Starting in 2022, some beneficial tax laws for businesses are expiring or phasing out. Three tax laws that are changing could increase businesses’ tax burden. We’ll also address how to implement other strategies to increase business cash flow.

Three tax law changes that could impact business cash flow:

- Internal Revenue Code (IRC) Section 163(j) limitation of business interest expense deduction. Taxpayers are no longer able to increase adjusted taxable income by depreciation expense or amortization expense to calculate interest expense under IRC Section 163(j).

- Bonus depreciation phase out. 100% bonus depreciation will start to decrease beginning in 2023.

- Capitalizing R&D costs. R&D expenses are now required to be capitalized and amortized over 5 years for expenses incurred in the United States and over 15 years for expenses incurred outside the United States.

Learn more about the following:

- IRC Section 163(j) limitation of business interest expense deduction

- Bonus depreciation phase out

- Capitalizing R&D costs

- Cash flow management strategies to help alleviate tax burdens

- ERC credit

- Accrual to cash

- Treating inventory as nonincidental materials and supplies

- Deduction of subnormal goods

- Assess opportunity to reduce capitalization costs

- State pass-through entity tax elections

- State and local tax planning

IRC Section 163(j) Limitation of Business Interest Expense Deduction

Many are aware of the interest expense deduction for certain taxpayers whose average annual gross receipts are over $27 million for tax years beginning in 2022.

Gross receipts may be subject to aggregation rules for certain related businesses. A taxpayer’s deduction of business interest is limited to 30% of adjusted taxable income (ATI). This limit was increased to 50% of ATI by the Coronavirus Aid, Relief, and Economic Security (CARES) Act for 2019 and 2020.

Beginning in 2022, ATI is a taxpayer’s taxable income calculated without regard to:

- Non-business income

- Gains

- Deductions

- Losses

- Business interest expense

- Business interest income

- Net operating loss deductions

- Qualified business income deductions

Prior to 2022, a taxpayer could also add back depreciation and amortization expenses to calculate ATI which mimics earnings before interest, depreciation, and amortization (EBITDA), plus business interest income.

Starting in 2022, a taxpayer cannot add back depreciation and amortization expenses to determine ATI, resulting in a lower ATI.

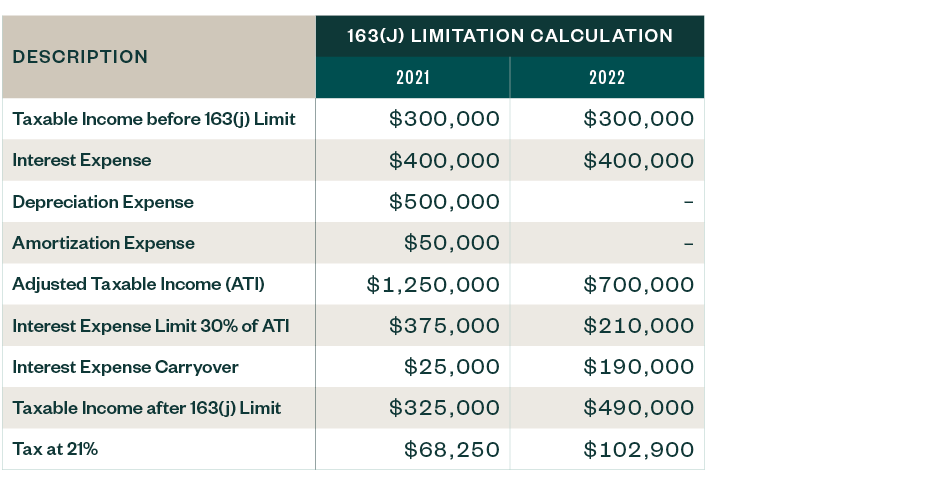

Let’s analyze the change in taxable income in the example below, assuming the taxpayer is a C corp.

Example: Change in Taxable Income

The net increase in corporate tax with adding back depreciation and amortization for ATI in 2022 is $34,650.

Many manufacturers leverage debt to purchase equipment which could create unexpected business cash flow issues. Companies should review debt agreements for potential cash flow saving opportunities. In some instances, buying equipment with cash may be cheaper than buying it with financed debt.

Bonus Depreciation Phase Out

A key benefit of bonus depreciation is that there’s no annual limit. Therefore, asset intensive businesses like manufacturers benefit from bonus depreciation.

