The Centers for Medicare and Medicaid Services (CMS) published the final rule for the fiscal year (FY) 2023 Inpatient Psychiatric Facilities Prospective Payment System (IPF PPS) in the Federal Register on July 29, 2022. This rule impacts freestanding psychiatric hospitals and excluded psychiatric units.

The final rule updates rates and establishes a permanent cap to smooth the impact of year-to-year changes in IPF payments related to decreases in the IPF wage index.

These rate and regulation changes are effective for discharges occurring on or after October 1, 2022. An overview of the final rule follows.

Final Changes to IPF Payments

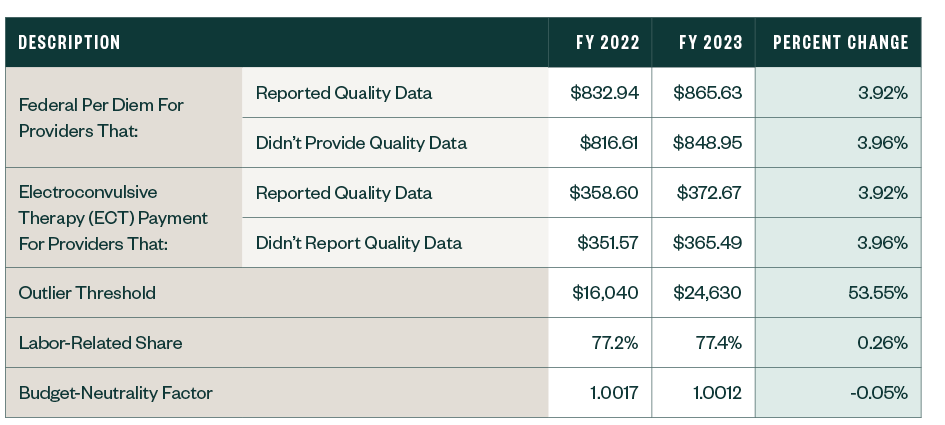

CMS finalized the following updates to the prospective payment rates, outlier threshold, and wage index for the IPF PPS.

IPF PPS Rates

Other Notable Updates

Wage Index Cap

CMS finalized the rule to make permanent its FY 2021 temporary policy of limiting year-over-year wage index decreases to 5%. As such, the FY 2023 wage index won’t be less than 95% of its final wage index for FY 2022. For subsequent years, a provider’s wage index won’t be less than 95% of its prior year wage index.

Inpatient Psychiatric Facilities Quality Reporting (IPFQR)

In the proposed rule, CMS did not make any changes to the IPFQR program but solicited comments on items to consider as it works to advance the use of various tools and measures to address health care disparities and advance equity.

Specifically, CMS sought feedback in five specific areas:

- Identification of goals and approaches for measuring health care disparities and using measure stratification across CMS quality programs

- Guiding principles for selecting and prioritizing measures for disparity reporting across CMS quality programs

- Principles for social risk factor and demographic data selection and use

- Identification of meaningful performance differences

- Guiding principles for reporting disparity results

In the final rule, CMS shared submitted comments without enacting changes and stated that the comments received would be considered if future policies are developed.

Economic Impact

The overall economic impact of the finalized FY 2023 changes results in an estimated increase in payments of $90 million from FY 2022.

Next Steps

Providers need to review whether the appropriate IPF rates have been loaded into their patient accounting system used to bill Medicare on or after October 1, 2021.

Once these revised rates are incorporated, it’s important to validate that the rates are calculating appropriately.

This can be accomplished by pulling a paid claim and running it through the IPF pricer tool that can be found on the CMS website.

We’re Here to Help

For more information about the final rule and potential implications for your organization, contact your Moss Adams professional.

You can also find more insights on our Provider Reimbursement Enterprise Services page.