The new lease accounting standard issued by the Financial Accounting Standards Board (FASB), formally known as Accounting Standard Codification (ASC) Topic 842, Leases, intends to provide users of financial statements greater visibility and transparency into the financial impacts of lease obligations and leased assets. While this standard is applicable regardless of industry, the life sciences industry may be impacted in potentially unexpected ways.

Many life sciences companies, whether preclinical, clinical, or commercial stage, or in the diagnostic, therapeutic, or medical device space, often use outsourced service providers to accomplish certain processes. These types of relationships can increase the risk for embedded lease arrangements.

For example, many life-science companies will need to consider whether there are embedded leases within outsourced service provider contracts such as outsourced manufacturing, R&D, or warehousing.

But first, let’s cover some basics.

Updates to Lessee Accounting for Leases

Under ASC 842, lessees are now required to recognize all leases of property, plant, and equipment on their balance sheet. However, many will likely adopt an optional practical expedient whereby leases with terms of 12 months or less aren’t recognized as assets and liabilities on the lessee’s balance sheet but rather accounted for as executory contracts—similar to how operating leases were accounted for prior to the FASB’s new lease accounting guidance.

The requirement to recognize all leases on the balance sheet may affect how an entity is evaluated by the users of its US generally accepted accounting principles (GAAP) financial statements such as banks, investors, board members, and other stakeholders across myriad industries, including life sciences. For example, entities may find themselves with lower liquidity ratios or higher working capital turnover due to the recognition of the right-of-use assets and lease liabilities on their balance sheets. This could impact their ability to seek additional credit or investment or affect compliance with financial covenants.

Effective Dates

ASC 842 is effective for private companies for fiscal years beginning after December 15, 2021, and interim periods within fiscal years beginning after December 15, 2022. Although the effective date is rapidly approaching, some life sciences companies have yet to start preparing to adopt this new accounting standard.

