This article was updated March 3, 2022.

Companies have a responsibility to serve employees by protecting their retirement benefits. This responsibility is the main role of a retirement plan fiduciary.

Fiduciaries are obliged to act according to prudent financial standards, and there are penalties associated with negligence.

This is especially true in today’s environment, in which fiduciaries are closely scrutinized by state and federal government agencies, including the IRS and Department of Labor (DOL).

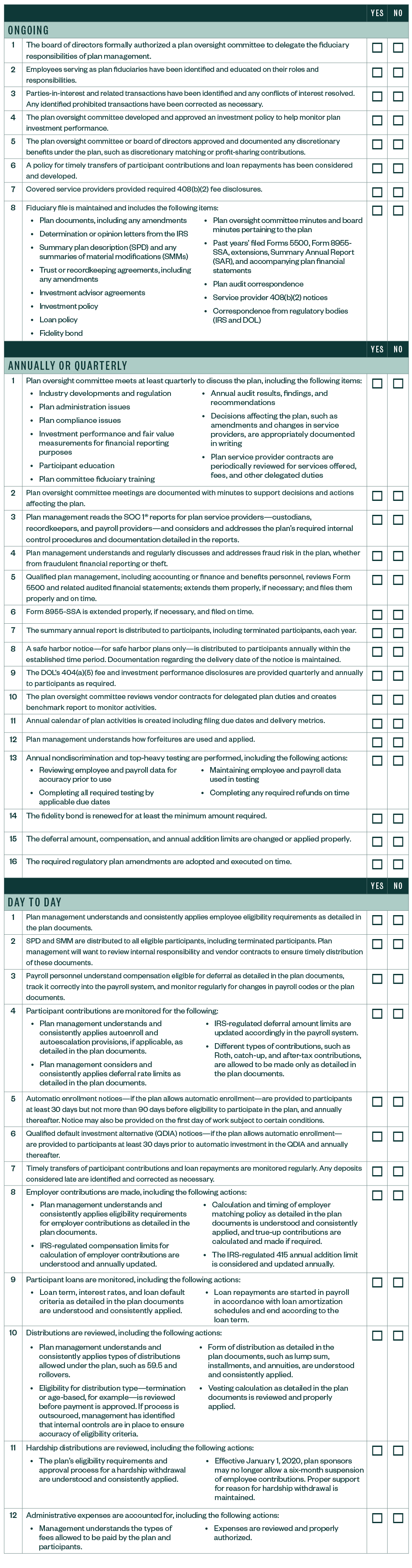

Fiduciary Responsibility Checklist

This comprehensive checklist can help you operate your plan in accordance with the terms of your plan documents, reduce operational defects, and fulfill many of your fiduciary responsibilities to your employees.

Please note, your specific fiduciary responsibility company checklist may be more detailed as your employee benefit plan design evolves and responsibilities within the organization change.

You can also view a PDF version of the checklist.

We’re Here to Help

For additional questions, contact your Moss Adams professional or visit our Employee Benefit Plans Services.