately report the portion of their expenses that are for charitable purposes. This portion includes:

- Excess of exempt function expenses over revenue

- Expenses related to nonincome producing exempt function activities

- Allocation of administrative and overhead expenses

These expenses factor into the qualifying distributions that go towards meeting the distributable amount.

What Is the Excise Tax on Private Foundations?

Most private foundations are subject to an excise tax on investment income, less related and allocable expenses.

Effective for tax years beginning after December 20, 2019, the net investment income excise tax rate is 1.39%. An exempt operating foundation isn’t subject to this tax.

Penalties for Noncompliance

In addition to the excise tax on net investment income, other excise taxes are imposed if it doesn’t comply with IRS restrictions and requirements.

Sometimes the excise tax—for example, the excise tax on self-dealing transactions—is only imposed on foundation managers and not on the private foundation. For other excise taxes, the foundation managers aren’t subject unless they knowingly ignored the restriction or requirement.

These foundation restrictions include:

- Restrictions on self-dealing between private foundations and their substantial contributors, board members, and other disqualified persons

- Requirements the foundation annually distribute income for charitable purposes to meet the distributable amount

- Limits on their holdings in private businesses, known as excess business holdings

- Provisions that the foundation may not make jeopardizing investments

- Provisions to assure expenditures further exempt purposes or are otherwise treated as taxable expenditures

These additional excise tax rates vary in amount and require additional tax forms to be filed with the IRS to disclose noncompliance, describe corrective actions taken, and calculate tax owed.

Are Private Foundations Subject to Unrelated Business Income Taxes (UBIT)?

Like public charities, private foundations are subject to UBIT rules. Congress created the rules to help confirm tax-exempt organizations aren’t given an unfair advantage over their corporate and trust counterparts.

Tax-exempt organizations are required to pay taxes when engaged in commercial activities outside the scope of their exempt purposes.

UBIT is reported separately on Form 990-T.

When Can Donors Take a Charitable Tax Deduction?

Individual donors may take a charitable tax deduction for donations made to a private foundation, similar to contributions to public charities.

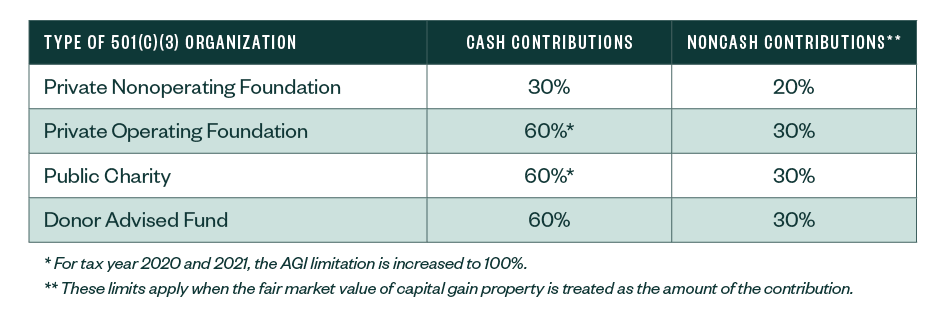

The amount is subject to certain adjusted gross income (AGI) limitations and varies depending on the type of Section 501(c)(3) organization.

AGI Limitations for Charitable Contributions to Private Foundations

Below is a chart with the AGI percent limitation by organization for cash and noncash contributions.

We’re Here to Help

To learn more about how to start and run a private operating foundation, contact your Moss Adams professional.