Three-Phased Approach to Implementation

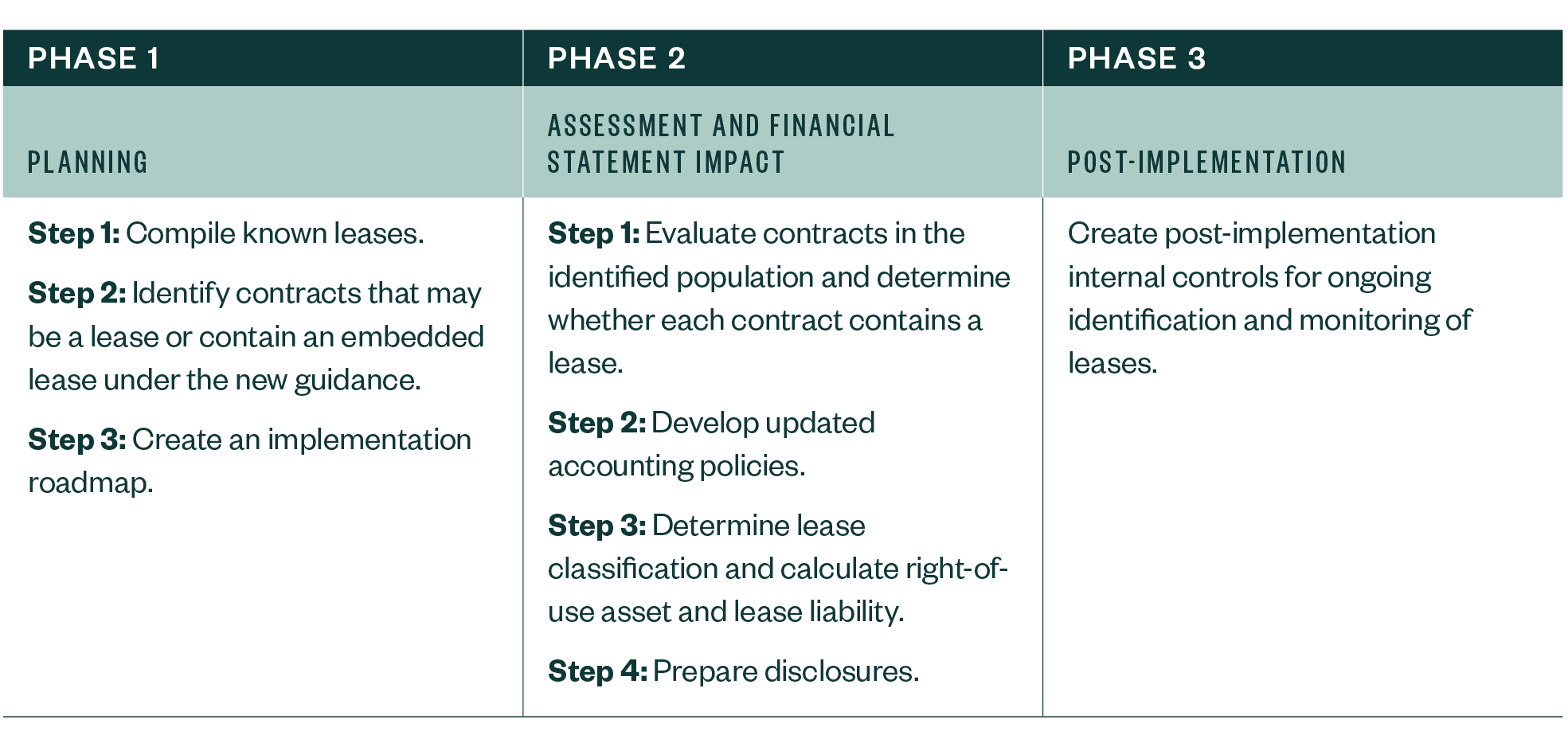

As your business organizes its adoption approach explore a step-by-step process broken into three phases.

Phase 1

ASC 842 fundamentally changes the accounting for lease transactions across all industries and has significant business implications for companies in the life sciences space. In addition to requiring all leases to be recognized on the balance sheet, the new guidance changes the definition of a lease to include all contracts, or part of a contract, that convey the right to control the use of identified property, plant, or equipment for a period in exchange for consideration.

Many life sciences companies enter lease contracts for office space, manufacturing facilities, or medical equipment which can be straightforward to identify. However, under the new lease definition, some leases may be embedded within other service contracts.

As contracts may meet the definition of a lease even if the contract doesn’t include the word lease, it can be challenging for companies implementing ASC 842 to identify a complete lease population. Entities will need to perform and document completeness procedures to ensure all contracts that are or may contain a lease are properly identified and that all leases were considered at the adoption of ASC 842. These completeness procedures can vary by company but performing a targeted review of the entity’s disbursement registers and discussing vendor relationships with those individuals charged with negotiating and executing contracts is an excellent place to start.

Once contracts that may contain a lease are identified, the next step is to evaluate them under the new guidance to determine if they are or contain leases during Phase 2 of the ASC 842 implementation outlined above.

Phase 2

Contract manufacturing agreements or other outsourced service agreements, such as outsourced R&D, have a higher risk of including embedded lease elements if they include the use of property, plant, and equipment or, as defined under ASC 842, an identified asset.

An identified asset can be either explicitly or implicitly identified. If the provider doesn’t have the practical ability to substitute and wouldn’t economically benefit from substituting the asset, the contract needs to be further assessed to determine which party has the right to control the use of the identified asset during the lease term. This assessment requires a deep dive into who has decision-making authority over the use of the identified asset and who benefits from the use of the identified asset.

If there is an identified asset, additional details to consider when determining whether an arrangement contains a lease include:

- Does the customer have the right to obtain substantially all the economic benefit from the use of the asset throughout the period of use?

- Does the customer or the supplier have the right to direct how and for what purpose the identified asset is used throughout the period of use?

- Does the customer have the right to operate the asset without the supplier having the right to change those operating instructions?

- Did the customer design the asset, or specific aspects of the asset, in a way that predetermines how and for what purpose the asset will be used throughout the period of use?

Common examples of embedded lease elements for life sciences companies may include:

- A medical supplies contract where a company purchases test kits from a supplier who also provides, at no charge, the equipment used to perform the test

- A contract manufacturing arrangement where a company has contracted for substantially all the manufacturer’s capacity and as a result, is able to direct the factory’s operations

Phase 3

Upon adoption of ASC 842, life sciences companies must make an effort to understand the new guidance and establish policies and procedures to properly identify and account for leases both at adoption and on an ongoing basis. After adopting ASC 842, it is imperative for life sciences companies to continue to monitor and address all necessary changes to operational and financial reporting requirements.

This may include the following:

- Developing updated accounting policies, including the creation of new general ledger accounts for more streamlined financial reporting and disclosure preparation

- Identifying and implementing new business processes and systems, including IT systems, required for ongoing compliance

- Designing new post-implementation internal controls

Neglecting to monitor new contracts or continuing to periodically search for embedded lease arrangements can have a material financial statement impact. As such, having a plan for post-implementation is crucial.

ASC 842 requires a significant shift in how life sciences companies are required to identify and monitor lease arrangements but planning your adoption approach through the phases outlined above can help with this shift.

We’re Here to Help

For more information about the new lease standard, refer to our guide: ASC Topic 842, Leases: The FASB’s New Guidance and Their Effect on Leasing Arrangements.

For additional questions or help understanding how the new standard may affect your business, contact your Moss Adams professional.

You can also learn more about our Life Sciences Practice and additional topics affecting the industry.