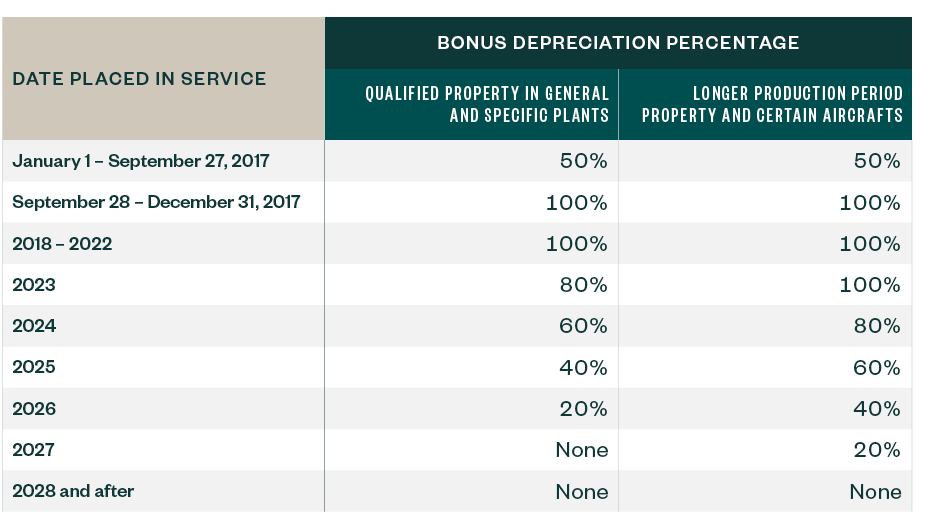

Taxpayers can claim 100% bonus depreciation for qualified property placed in service through 2022, but the amount will drop each subsequent year by 20%, until bonus depreciation sunsets in 2027.

Qualified property can be new or used and must be acquired by the taxpayer. A taxpayer can elect out of bonus depreciation. Some examples of qualified property are:

- Furniture, equipment, and machinery

- Interior improvements to nonresidential property, excluding elevators, escalators, interior structural framework, and building expansion

Bonus Depreciation Rates

The table below shows the bonus depreciation rates. The bonus depreciation rate remained at 50% for assets acquired before September 28, 2017, and placed in service before January 1, 2018.

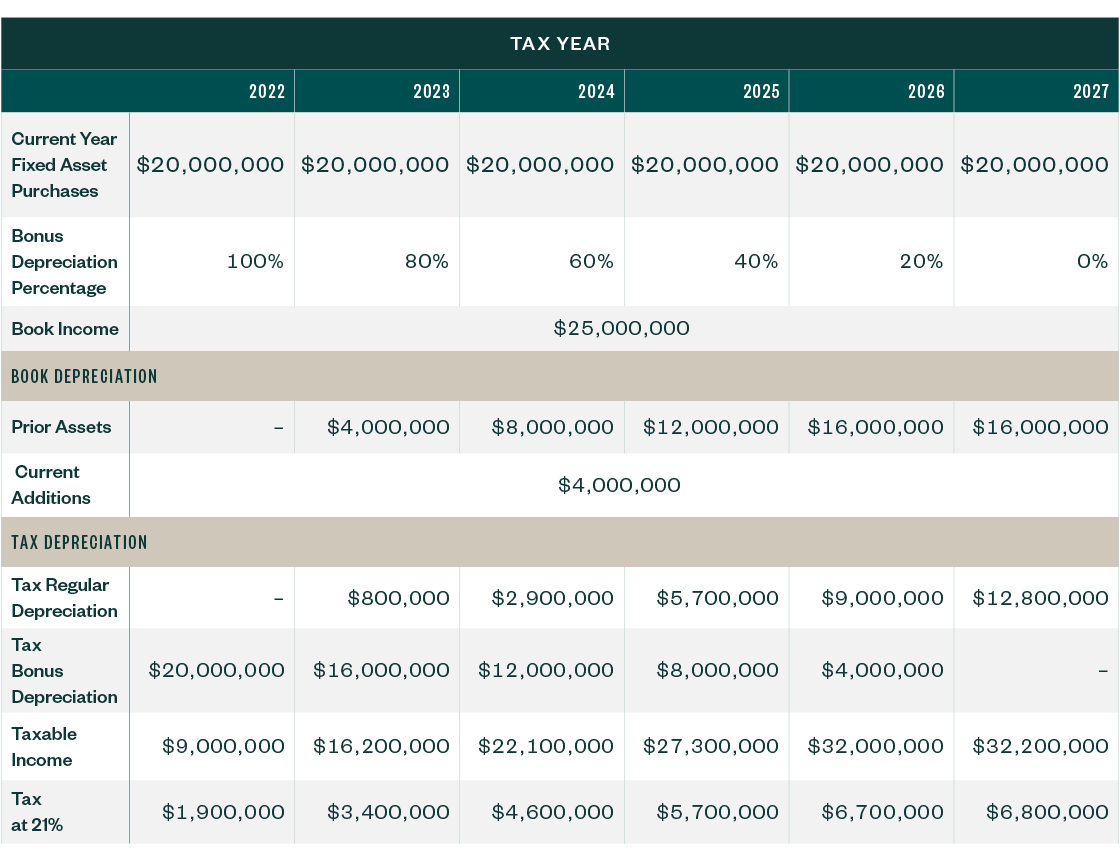

Potential Tax Liabilities with Bonus Depreciation Phase Out

Let’s explore the potential tax liabilities with the bonus depreciation phase out, assuming the taxpayer is a C corp. The taxpayer purchases about $20 million of equipment per year with a useful life of five years from 2022 to 2027 and has book income of $25 million per year.

