Section 498 (c)(1) of the Higher Education Act (HEA) authorizes the US Department of Education (ED) to establish ratios and other criteria for determining whether an institution has sufficient financial responsibility.

Below, explore how your institution can assess its financial responsibility scores and benefits of a good ranking.

What Are Financial Responsibility Composite Scores?

Current regulation establishes a methodology to measure different aspects of financial health based on three ratios:

- Primary reserve

- Equity

- Net income

These combine into a composite score to measure financial responsibility.

What Is the Calculation for the Financial Responsibility Composite Score?

Combining an institution’s ratio results into a composite score requires several mathematical steps:

- Determine the value of each ratio

- Calculate a strength factor score for each ratio using HEA criteria

- Calculate a weighted score for each ratio by multiplying the strength factor score by its corresponding weighted percentage

Add the weighted scores for the composite score

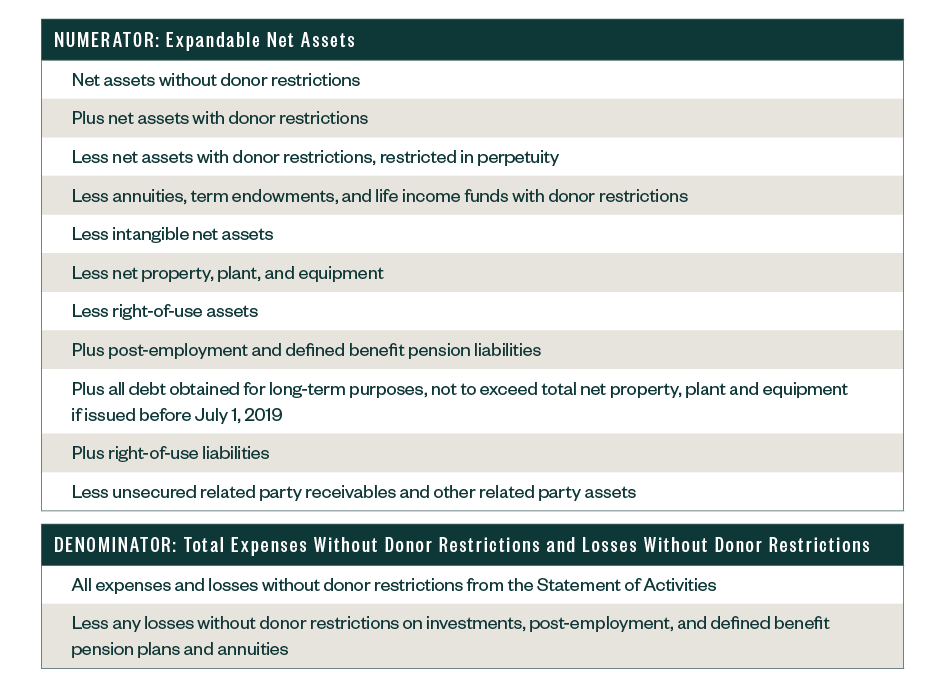

Calculate the Primary Reserve Ratio

Calculate the Equity Ratio

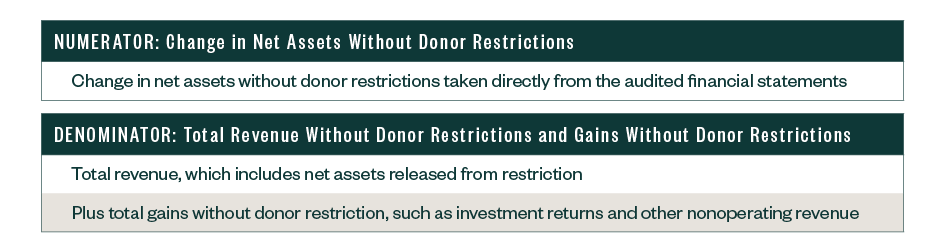

Calculate the Net Income Ratio

Total gains include net investment gains. To identify reported net amounts, you will need to individually evaluate gains/losses other than from investments presented in the nonoperating section.

When you report such items on a net basis, break out the gross amount of gains to include with the total gains as in the denominator mentioned above.

Accumulating the above information can be challenging as it may not be clearly presented in the institution’s financial statements or notes to the financial statements. In some cases, institutions may need to revise financial statement or footnote presentation to present the required information.

What Is a Good Score?

ED calculates a numeric score for each institution.

Composite scores are only one of several factors that ED uses to assess an institution’s financial responsibility compliance.

The composite financial score isn’t a reflection of the quality of education at a given institution.

What Benefits Can a Financially Responsible Institution Receive?

ED subjects institutions considered financially responsible to less oversight and they won’t need to comply with enhanced cash disbursement requirements and other consequences.

What Monitoring Occurs When an Institution Isn’t Financially Responsible?

Institutions with a score below 1.0 can still participate in Federal Title IV financial aid programs under a provisional certification for up to three years.

Institutions will need to provide surety to the ED of at least 10% of the previous year’s funding. This percentage isn’t a fixed determinant; it will differ from institution to institution and the ED decides the outcome on a case-by-case basis.

What Actions Could an Institution Take to Improve Its Score?

The three ratios stem from year-end amounts, so improving the statement of financial position at year-end is key to a successful composite score. An institution could consider reducing reliance on related party receivables.

Although scores are calculated at year-end, a best practice could be for schools to calculate more often to plan for any necessary year-end action steps.

How Do You Report This Information?

For ED to calculate the ratios, you need to present a supplementary schedule to the financial statements or a footnote to the financial statements that contains all critical information. The audit opinion should address the supplementary information.

Ultimately, the financial statements with this information must accompany the institution’s eZ-Audit filing, which is due within nine months of the institution’s fiscal year-end.

We’re Here to Help

If you have any questions regarding the financial responsibility composite scores, please contact your Moss Adams professional. You can also learn more about our Not-for-Profit Practice and additional topics affecting the industry.