An alternative to bonus depreciation is IRC Section 179 expense. The annual IRC Section 179 limit is $1.08 million for tax years starting in 2022. On top of the dollar limit, there’s a dollar-for-dollar reduction for property placed in service over $2.7 million for 2022.

For example, if a taxpayer purchases assets worth $3 million, which are eligible for IRC Section 179, then the taxpayer may deduct only $780,000 under IRC Section 179 in 2022. IRC Section 179 is also limited by the amount of a business’s taxable income, and the deduction is limited for some assets such as luxury automobiles.

IRC Section 179 is limited to $0 for this taxpayer, due to the fixed asset purchases being over the $2.7 million dollar limit. As taxpayers take advantage of bonus depreciation, they may see large book depreciation addbacks due to decreases in tax depreciation in existing assets.

Capitalizing R&D Costs

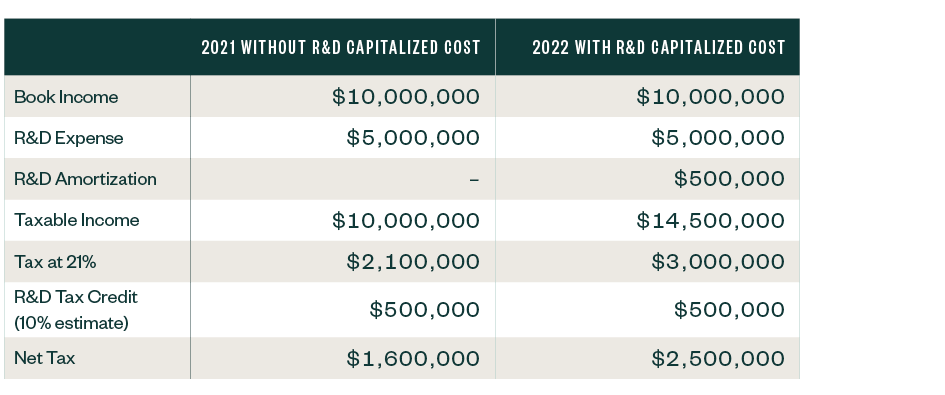

Under current tax law companies are required to capitalize R&D costs, including software development costs, incurred in tax years after December 31, 2021.

Starting in 2022, a company is required to capitalize and amortize over five years for domestic R&D or 15 years for foreign R&D costs.

There’s legislation with bipartisan support in Congress that could repeal the current law. However, the prospects of this legislation are uncertain.

Example: Tax Impact of Capitalizing R&D Expenses

Cash Flow Management Strategies to Help Alleviate Tax Burdens

The following are a few strategies that could help alleviate your company’s tax burden:

- Use of the employee retention credit (ERC)

- Accrual to cash accounting method change

- Treating inventory as nonincidental materials and supplies

- Deduction of subnormal goods

- Reduction of capitalization costs

- Making state pass-through entity tax elections

- State and local tax planning

ERC Credit

Introduced in the CARES Act, then expanded in the Consolidated Appropriations Act, 2021, and the American Rescue Plan Act, the employee retention credit, commonly referred to as the ERC credit, is a refundable tax credit used to offset the employer’s payroll taxes on IRS Form 941.

Who Qualifies for the ERC Credit?

Employers whose business experienced a full or partial suspension due to emergency orders from a government authority that limited commerce, travel, or group meetings may qualify.

A business may also qualify if it experienced a reduction in gross receipts for the current calendar quarter compared to the same calendar quarter in 2019—a 50% reduction between March 13, 2020, and December 31, 2020, and a 20% reduction between January 1, 2021, and September 30, 2021.

In addition, qualified employers may claim the ERC credit if they’ve received a Paycheck Protection Program (PPP) loan and experienced a qualified full or partial suspension of operations or a qualified reduction in gross receipts. However, qualified wages for the ERC credit don’t include wages paid from forgiven PPP proceeds.

What Is a Qualified Small Employer?

To claim the credit in 2020, qualified small employers are measured as having 100 or fewer full-time employees (FTEs) in 2019. For 2021, they’re measured as having 500 or fewer FTEs in 2019.

A qualified small employer for 2020 and 2021 may be able to claim credits on all their employee wages, whereas larger employers are only able to claim a credit for employees who are being paid and not performing services.

What Is the Available ERC Credit?

Depending on the qualification period, the ERC credit could equal:

- 50% of qualified wages per employee, per quarter, up to a total of $10,000 in wages per employee for all quarters in 2020

- 70% of qualified wages per employee, per quarter, up to a total of $10,000 in wages for each qualifying quarter in 2021

This means an employer eligible for the ERC credit in three quarters in 2021 could receive up to $21,000 in credits per employee in 2021.

Employers who didn’t claim the ERC credit on their originally filed IRS Form 941 may retroactively claim the credits using the IRS Form 941-X.

See our prior alert on how employers may qualify and be eligible for the ERC credit during qualified quarters between March 13, 2020, and September 30, 2021.

Accrual to Cash

Accrual to cash is an accounting method change that may be an effective way to defer taxable income—especially in industries where standard receivable terms are 90 days or more, including government contracts.

This method change recognizes revenue when actually or constructively received and deductions when expenses are paid. For 2022, many manufacturing companies with average gross receipts for the three prior years of $27 million or less may qualify to use the cash method of accounting.

Treating Inventory as Nonincidental Materials and Supplies

For 2022, companies with average gross receipts of $27 million or less for the prior three years may be able to treat the cost of inventory as nonincidental materials and supplies. The cost can be recovered by expensing it through cost of goods sold in the year either when the inventory is provided to the customer or the year when the company pays for the cost of the item, whichever is later.

Conversion costs, such as direct labor and overhead costs, aren’t considered nonincidental materials and supplies.

Deduction of Subnormal Goods

A company could be afforded a tax deduction for the write-down of subnormal goods if careful steps are followed. While many companies record an inventory obsolescence reserve on their financial statements, these reserves aren’t typically deductible for tax until realized.

If certain steps are taken, a deduction for subnormal goods may be permitted for income tax purposes. The lower inventory valuation must be substantiated by providing evidence of the following:

- Actual offerings

- Actual sales

- Actual contract cancellations

Assess Opportunity to Reduce Capitalization Costs

The IRS issued final regulations in late 2018 for companies that maintain inventory. The tax uniform inventory capitalization (UNICAP) rules changed how companies use either the simplified production method (SPM) or simplified resale method (SRM). They also added a new method, the modified simplified production method (MSPM), that should be considered for larger producers.

Most importantly, the regulations don’t change the types of costs subject to capitalization or the amounts of these costs. Rather, they affect whether these types and amounts are considered additional IRC Section 263A costs or IRC Section 471 costs, which impacts the computation of the absorption ratio.

These rules are required. If they haven’t already done so, companies should consider conforming to the new rules, and whether there’s an opportunity to reduce capitalization costs.

State Pass-Through Entity Tax Elections

As a part of the 2017 tax legislation, Congress capped the deduction for state and local taxes by individual taxpayers to $10,000 per year for tax years 2018–2025. Businesses were not limited to the $10,000 limit. The pass-through entity tax regimes permitted by several states allow pass-through entities to become the entity-level taxpayer.

As of August 2022, 29 states have enacted pass-through entity tax regimes, providing an opportunity for owners of pass-through entities to claim a full deduction for state taxes paid on the pass-through entity’s income.

State and Local Tax Planning

State and local taxes are constantly changing, and there is a potential for benefit in looking into them.

Sales and Use Tax Refund Review

With more than 9,000 state, local, and district-level jurisdictions imposing sales and use taxes, combined with varying tax laws among the states, companies often overlook opportunities for savings that can affect their bottom line. A sales and use tax refund review can help your business identify these missed opportunities by securing sales tax refunds and avoiding overpayments in the future.

The objective is to secure overpaid sales and use tax refunds by reviewing a company’s purchase-related information—such as fixed assets and accounts payable data along with related invoices—for the last three-to-four years.

The following manufacturing exemptions are typical opportunities for savings, available in some, but not all, states:

- Manufacturing equipment directly used in the manufacturing or processing

- Repair and replacement parts

- R&D equipment and parts

- Items purchased for resale

- Wrapping and packaging materials purchased for resale

- Federal and state government purchase-related exemptions

- Nontaxable services

- Other industry and state specific exemptions

Texas

The Texas enterprise zone provides cash grants to companies that open or expand a facility within Texas when there’s at least one out-of-state option.

Cash grant amounts are discretionary and issued based on projected job creation and capital investment.

We’re Here to Help

For guidance on navigating changes in tax regulation or implementing cash flow strategies, contact your Moss Adams professional.

For additional resources, visit our Manufacturing & Consumer Products Practice page.